Chrysler 2004 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2004 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FIAT GROUP

02

118

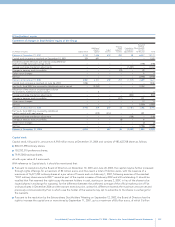

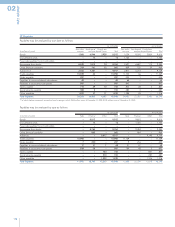

Bonds

Bonds, including convertible bonds, amount to 8,825 million euros (11,375 million euros at December 31, 2003) and can be analyzed

by year of maturity as follows:

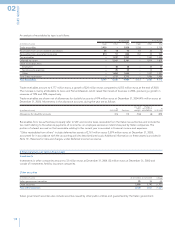

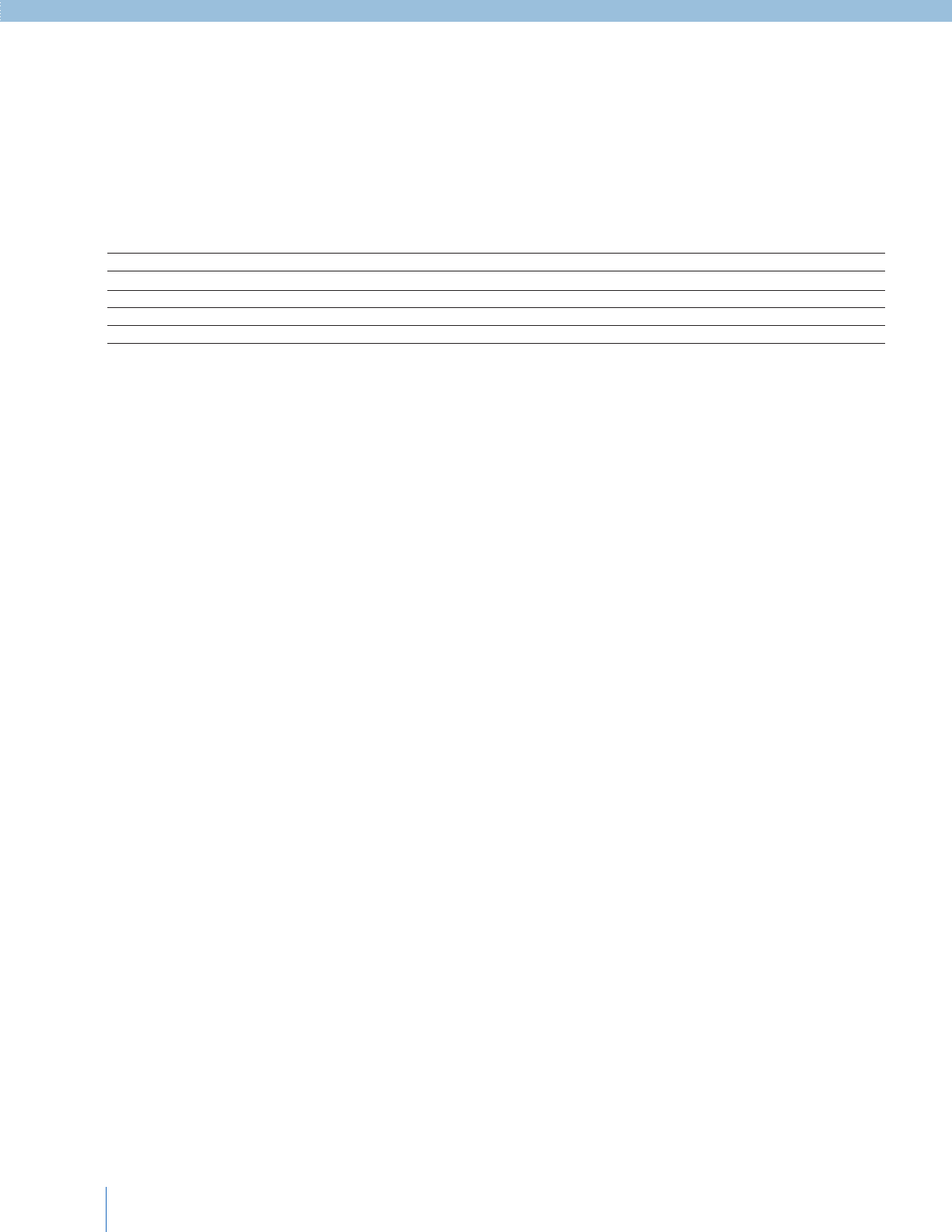

(in millions of euros) 2005 2006 2007 2008 2009 Thereafter Total

EMTN 1,421 2,350 181 227 168 2,600 6,947

Convertible bonds – – 13 – – – 13

Other bonds 447 – 93 – 367 958 1,865

Total Bonds 1,868 2,350 287 227 535 3,558 8,825

The bonds issued by the Fiat Group are governed by different terms and conditions according to the following types of bonds:

■Euro Medium Term Note (EMTN Program): these notes have been issued under a program that is utilized for approximately 7

billion euros and guaranteed by Fiat S.p.A. Issuers taking part in the program are Fiat Finance & Trade Ltd. S.A. (for an amount

outstanding of 6,802 million euros), Fiat Finance North America Inc. (for an amount outstanding of 65 million euros) and Fiat

Finance Canada Ltd. (for an amount outstanding of 80 million euros).

■Convertible bonds: this represents the residual debt, after repayment, in July 2004, of the 5-year bond originally convertible into

General Motors Corp. common stock (“Exchangeable”), at a conversion price of 69.54 U.S. dollars per share with 3.25% interest

and maturing on January 9, 2007. With reference to this bond, during the first quarter of 2004 Fiat repurchased, for cancellation,

540 million U.S. dollars in bonds out of total of 2,229 million U.S. dollars. In June 2004, by virtue of the contractually envisaged

right of each bondholder to request early repayment of all or part of its bonds, repayment for a total of 1,672 million dollars

(equivalent to approximately 1.4 billion euros) in bonds was requested by the deadline provided by the contract. A residual debt

of 17 million U.S. dollars (equivalent to 13 million euros) remains at this date. With reference to the risk, implicit in the bond, of an

increase in the General Motors share price above 69.54 U.S. dollars, a Total Return Equity Swap agreement was put into place,

terminated in 2004 and replaced by the purchase of a call option on General Motors stock, as described in Note 14.

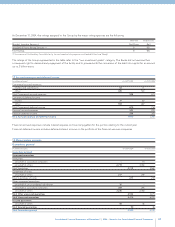

■Other bonds: these refer to the following issues:

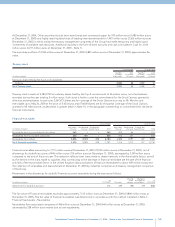

– Bonds issued by Fiat Finance & Trade Ltd. S.A. with coupon interest at 1.5% and maturing June 27, 2005 for an amount of 40

billion Japanese yen, equivalent to 287 million euros;

– Bonds issued by Case New Holland Inc. (“CNH Inc.”) in 2004 (with coupon interest at 9.25% and maturing August 1, 2011 for an

amount of 1,050 million U.S. dollars, equivalent to 771 million euros) and in 2005 (with coupon interest at 6.00% and maturing

June 1, 2009 for an amount of 500 U.S. dollars, equivalent to 367 million euros); the bond indenture contains a series of

financial covenants that are common to the high yield American bond market;

– Bonds issued by CNH America LLC and CNH Capital America for a total amount outstanding of 599 million U.S. dollars,

equivalent to 440 million euros.

The prospectuses, the offering circulars or their abstracts relating to the aforementioned principal bond issues are available on the

Group’s website at www.fiatgroup.com under “Shareholders and Investors – Financial Publications”.

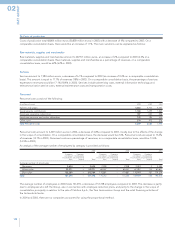

The majority of the bonds issued by the Group contain commitments (“covenants”) by the issuer and in some cases by Fiat, as the

guarantor, that, in international practice, are common for bond issues of this type when the issuers are in the same industrial segment

in which the Group operates, such as, in particular: (i) the so-called negative pledge clause which requires that the benefit of any real

present or future guarantees given as collateral on the assets of the issuer and/or Fiat, on other bonds and other credit instruments

should be extended to these bonds, to the same degree, (ii) the so-called pari passu clause, on the basis of which obligations cannot

be undertaken which are senior to the bonds issued, (iii) the obligation of providing periodical disclosure, (iv) for some of the bond

issues, the so-called cross-default clauses whereby the bonds become immediately due and payable when certain defaults arise in

respect of other financial instruments issued by the Group and (v) other clauses generally present in issues of this type.

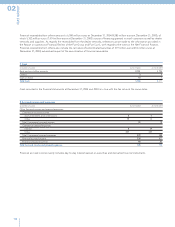

The bonds issued by Case New Holland Inc. (“CNH Inc.”) with coupon interest at 9.25% and maturing on August 1, 2011 (for an

amount of 1,050 million U.S. dollars, equivalent to 771 million euros) and with coupon interest at 6.00% and maturing on June 1, 2009

(for an amount of 500 million U.S. dollars, equivalent to 367 million euros), contain, moreover, financial covenants common to the high

yield American bond market which place restrictions, among other things, on the possibility of the issuer and certain companies of

the CNH group to secure new debt, pay dividends or buyback treasury stock, realize certain investments, conclude transactions with

associated companies, give collateral on its assets, conclude sale and leaseback transactions, sell certain fixed assets or merge with