Chrysler 2004 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2004 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

99

Consolidated Financial Statements at December 31, 2004 – Notes to the Consolidated Financial Statements

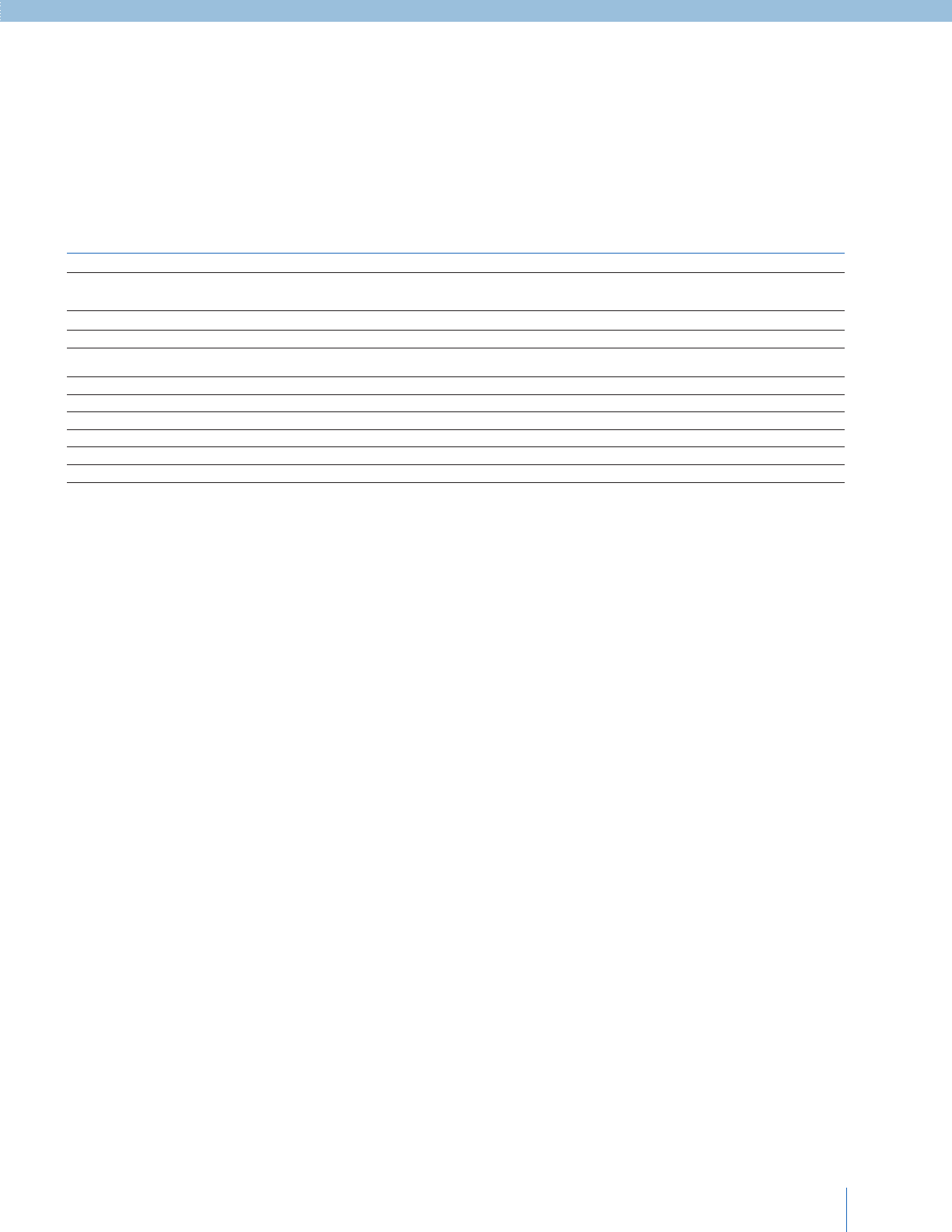

COMPOSITION, PRINCIPAL CHANGES AND OTHER INFORMATION

Fixed assets

1 Intangible fixed assets

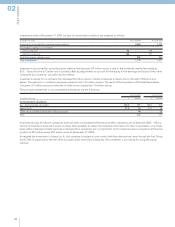

Net of Change in Foreign Disposals Net of

amortization the scope of Reclassi- exchange and Other amortization

(in millions of euros) 12/31/2003 Additions

Amortization

consolidation fications effects changes 12/31/2004

Start-up and expansion costs 144 11 (41) – – 1 – 115

Research, development and advertising expenses 22 4 (9) – 11 – – 28

Industrial patents and

intellectual property rights 406 48 (116) 3 85 (14) (10) 402

Concessions, licenses, trademarks and similar rights 347 37 (82) (16) 21 (10) – 297

Goodwill 151 1 (16) 38 – (9) (14) 151

Intangible assets in progress and advances 246 99 – – (131) – (10) 204

Other intangible assets 157 38 (65) (7) 14 – (1) 136

Differences on consolidation 2,251 26 (146) – – (130) (12) 1,989

Total Intangible fixed assets 3,724 264 (475) 18 – (162) (47) 3,322

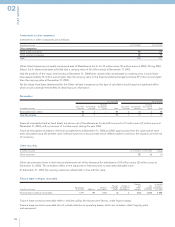

Intangible fixed assets are shown net of writedowns of 662 million euros (614 million euros at December 31, 2003) of which 604 million

euros (579 million euros at December 31, 2003) relates to Goodwill and Differences on consolidation. Writedowns recorded in 2004

amount to 48 million euros (55 million euros in 2003) and are included in the Disposals and Other changes column.

Start-up and expansion costs at December 31, 2004 consist of deferred plant start-up costs and corporate formation costs of 57

million euros (60 million euros at December 31, 2003) and capital increase costs of 58 million euros (84 million euros at December

31, 2003).

Differences on consolidation amount to 1,989 million euros at December 31, 2004, (2,251 million euros at December 31, 2003) and

include the net goodwill (net of amortization and writedowns, as described below) on the acquisition of the Case Group and other

CNH Group companies for 1,756 million euros, the Irisbus Group for 43 million euros, Meridian Technologies Inc. for 23 million euros,

certain Components Sector companies for 39 million euros (including 20 million euros as a result of the purchase of Magneti Marelli

Sistemi Elettronici in 2004), certain Production Systems Sector companies for 39 million euros and other minor companies for 26

million euros. Differences on consolidation also include goodwill deriving from the Tender Offer issued in 2000 for the shares of

Magneti Marelli S.p.A. for 15 million euros, as well as goodwill from the CNH Global N.V. capital increase effected in 2000 for 48

million euros.

As regards the amounts recorded in Goodwill and Differences on consolidation, amortization is charged over periods ranging from

five to twenty years, on the basis of the expected recoverability of these amounts. At the end of the year, however, specific reviews

were conducted to verify whether such amounts are recoverable by considering the existing prospects of earnings. From the analyses

performed, taking into consideration the changed market conditions, the restructuring plans initiated by certain Sectors of the Group

and the consequent impact on the business plans of various Sectors, permanent impairments in value were identified at December

31, 2004 that gave rise to writedowns totaling 25 million euros (38 million euros at December 31, 2003).