Chrysler 2004 Annual Report Download - page 180

Download and view the complete annual report

Please find page 180 of the 2004 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FIAT S.P.A.

03

178

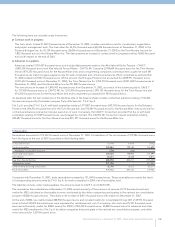

As required by Article 2426, Section 3, of the Italian Civil Code, it should be emphasized that certain investments are carried at an

amount that exceeds the value of the corresponding portion of the underlying stockholders’ equity in the latest approved financial

statements, after deducting dividends and after the adjustments required for consolidation purposes.

In particular, the values of the investments in Magneti Marelli Holding S.p.A., Fiat Partecipazioni S.p.A., and Ferrari S.p.A. determined

on the basis of the abovementioned criteria that are reported on the balance sheet are higher than the corresponding shares of

stockholders’ equity in the companies (34 million euros, 482 million euros, and 65 million euros, respectively). When determining

possible adjustments for permanent losses, it was taken into account that these investments have objectively higher inherent values

than what is documented by accounting records.

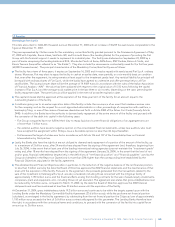

In particular:

■Magneti Marelli Holding S.p.A.: the higher values for the investment reported on the balance sheet were maintained in

consideration of the positive performance of the subsidiary during the fiscal year and a positive business outlook;

■Fiat Partecipazioni S.p.A.: when determining the adjustment for the impairment, the contractually agreed gain on the indirect

investment in Italenergia Bis S.p.A. that can be realized in 2005 upon exercise of the put option for sale to EDF was taken into

account; in addition to the higher current value (represented by the stock market price at year end), with respect to the carrying

value of the investment in Rizzoli Corriere della Sera MediaGroup S.p.A.;

■Ferrari S.p.A.: the higher values for the investment on the balance sheet was maintained in consideration of the current value

shown on the occasion of the sale of 34% of the investment to Mediobanca in 2002 (see Note 14 hereunder for the disclosure

of the mutual commitments assumed at that time) and a positive business outlook.

All the other investments in subsidiaries have a book value that is less than or equal to the stockholders equity determined

in accordance with the aforesaid principles.

Other securities

These consist of listed Treasury securities pledged to fund scholarship grants.

At December 31, 2004, their book value totaled 74 thousand euros (based on their quotations at December 30, 2004), compared with

75 thousand euros at December 31, 2003.

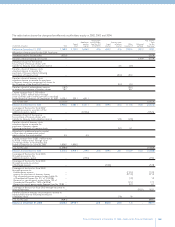

As regards fixed assets, the tables at the end of these Notes to the Financial Statements include the following:

■the additional information on cost, upward adjustments, writedowns and amortization and depreciation required under Article 2427

of the Italian Civil Code; and

■as required under Article 10 of Law No. 72 of March 19, 1983, a mention of the assets held at December 31, 2004 which have been

adjusted for inflation pursuant to the relevant laws.

Current assets

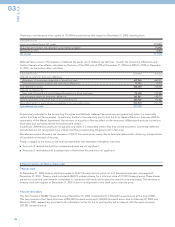

4 Inventories

This item consists of costs incurred in connection with the High-Speed Railway Project. Fiat, as general contractor, has signed

contracts with Treno Alta Velocità - T.A.V. S.p.A. (which, in turn, had received the order from F.S. S.p.A. - Italian Railways) for the

executive design and construction of two high-speed rail lines (Bologna-Florence and Turin-Milan; the latter is split up in the Turin-

Novara and Novara-Milan lines). At December 31, 2004, contract prices for the works were the following: 3,825 million euros for the

Bologna-Florence line, 4,456 million euros for the Turin-Novara line, and 1,981 million euros for the Novara-Milan line. Work on this

latter line began following the signing of the amendment of July 21, 2004.

Fiat S.p.A. has entrusted the CAV.E.T. and CAV.TO.MI. consortia with the design and execution of works, retaining responsibility for

coordination and organization, while project management was subcontracted. The contracts for the job connected to the Turin-

Novara and Novara-Milan lines are still in course of definition with the CAV.TO.MI. Consortium.

Financing of the project is carried out by means of advances paid by T.A.V. S.p.A. to Fiat S.p.A., which then transfers to the two

consortia the net amounts after deducting its fee (about 3.8%).