Chrysler 2004 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2004 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

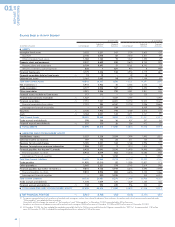

REPORT ON

OPERATIONS

01

42

FINANCIAL REVIEW OF FIAT S.P.A.

OPERATING PERFORMANCE

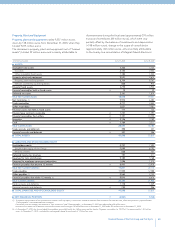

The Parent Company Statement of Operations showed a loss of

949 million euros, as compared to the loss of 2,359 million euros

in the previous fiscal year.

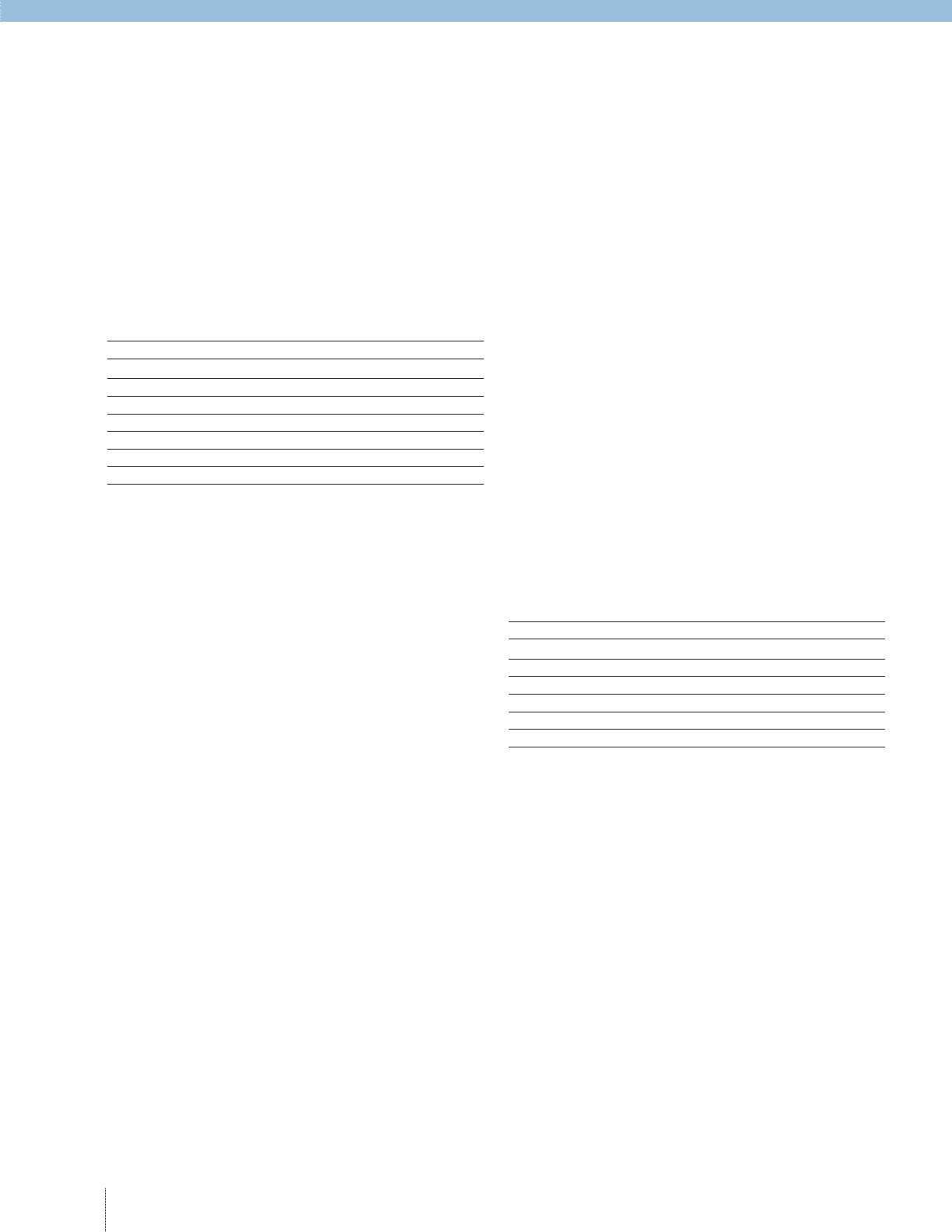

The breakdown of this result is illustrated in the following table:

(in millions of euros) 2004 2003

Investment income 683 400

Adjustments to financial assets (1,641) (2,379)

Net financial expenses (137) (169)

Cost of personnel and services net of revenues (119) (130)

Non-operating income (expenses) (13) (20)

Income taxes 278 (61)

Net result (949) (2,359)

Investment income totaled 683 million euros, and consisted

of dividends and the gain of 606 million euros resulting from

partial reimbursement of capital stock by the subsidiary

IHF – Internazionale Holding Fiat S.A.

The adjustments to financial assets posted in 2004 totaled

1,641 million euros, reflecting the 1,624 million euro writedown

in the book value of the investment in Fiat Partecipazioni S.p.A.,

which was mainly impacted by the negative performance of the

Automobiles Sector.

In 2003, these adjustments totaled 2,379 million euros and

stemmed from the writedown of the investment in Fiat

Partecipazioni (again, impacted by the negative performance

of the Automobiles Sector), in Fiat Netherlands Holding N.V.

(for the losses generated by Iveco and CNH) and Magneti

Marelli Holding S.p.A.

Net financial expenses totaled 137 million euros, down from

the 169 million euros reported in 2003, thanks to lower interest

expenses in consequence of the decline in interest rates and

reduced indebtedness.

The cost of personnel and services net of revenues totaled

119 million euros, as compared with 130 million euros in 2003.

In particular:

■the cost of personnel and services totaled 207 million euros

and consisted of service costs totaling 110 million euros,

personnel costs totaling 53 million euros, and, for the

remainder, amortization and other operating costs. The 36

million euro decrease stems from the lower cost of personnel.

The average number of employees was 151 persons

(including 12 persons seconded to the principal companies

of the Group), against an average number of 167 persons

in 2003 (including 15 persons who were seconded);

■Revenues totaled 88 million euros, consisting of licensing fees

for use of the Fiat brand, calculated as a percentage of the

revenues generated by the individual Group companies that

use it, and the services rendered by executives. The decrease

of 25 million euros with respect to the previous year derives

from lower charges to Group companies following the sale

of activities in 2003.

Net non-operating expenses totaled 13 million euros, consisting

mainly of the extraordinary expenses incurred in 2004 following

implementation of the Parent Company restructuring and

reorganization plan.

In 2003, they consisted mainly of commissions paid to

Mediobanca S.p.A for extension of the commitments it had

assumed as part of the 2002 agreement for sale of 34% of Ferrari.

Income taxes totaled a positive 278 million euros, due almost

entirely to the posting of deferred tax assets on tax losses

carried forward and temporary differences, the recovery of which

became reasonably certain in consequence of the settlement

received in February 2005 upon cancellation of the Master

Agreement with General Motors.

Instead, in 2003 they were negative, due to the cancellation

of tax prepayments whose recovery in following years was

no longer reasonably certain (61 million euros).

BALANCE SHEET

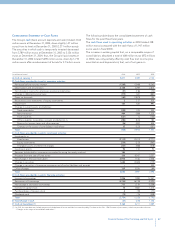

The following table illustrates highlights of the Parent Company

Balance Sheet:

(in millions of euros) At 12/31/2004 At 12/31/2003

Fixed assets 5,342 7,404

of which: equity investments 5,249 7,282

Working capital 99 77

Total net invested capital 5,441 7,481

Stockholders’ equity 4,466 5,415

Net financial position (975) (2,066)

Fixed assets consist mainly of investments in the most

important companies of the Group.

The principal increase was represented by the purchase from

Fiat Partecipazioni S.p.A of the investments in Comau S.p.A.,

Teksid S.p.A., and Business Solutions S.p.A. for 244 million euros

as part of the plan to streamline the Group corporate structure

and portfolio of investments in Fiat S.p.A.

The greatest decreases consisted of the partial reimbursement

of the capital stock of IHF – Internazionale Holding Fiat S.A.

(reduction in its book value by 635 million euros) and

writedowns of the previously analyzed investments.

Working capital is comprised by inventories net of advances,

trade, tax, and employee receivables/payables, and credits for

tax prepayments, totaling 73 million euros, as well as ordinary

treasury stock in the amount of 26 million euros (4,384,019

shares). The 22 million euro increase with respect to December

31, 2003 is mainly the result of increased deferred tax assets net

of higher trade payables.

Stockholders’ equity totaled 4,466 million euros at December

31, 2004, down by 949 million euros with respect to December

31, 2003 due to the loss for the year.