Chrysler 2004 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2004 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FIAT GROUP

02

124

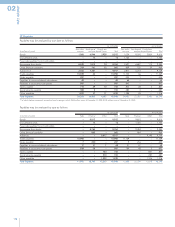

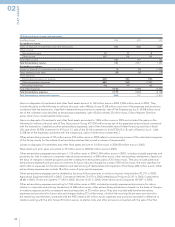

The difference between the “Carrying value” and “Fair Value” is mainly due to the accounting principles adopted for the valuation of

the financial instruments designated as hedges. As disclosed in the Accounting Policies, it is not possible to completely adopt IAS 39

under current Italian law since all derivative financial instruments would have to be recorded at fair value in the financial statements,

including those designated as hedges. The latter, instead, have been valued symmetrically with the underlying hedged item.

Therefore, where the hedged item has not been adjusted to fair value in the financial statements, the hedging financial instruments

have also not been adjusted. Similarly, where the hedged item has not yet been recorded in the financial statements (hedging of

future flows), the valuation of the hedging instrument at fair value is deferred.

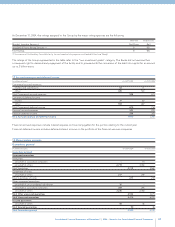

At December 31, 2004, the integral adoption of IAS 39, with reference to the aforementioned derivative financial instruments, would

have had an effect on the balance sheet, on the one hand, for the adjustment of derivative financial instruments to arrive at fair value

with a positive effect of 391 million euros (a positive effect of 685 million euros at December 31, 2003), and, on the other hand, for the

adjustment of the hedged balance sheet items (mainly payables) with a net negative effect (due to the trend in interest rates) of 329

million euros (262 million euros at December 31, 2003) and, for the part relating to the hedging of future flows, a higher accumulated

value of reserves in stockholders’ equity of 41 million euros (a lower accumulated value of 22 million euros at December 31, 2003), net

of the amount set aside for deferred income taxes. The integral adoption of IAS 39, always with reference to the aforementioned

derivative financial instruments, would have led to negative effects on the net result for the year of approximately 286 million euros,

net of tax charges (positive effects of 272 million euros at December 31, 2003). This economic impact would basically have been the

result of the provision, at December 31, 2003, of the positive fair value of the Equity Swap on General Motors shares.

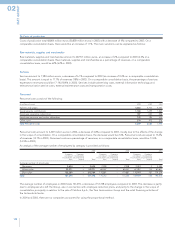

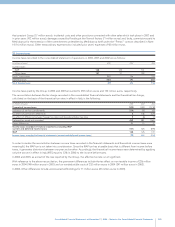

With particular regard to the previously mentioned equity swap arrangements, the amount at December 31, 2004 of 66 million euros

represents the notional amount of the equity swap stipulated to hedge the risk of an increase in the Fiat share price above the

exercise price of 10,000,000 stock options granted to Mr. Marchionne. In particular, the Board of Directors resolved to grant Mr.

Marchionne, as a portion of his variable compensation as Chief Executive Officer, options for the purchase of 10,670,000 Fiat ordinary

shares at the price of 6.583 euros per share, exercisable from June 1, 2008 to January 1, 2011. In each of the first three years, he

accrues the right to purchase, from June 1, 2008, a maximum of 2,370,000 shares per year and on June 1, 2008 he accrues the right to

purchase, effective that date, the residual portion amounting to 3,560,000 shares. The right to exercise the options related to this last

portion of shares is subject to certain predetermined profitability targets that should be reached during the reference period. The risk

of a significant increase in the Fiat share price above the exercise price of these options has been covered, with reference to 670,000

shares, by treasury stock in portfolio (see Note 6), whereas with reference to the remaining 10,000,000 shares, the aforementioned

“Total Return Equity Swap” agreement was put into place with a reference price of 6.583 euro per share and expiring on July 29,

2005. In accordance with accounting principles, the aforementioned Equity Swap, despite being entered into for hedging purposes,

cannot be treated in hedge accounting and accordingly is defined as a trading derivative financial instrument. It follows that, in

accordance with the principle of prudence, if during the period of the contract the Fiat shares perform positively, the positive fair

value of the instrument is not recorded in the statement of operations; if, instead, the performance is negative, the negative fair value

of the instrument is recorded immediately as a cost under financial expenses. At December 31, 2004, the Equity Swap has a negative

fair value of 7 million euros that has therefore been recorded in the financial statements.

At December 31, 2003, the Equity Swaps caption included:

■For 62 million euros, the notional amount of the equity swap stipulated to hedge the risk of an increase in the Fiat share price

above the exercise price of 10,000,000 stock options granted to Mr. Morchio. Near the contract expiration date (August 2004),

the equity swap was replaced by the aforementioned contract in respect of the stock options granted to Mr. Marchionne. The

replacement gave rise to income of 5 million euros. Moreover, during 2004, the aforementioned stock options expired upon

the resignation of Mr. Morchio.

■For 916 million euros, the notional amount of the equity swap stipulated in 2002 at the same time as the sale of the General

Motors shares and which was put into place to hedge the risk, implicit in the Exchangeable bonds described previously, of an

increase in the General Motors share price above the conversion price (Note 12). During the first half of 2004, this equity swap

was terminated in advance and replaced, in order to hedge the risk implicit in the Exchangeable bonds, by the purchase of call

options on General Motors common stock. The transaction gave rise to net financial income of approx. 300 million euros.

Following the repayment of almost all the bonds (see Note 12), these options, although purchased for hedging purposes,

are classified as trading transactions and valued at the lower of cost and market (3 million euros at December 31, 2004).

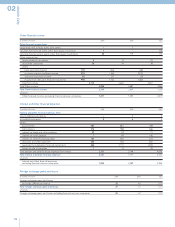

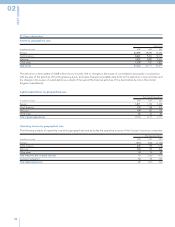

Other commitments amounted to 12,813 million euros at December 31, 2004 (10,350 million euros at December 31, 2003) and

include commitments for the execution of works in the amount of 10,261 million euros (8,011 million euros at December 31, 2003)

under the contracts between Fiat S.p.A., as General Contractor, and Treno Alta Velocità T.A.V. S.p.A. for the design and construction