Chrysler 2004 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2004 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

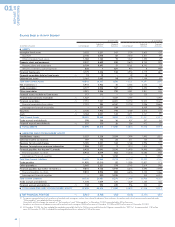

reserves for 901 million euros (791 million euros in 2003),

restructuring reserves for 408 million euros (471 million euros in

2003), reserves for pensions for 1,432 million euros (1,503 million

euros in 2003), reserves for employee severance indemnities

for 1,286 million euros (1,313 million euros in 2003), and reserves

for other risks and charges for 2,276 million euros (2,216 million

euros in 2003).

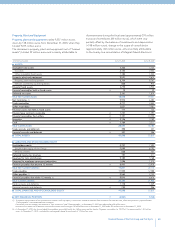

Net Invested Capital

Net invested capital totaled 10,718 million euros, compared

with 10,522 million euros at December 31, 2003. The increase

of 196 million euros is attributable to the increase in working

capital and deferred tax assets, which were only partially offset

by the decrease in fixed assets (mainly foreign exchange effect

and disinvestments during the period), and financial fixed assets

(dividends paid by BUC - Banca Unione di Credito accounted

for using the equity method).

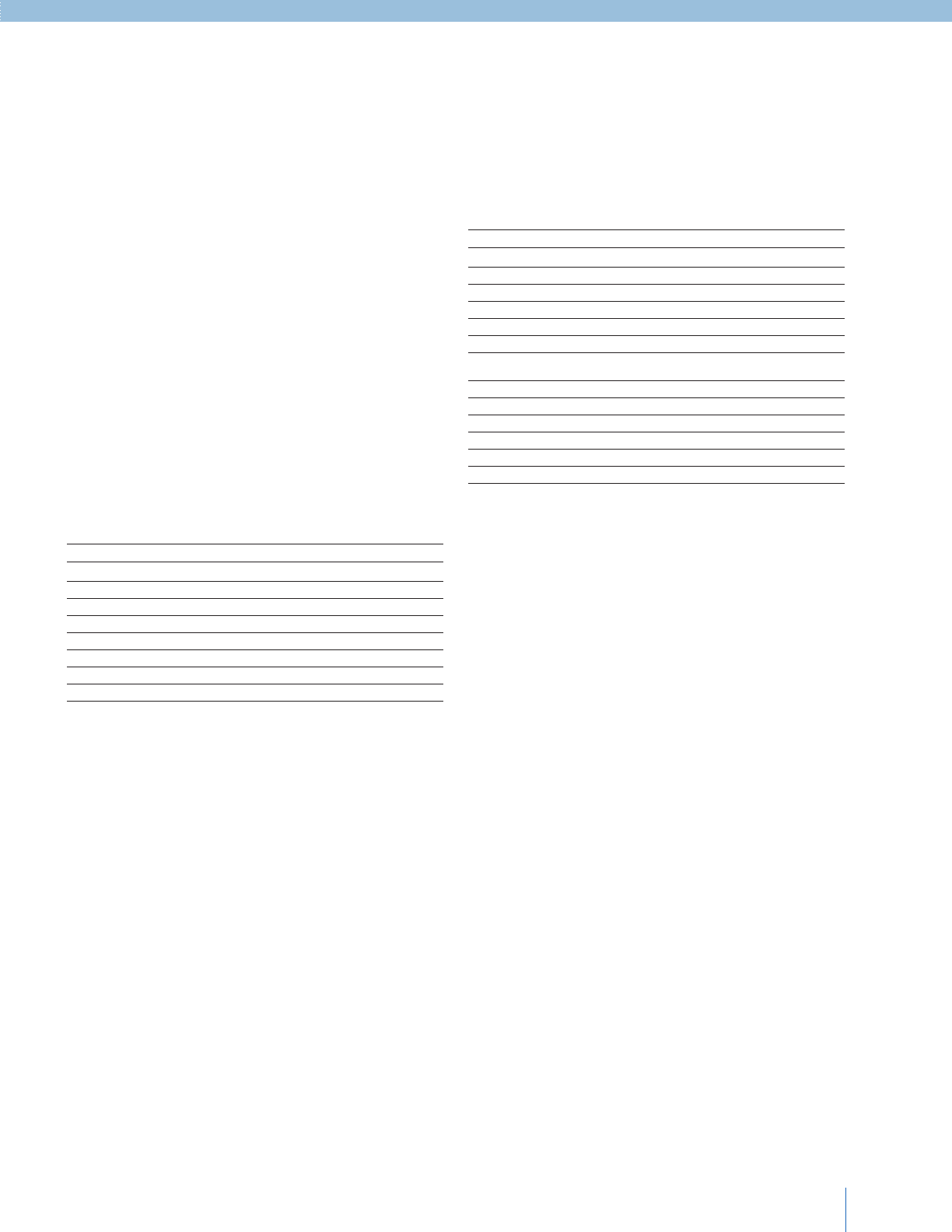

The following table illustrates the composition of net invested

capital at the end of 2004 and 2003.

(in millions of euros) At 12.31.2004 At 12.31.2003 Change

Intangible fixed assets 3,322 3,724 (402)

Property, plant and equipment 9,537 9,675 (138)

Financial fixed assets 3,779 3,950 (171)

Financial assets not held as fixed assets 117 120 (3)

Deferred tax assets 2,161 1,879 282

Reserves (6,668) (6,692) 24

Working capital (1,530) (2,134) 604

Net invested capital 10,718 10,522 196

Stockholders’ Equity

Consolidated stockholders’ equity totaled 5,757 million euros

(7,494 million euros at December 31, 2003). The reduction

largely reflects the loss posted for the period (1,548 million

euros), the reduction in minority interests (62 million euros,

largely in consequence of the purchase of residual shares in

Fiat Auto Poland), distributed dividends (19 million euros),

and the decrease stemming from foreign exchange translation

differences (126 million euros).

Stockholders’ equity of the Group was 5,099 million euros,

against 6,793 million euros at December 31, 2003.

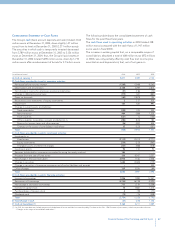

Net Financial Position

The net financial position, i.e. net indebtedness (financial

payables and related accruals and deferrals, net of cash and

securities) minus financial receivables, totaled -4,961 million

euros at December 31, 2004, reflecting an increase of 1,933

million euros compared with the negative net financial position

of 3,028 million euros at the beginning of the fiscal year.

The following table shows the net financial position at

December 31, 2004 and December 31, 2003.

(in millions of euros) At 12.31.2004 At 12.31.2003 Change

Financial payables (18,743) (22,034) 3,291

Accrued financial expenses (523) (593) 70

Prepaid financial expenses 93 85 8

Cash 3,164 3,211 (47)

Securities 2,126 3,789 (1,663)

Net indebtedness (*) (13,883) (15,542) 1,659

Financial receivables and lease

contracts receivable 8,897 12,576 (3,679)

Accrued financial income 234 301 (67)

Deferred financial income (209) (363) 154

Net Financial Position (4,961) (3,028) (1,933)

(*) Net Indebtedness

Industrial Activities (5,909) (5,088) (821)

Financial Activities (7,974) (10,454) 2,480

Aggregate liquidity (Cash and Securities) of the Group at

December 31, 2004, held principally by the companies that

operate centralized cash management activities, totaled

approximately 5.3 billion euros, approximately 1.7 billion euros

less than at December 31, 2003, partially in consequence of

the reimbursement of financial payables, including bond loans

of 2.7 billion euros.

Net indebtedness (financial payables and relative accruals and

deferrals, net of cash and securities) totaled approximately 13.9

billion euros at December 31, 2004, about 1.7 billion euros less

than at December 31, 2003. The net indebtedness of Industrial

Activities increased by 821 million euros in connection with

the operating requirements of the period, while the net

indebtedness of Financial Activities decreased by approximately

2.5 billion euros in consequence of the reduction in financial

assets for the reasons described hereunder in the analysis of the

“Financial Position and Operating Results by Activity Segment.”

Gross indebtedness (financial payables and relative accruals

and deferrals), equal to 19.2 billion euros, decreased by

approximately 3.4 billion euros, principally in consequence

of the reimbursement of bonds, including the bond for

approximately 1 billion euros issued by Fiat Finance & Trade,

reimbursed at the end of March 2004, and the bond

exchangeable for General Motors shares for 2.2 billion

dollars, equal to approximately 1.8 billion euros.

In connection with the above bond, it should be noted that:

■During the first quarter of 2004, Fiat had repurchased 540

million dollars in bonds to be cancelled out of a total of 2,229

million dollars;

■in June 2004, pursuant to the contractual right of each

bondholder to request early reimbursement of all or part of its

bonds, reimbursement for the above indicated amount was

requested by the contractually envisaged deadline. As of

35

Financial Review of the Fiat Group and Fiat S.p.A.