Chrysler 2004 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2004 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FIAT GROUP

02

112

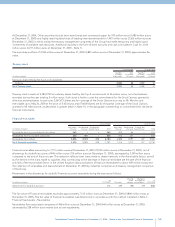

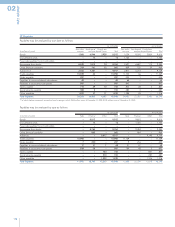

euros are to be reserved, pursuant to paragraph 7 of Article 2441 of the Italian Civil Code, to the banks that underwrote the

“Mandatory Convertible Facility” described in Note 12 if the facility is not reimbursed earlier than the contractual deadline of

September 2005. In fact, in this case, any residual debt for the principal will be reimbursed in the form of ordinary shares of

Fiat S.p.A. subscribed by the banks, with the obligation that they be offered as an option to all Fiat stockholders.

■The resolutions for the capital increases servicing the stock option plans (28 million euros) have been revoked, as the Board

of Directors decided on June 26, 2003 to use ordinary treasury stock to be purchased for this purpose.

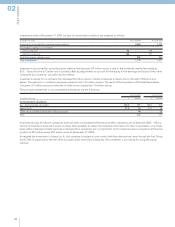

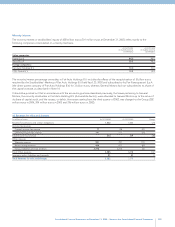

Additional paid-in capital

Additional paid-in capital, which amounted to 279 million euros at December 31, 2003, has been totally offset in 2004 following

its utilization to cover the loss for fiscal 2003 as voted by the Stockholders’ Meeting held May 11, 2004.

Legal reserve

The legal reserve amounts to 447 million euros at December 31, 2004 with a reduction of 212 million euros in respect of December

31, 2003 following its utilization to cover the loss for fiscal 2003.

Cumulative translation adjustments

Cumulative translation adjustments show a negative change of 106 million euros compared to December 31, 2003 mainly due to

the effect of the weakness of the U.S. dollar against the euro.

Retained earnings and Other reserves

Retained earnings and Other reserves include, in addition to the undistributed earnings of the consolidated companies, also

monetary revaluation reserves and other reserves in suspension of taxes.

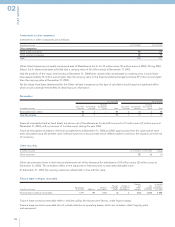

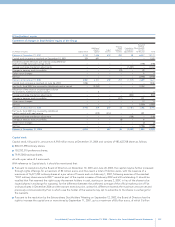

Reconciliation to Stockholders’ equity and Net loss of the Parent company Fiat S.p.A.

Stockholders’ Net Income Stockholders’ Net Income

equity at (Loss) equity at (Loss)

(in millions of euros) 12/31/2004 2004 12/31/2003 2003

Statutory financial statements of Fiat S.p.A. 4,466 (949) 5,415 (2,359)

Elimination of the carrying values of consolidated investments and the related

dividend income recorded in the statutory financial statements of Fiat S.p.A. (5,122)(676) (7,143) (254)

Elimination of writedowns against consolidated investments recorded by Fiat S.p.A. – 1,639 – 2,371

Equity and results of operations of consolidated companies 5,831 (1,913) 8,598 (1,634)

Consolidation adjustments:

Elimination of intra-Group dividends –(386) – (92)

Elimination of intra-Group profit and losses from sales of investments – 698 –25

Elimination of intra-Group profit and losses in inventories,

investments, property, plant and equipment and other adjustments (76)1(77) 43

Consolidated financial statements 5,099 (1,586) 6,793 (1,900)