Chrysler 2004 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2004 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

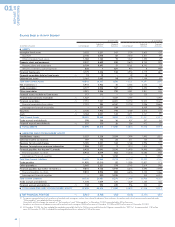

Financial Review of the Fiat Group and Fiat S.p.A.

■Iveco closed fiscal 2004 with operating income of 357 million

euros, up sharply from the operating income of 81 million

euros reported in 2003. The Sector benefited from the

positive effect of higher volumes, repositioning of the product

range, and major savings on product costs.

■Magneti Marelli reported major growth in its operating

income, which rose from 32 million euros in 2003 to 116

million euros in 2004. This result also benefited from the

contribution made by the Electronic Systems business, which

was consolidated effective January 1, 2004 and generated

operating income of approximately 26 million euros. This

improvement, which totaled 58 million euros on a comparable

consolidation basis, was achieved through actions that made

it possible to render the cost structure more competitive and

absorb the pressure on sales prices.

■Teksid closed fiscal 2004 with operating income of 35 million

euros, compared with income of 12 million euros in 2003.

The improvement in the operating result is attributable to the

positive effect of higher volumes and efficiency gains realized

through streamlining of production structures, which largely

offset the increase in costs of raw materials and the negative

foreign exchange effect.

■Comau posted operating income of 32 million euros,

compared with income of 2 million euros in 2003. This

marked improvement was realized thanks to higher margins

on contract work, extensive streamlining of overhead costs,

and more efficient use of internal resources.

■Business Solutions reported operating income of 36 million

euros for 2004. The decrease from the 45 million euros in

operating income reported for 2003 is attributable to changes

in the scope of consolidation. On a comparable basis,

operating income would have shown an improvement of

11 million euros thanks to the positive effects of efficiencies

realized in all its operating areas.

■Itedi had operating income of 12 million euros in 2004. The

increase from the 10 million euros reported a year earlier

stemmed from higher advertising revenues, lower paper costs,

and continuation of the company-wide cost cutting program.

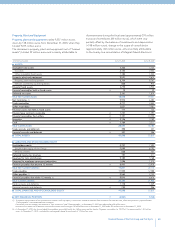

EBIT (Earnings Before Interest and Taxes)

Group EBIT was -833 million euros, compared with -319 million

euros in 2003 (equal to a loss of 434 million euros for Continuing

Operations alone). In 2003, the balance of net gains/losses

resulting from the disposal of activities (principally the Toro

Assicurazioni Group and FiatAvio) totaled 1,747 million euros,

while in 2004 the sales of Fiat Engineering, Midas, and Edison

shares and warrants generated net gains of 154 million euros.

The comparison with Continuing Operations net of these gains

thus shows an improvement of 1,194 million euros, including

736 million euros contributed by the operating result detailed

hereinabove. The reduction in provisions and expenses for

restructuring and lower extraordinary writedowns represent

the other principal causes of improvement.

The change in EBIT was influenced by the following items:

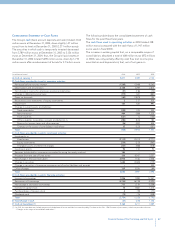

The balance of non-operating income and expenses in 2004

was -863 million euros, in contrast with a positive 359 million

euros for Continuing Operations in 2003 (positive balance of

347 million euros at the consolidated level in 2003). Net of the

foregoing gains, the 2004 figure would be 1,017 million euros,

compared with the corresponding amount (for Continuing

Operations) of -1,388 million euros in 2003 (1,400 million euros

at a consolidated level). The 2004 figure reflects the following

items:

■Restructuring expenses of 508 million euros (658 million euros

in 2003): these expenses are represented by the costs incurred

or determined according to plans for personnel laid off with

long-term unemployment benefits, severance incentives, and

writedown of property, plant and equipment and intangible

fixed assets aimed at production streamlining. Restructuring

expenses include expenses and provisions that refer mainly

to Fiat Auto (325 million euros), CNH (65 million euros), and

Magneti Marelli (45 million euros).

■A total of -35 million euros (215 million euros in 2003) in other

extraordinary writedowns of activities, due to a change in the

market outlook of certain businesses, particularly in regard to

the depreciation of property, plant, and equipment at Fiat

Auto.

■A total of 435 million euros (501 million euros) in extraordinary

provisions to reserves for future risks and charges, other

expenses and prior period expenses, net of other non-

operating income and prior period income, with approximately

246 million euros of this total being attributable to the process

of reorganization and streamlining of relationships with Group

suppliers.

■Prior-period tax charges of 39 million euros (26 million euros

in 2003).

In 2003, the costs were largely represented by the restructuring

expenses connected with industrial streamlining programs,

particularly at Fiat Auto, CNH, and Comau, and writedowns

of assets, especially fixed assets at Fiat Auto, made on the

basis of changed market prospects. Other expenses and

extraordinary provisions to various liabilities and risk reserves

also had an impact, such as those for flood damage at the

Termoli plant and the residual commitments stemming from

investments in the telecommunications sector.

Investment income totaled 8 million euros, against a net loss

of 79 million euros from Continuing Operations in 2003, which

reflected losses of 76 million euros in losses at the Leasys joint

venture, which were reduced to 20 million euros in 2004.