Chrysler 2004 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2004 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FIAT GROUP

02

104

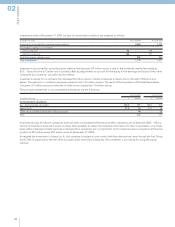

(in millions of euros) 2004 2003

Statement of operations data

Net sales 6,530 6,598

Operating income 255 296

Net financial expenses 31 38

Net income 139 180

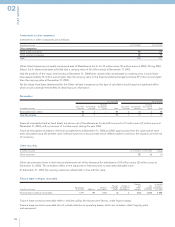

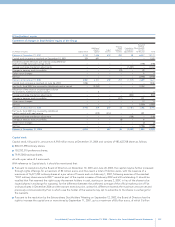

In view of the strictly industrial nature of the joint venture and in order to achieve a reading of its industrial performance that is

consistent with the past, commencing in 2001 and during the period in which the industrial convergence is being implemented

(estimated in approximately three years), the Group’s share of the results of the company has been included in the consolidated

statement of operations as a split between the operating/industrial component and the other non-operating components. In

particular, the Group’s share of the operating result of the company (127 million euros in 2004, 147 million euros in 2003, 143 million

euros in 2002 and 47 in the second half of 2001), determined by the transfer pricing policy adopted, is included in the consolidated

statement of operations as an adjustment to the cost of the products purchased from the joint venture, whereas the share of the

result in the other non-operating components is allocated to the respective principal captions, without effect on the total net result

recorded by the Group.

Lastly, as a consequence of the “Termination Agreement” signed between Fiat and General Motors on February 13, 2005, the joint

venture will be dissolved during the first half of 2005 in the manner described previously in the Report on Operations – Significant

events occurring since the end of the fiscal year and business outlook. Based upon the rules established in the agreement for the

allocation of the assets between the two partners, it is deemed that the carrying value of Fiat-GM Powertrain recorded in the financial

statements is fully recoverable.

Italenergia Bis

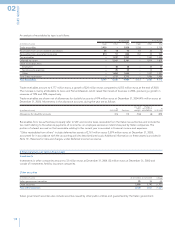

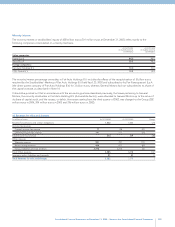

With reference to the investment in Italenergia Bis S.p.A., during the second half of 2002, the Fiat Group sold a 14% holding to

certain other stockholders of the company (Banca Intesa, IMI Investimenti and Capitalia, hereinafter the “Banks”) for 548 million

euros, realizing a gain of 189 million euros. The related sales contracts and the contemporaneous agreements with another

stockholder of Italenergia Bis (Electricité de France, hereinafter “EDF”) provide, among other things, that:

■By virtue of an option acquired in respect of EDF (the so-called EDF Put), Fiat may elect, between March and April 2005, to sell

the shares it still holds in Italenergia Bis (223,151,568 shares, equal to 24.6%,) to EDF, at a price corresponding to the value of the

investment, as estimated on the basis of the valuations performed by three experts appointed for that purpose. That price, less a

premium of 127 million euros, payable only in the event the option is exercised, may not be less than a minimum (floor) of 1,147

million euros, or 5.141698 euros per share.

■In connection with the EDF Put, the Banks (in addition to the put agreements negotiated independently with EDF for their

respective initial holdings in Italenergia Bis) obtained a so-called “tag along/drag along” agreement from Fiat, and Fiat arranged

a symmetrical Put/Call contract with EDF (conditional upon the prior exercise of the EDF Put by Fiat) that gives rise to two

scenarios:

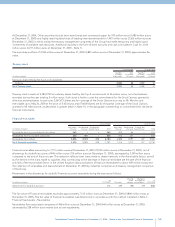

a) Fiat independently exercises the EDF Put on its own 24.6% holding and in this case:

–The Banks exercise the “tag along” under which the Banks ask Fiat to exercise for each of them the put clause of the put/call

agreed with EDF at the same price conditions as the EDF Put (valuation at fair market value, minimum floor of 5.141698 euro

per share).

–The corresponding “drag along” allows Fiat to reacquire the Banks’ shares in any case and to surrender them to EDF which in

turn has, by means of the call clauses in the Put/Call, the right to ask Fiat to acquire and surrender the shares. In substance, by

means of the call, EDF may (providing that Fiat exercised the EDF Put, which is a condition for the Put/Call) acquire the entire

original Fiat investment.

b) Fiat does not independently exercise the EDF Put on its own 24.6% holding and in this case:

–The individual Banks, separately, have the right to request Fiat to exercise its Put on EDF which allows the Banks to exercise the

“tag along”, as described above, and to realize a gain.

–Fiat may elect not to exercise the EDF Put, as instead requested, and the Banks have the right to ask that Fiat purchase from

the same Banks their respective 4.66% holdings at the lower of the price determined pursuant to the EDF Put, in accordance

with the same criteria and procedures agreed with EDF, and 6.5 euros per share.

–Fiat does not have a call right on the Banks’ holdings which were sold to the Banks definitively.