Chrysler 2004 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2004 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

119

Consolidated Financial Statements at December 31, 2004 – Notes to the Consolidated Financial Statements

other companies and financial covenants which impose a maximum limit on further indebtedness by the CNH group companies

which can not exceed a specific ratio of cash flows to dividend payments and financial expenses. Such covenants are subject to

various exceptions and limitations and, in particular, some of these would no longer be binding should the bonds be assigned

an investment grade rating by Standard & Poor’s Rating Services and/or Moody’s Investors Service.

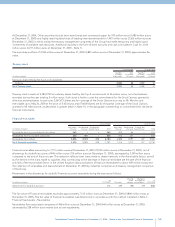

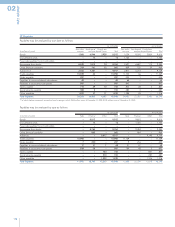

The major bond issues outstanding at December 31, 2004 are the following:

Face value Outstanding

of outstanding amount

bonds (in millions

Currency (in millions) Coupon Maturity of euros)

Euro Medium Term Notes:

Fiat Fin. North America EUR 100 5.13% Feb. 21, 2005 65

Fiat Finance & Trade EUR 155 Indexed July 5, 2005 155

Fiat Finance & Trade EUR 130 Indexed July 5, 2005 130

Fiat Finance & Trade EUR 500 6.13% Aug. 1, 2005 500

Fiat Finance & Trade EUR 300 6.13% Aug. 1, 2005 300

Fiat Finance & Trade GBP 120 7.00% Oct. 19, 2005 170

Fiat Finance & Trade (1) EUR 1,700 5.75% May 25, 2006 1,700

Fiat Finance Canada EUR 100 5.80% July 21, 2006 80

Fiat Finance & Trade (1) EUR 500 5.50% Dec. 13, 2006 500

Fiat Finance & Trade (1) EUR 1,000 6.25% Feb. 24, 2010 1,000

Fiat Finance & Trade (1) EUR 1,300 6.75% May 25, 2011 1,300

Fiat Finance & Trade (1) EUR 617 (2) (2) 617

Others (3) 430

Total Euro Medium Term Notes 6,947

Convertible bonds:

Fiat Fin. Luxembourg (4) USD 17 3.25% Jan. 9, 2007 13

Total Convertible bonds 13

Other bonds:

Fiat Finance & Trade JPY 40,000 1.50% June 27, 2005 287

CNH America LLC USD 218 7.25% Aug. 1, 2005 160

CNH Capital America LLC USD 127 6.75% Oct. 21, 2007 93

Case New Holland Inc. USD 1,050 9.25% Aug. 1, 2011 771

Case New Holland Inc. USD 500 6.00% June 01, 2009 367

CNH America LLC USD 254 7.25% Jan. 15, 2016 187

Total Other bonds 1,865

Total Bonds 8,825

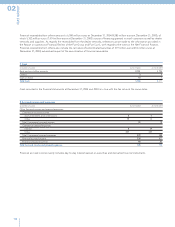

(1) Bonds listed on the Mercato Obbligazionario Telematico of the Italian stock exchange (EuroMot). Furthermore, the majority of the bonds issued by the Fiat Group are also listed on

the Luxembourg stock exchange.

(2) “Fiat Step-Up Amortizing 2001-2011” bonds repayable at face value in five equal annual installments each for 20% of the total issued (617 million euros) due beginning from the sixth

year (November 7, 2007) by reducing the face value of each bond outstanding by one-fifth. The last installment will be repaid on November 7, 2011. The bonds pay coupon interest

equal to: 4.40% in the first year (Nov. 7, 2002), 4.60% in the second year (Nov. 7, 2003), 4.80% in the third year (Nov. 7, 2004), 5.00% in the fourth year (Nov. 7, 2005), 5.20% in the fifth

year (Nov. 7, 2006), 5.40% in the sixth year (Nov. 7, 2007), 5.90% in the seventh year (Nov. 7, 2008), 6.40% in the eighth year (Nov. 7, 2009), 6.90% in the ninth year (Nov. 7, 2010), 7.40%

in the tenth year (Nov. 7, 2011).

(3) Bonds with amounts outstanding equal to or less than the equivalent of 50 million euros.

(4) Bonds convertible into General Motors Corp. common stock.

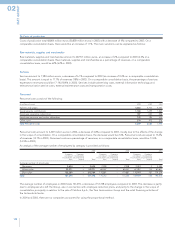

The Fiat Group intends to repay the issued bonds in cash at maturity by utilizing available liquid resources. To this end, available

liquidity at the end of 2004 totals approx. 5.3 billion euros. The Fiat Group also has available unused committed credit lines for more

than 1.7 billion euros.

Moreover, the companies in the Fiat Group may from time to time buy back bonds on the market that were issued by the Group also

for purposes of their cancellation. Such buybacks, if made, will depend upon market conditions, the financial situation of the Group

and other factors which could affect such decisions.