Chrysler 2004 Annual Report Download - page 197

Download and view the complete annual report

Please find page 197 of the 2004 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

195

Financial Statements at December 31, 2004 – Notes to the Financial Statements

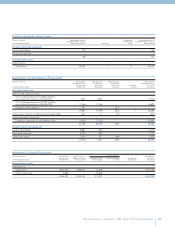

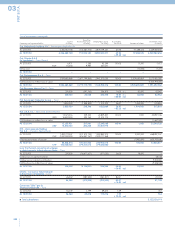

19 Extraordinary income and expenses

Extraordinary income

Extraordinary income totaled 1,579 thousand euros in 2004, for an increase of 1,384 thousand euros from the previous year. It consists

of 1,464 thousand euros for tax expenses determined in previous years in an amount exceeding what was owed upon payment and

115 thousand euros in other income.

Extraordinary expenses

Extraordinary expenses in 2004 totaled 15,151 thousand euros and consisted of 429 thousand euros from losses on the disposal

of investments, 14,704 thousand euros on incentives and expenses for the retirement of personnel in consequence of corporate

restructuring and reorganization plans, and 18 thousand euros for other costs.

The losses on disposals refer to the sale to Fiat Partecipazioni S.p.A. of 100% of Fiat International S.p.A. (84 thousand euros),

of 19.35% of the Istituto per la Ricerca e la Cura del Cancro S.p.A. (197 thousand euros), and 10.90% of the Istituto Europeo

di Oncologia S.r.l. (148 thousand euros).

In 2003 they essentially referred to bank commissions paid to Mediobanca S.p.A. for the postponement of the commitments

undertaken in connection with the “Ferrari” contract (15,504 thousand euros) and expenses connected with the valuation of the

Insurance Sector headed by Toro Assicurazioni S.p.A. (1,617 thousand euros), and IRPEG (corporate income taxes) for fiscal 2002

(2,441 thousand euros).

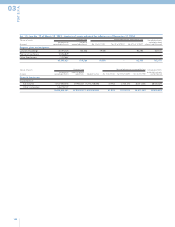

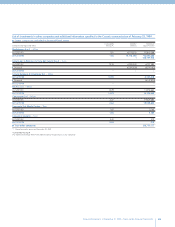

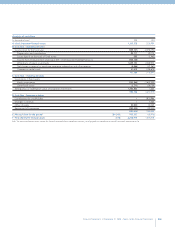

20 Income taxes

In 2004, there was income for 278,442 thousand euros. In particular, they include current income taxes (IRES) (credit 1,442 thousand

euros) stemming mainly from the income owed to Fiat S.p.A. for the tax loss used in connection with the consolidated tax return to

set off taxable income contributed by other companies, as well as deferred tax assets of 277,000 thousand euros, which were

previously commented on at note 5.

On the other hand, in 2003 there was a net tax liability of 60,664 thousand euros following cancellation of the deferred tax assets

determined in previous fiscal years when it became unlikely that they could be recovered and thus posted on the financial

statements.

In 2004, taxes represented 22.7% of income before taxes, and the difference with the theoretical IRES rate of 33% is due mainly to the

negative effect of writedowns of the investments carried out in the fiscal year that are no longer deductible according to current tax

norms, but partially balanced by the positive effect of deferred tax assets posted in consequence of temporary differences that arose

in previous years and tax losses carried forward.