Chrysler 2004 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2004 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

117

Consolidated Financial Statements at December 31, 2004 – Notes to the Consolidated Financial Statements

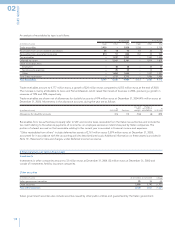

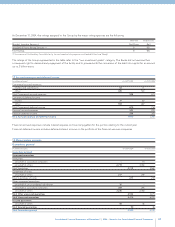

Payables decreased by 3,332 million euros compared to December 31, 2003 due to the following:

■Trade payables total 11,955 million euros, with a decrease of 633 million euros compared to 12,588 million euros at the end of

2003. The reduction is principally attributable to Fiat Auto, which, during the last quarter of 2003, as a result of the launch of new

car models, had increased production levels that during 2004 returned to normal levels.

■Financial payables decreased by 3,291 million euros mainly due to the repayment of bonds, including the bond for about 1 billion

euros issued by Fiat Finance and Trade, repaid at the end of March 2004, and the bond convertible into General Motors common

stock for 2.2 billion U.S. dollars, equivalent to approximately 1.8 billion euros.

■Other payables increased by 592 million euros primarily due to the effect of the advances received from customers (mainly

connected with work to complete the T.A.V. project - see Note 4).

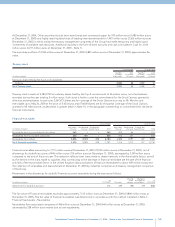

Financial payables total 18,743 million euros at December 31, 2004 (22,034 million euros at December 31, 2003). Financial payables

due within one year amount to 9,810 million euros at December 31, 2004 (6,616 million euros at December 31,2003) and their carrying

values approximate fair value as a consequence of the short-term maturity. These payables include the loan of approximately 1,150

million euros guaranteed by the EDF put option and the Mandatory Convertible Facility of 3 billion euros, described later.

The portion of medium and long-term Financial payables due beyond one year amounts to 8,933 million euros at December 31, 2004

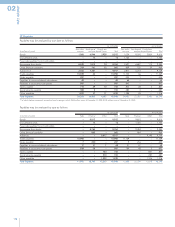

(15,418 million euros at December 31, 2003). The scheduled maturities are:

(in millions of euros) 2006 2007 2008 2009 Thereafter Total

Medium and long-term financial payables due beyond one year 3,311 692 369 527 4,034 8,933

The fair value of medium and long-term Financial payables due beyond one year would be 125 million euros higher than the carrying

value at December 31, 2004 (at December 31, 2003, fair value would have been 397 million euros lower than the carrying value). The

fair values of such financial payables take into account the current market cost of funding with similar maturities, and, for bonds, their

market prices.

The interest rates and the nominal currencies of medium and long-term financial payables, including the current portion of 7,253

million euros at December 31, 2004 (2,757 million euros at December 31, 2003) are as follows:

Less From 5% From 7.5% From 10% Greater

(in millions of euros) than 5% to 7.5% to 10% to 12.5% than 12.5% Total

Euro and euro-zone currencies 6,079 6,720 61 2 – 12,862

U.S. dollar 159 807 785 – – 1,751

Japanese yen 295––––295

Brazilian real 22 7 783 19 118 949

British pound – 171 – – – 171

Canadian dollar 134 ––––134

Other 319 2 – –24

Total 2004 medium and long-term debt 6,692 7,724 1,631 21 118 16,186

Total 2003 medium and long-term debt 8,918 8,083 968 6 200 18,175

Financial payables with nominal rates in excess of 12.5% relate principally to companies operating in Brazil.

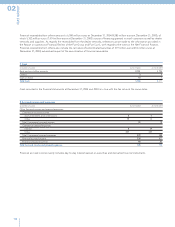

Medium and long-term financial payables include the loan of approximately 1,150 million euros secured from Citigroup and a small

group of banks that is guaranteed by the EDF put option (refer to the EDF Put described in Note 3) held by the Fiat Group on its

remaining investment (24.6%) in Italenergia Bis and the shares in the same Italenergia Bis pledged by Fiat. The loan is due in

September 2005.

Financial payables secured by mortgages and other liens on property, plant and equipment amount to 1,272 million euros at

December 31, 2004 (1,234 million euros at December 31, 2003).

At December 31, 2004, the Group has an unused “committed” line of credit available mainly denominated in U.S. dollars for

an equivalent amount of more than 1,700 million euros (approximately 2,000 million euros at December 31, 2003). The decrease

can principally be ascribed to the effects of the translation of the credit lines in their original currencies to euros.