Chrysler 2004 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2004 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

131

Consolidated Financial Statements at December 31, 2004 – Notes to the Consolidated Financial Statements

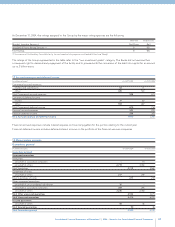

Other financial income of 2,246 million euros in 2004 (2,809 million euros in 2003), when shown net of Interest and other financial

expenses of 2,320 million euros (3,157 million euros in 2003) and the net balance of foreign exchange gains of 25 million euros (47

million euros in 2003) results in a net negative balance of 49 million euros (a net negative balance of 301 million euros in 2003).

However, the result for fiscal 2003 had benefited from financial income, net of the relative financial expenses, on the businesses sold

(mainly the retail activities of Fiat Auto and the Toro Assicurazioni Group) for approximately 170 million euros. On a comparable

consolidation basis, the improvement is about 420 million euros and is the consequence of both nonrecurring transactions (mainly

the net amount of income of approximately 300 million euros from the termination of the Equity Swap on General Motors stock) and

lower average indebtedness during the year and generally more favorable market interest rates.

Foreign exchange gains, net, of 25 million euros (foreign exchange gains, net, of 47 million euros in 2003), represent the balance

between foreign exchange gains of 2,443 million euros in 2004 (2,519 million euros in 2003) and foreign exchange losses of 2,418

million euros in 2003 (2,472 million euros in 2003).

Discounts and other expenses include receivables discounting and securitization expenses of 195 million euros in 2004 (280 million

euros in 2003).

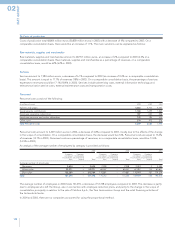

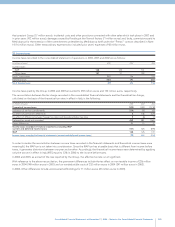

18 Adjustments to financial assets

(in millions of euros) 2004 2003 2002

Revaluations:

Equity investments 125 91 68

Financial fixed assets other than equity investments –––

Securities held in current assets other than equity investments –14 7

Total Revaluations 125 105 75

Writedowns:

Equity investments 126 263 809

Financial fixed assets other than equity investments 23 184

Securities held in current assets other than equity investments 2845

Financial receivables 71 518

Total Writedowns 222 277 956

Total Adjustments to financial assets (97) (172) (881)

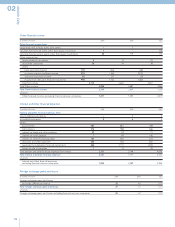

Revaluations and writedowns of equity investments also include the share of the earnings and losses of companies accounted for

using the equity method.

Revaluations of equity investments of 125 million euros in 2004 include the results of following companies (in millions of euros): BUC –

Banca Unione Credito 9 (11 in 2003), various companies of CNH Global N.V. 28 (24 in 2003), companies of Automobiles Sector 56 (20

in 2003), other companies 32 (36 in 2003).

Writedowns of equity investments of 126 million euros in 2004 (263 million euros in 2003) include the share of the losses of the

companies valued using the equity method and the permanent impairments in value of the companies valued at cost, for the

following (in millions of euros): various companies of CNH Global N.V. 4 (9 in 2003), companies in the Automobile Sector 51(112 in

2003), companies of the Commercial Vehicles Sector 28 (3 in 2003), companies of the Service Sector 26 (7 in 2003), other companies

17 (4 in 2003). In 2003, the amount included writedowns in following companies (in millions of euros): Italenergia Bis S.p.A. 24, Atlanet

S.p.A. 56, and the first four months of Toro Assicurazioni Group 48.

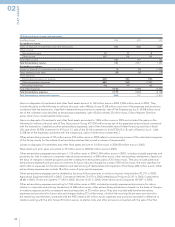

Writedowns of financial receivables of 71 million euros (5 million euros in 2003) include provisions to the allowance for doubtful

financial accounts receivable to adjust certain items to realizable value after settlement for the partial collection of a receivable which

became known during the early months of 2005.