Chrysler 2004 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2004 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

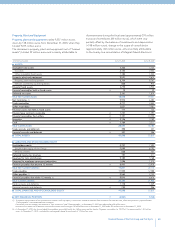

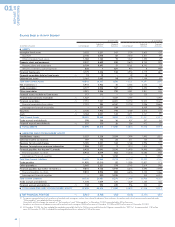

BREAKDOWN OF NET INDEBTEDNESS AND NET FINANCIAL POSITION BY ACTIVITY SEGMENT

At 12.31.2004 At 12.31.2003

Industrial Financial Industrial Financial

(in millions of euros) Consolidated Activities Activities Consolidated Activities Activities

Financial payables net of intersegment activities (18,743)(10,482)(8,261) (22,034) (11,531) (10,503)

Accrued financial expenses (523)(451)(72) (593) (416) (177)

Prepaid financial expenses 93 71 22 85 68 17

Cash 3,164 3,021 143 3,211 3,121 90

Securities 2,126 1,932 194 3,789 3,670 119

Net indebtedness (13,883)(5,909)(7,974) (15,542) (5,088) (10,454)

Financial receivables and lease contracts receivable 8,897 1,003 7,894 12,576 2,114 10,462

Accrued financial income 234 232 2 301 298 3

Deferred financial income (209)(34)(175) (363) (65) (298)

Net Financial Position (4,961)(4,708)(253) (3,028) (2,741) (287)

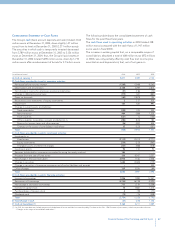

Activities column. However, funds that were transferred to

Financial Activities, were posted net of the relative intersegment

relationships, as shown in the table below.

41

Financial Review of the Fiat Group and Fiat S.p.A.

Cash and cash equivalents collected by the centralized cash

management during its activity have been recorded in the item

Financial payables net of intersegment activities in the Industrial

At 12.31.2004 At 12.31.2003

Industrial Financial Industrial Financial

(in millions of euros) Consolidated Activities Activities Consolidated Activities Activities

Financial payables to others due within 12 months 9,810 8,926 884 6,616 5,150 1,466

Financial payables to others due beyond 12 months 8,933 8,079 854 15,418 14,480 938

(Intersegment financial receivables) –(6,757)(234) – (8,459) (360)

Intersegment financial payables – 234 6,757 – 360 8,459

Financial payables net of intersegment activities 18,743 10,482 8,261 22,034 11,531 10,503

The Group’s net indebtedness (financial payables net of

intersegment payables, cash, and marketable securities)

decreased by a further 1,659 million euros in 2004 (from 15,542

million euros to 13,883 million euros). In particular:

■the net indebtedness of Industrial Activities increased by 821

million euros in consequence of the operating requirements

of the period (mainly the loss for the period and the increase

in working capital), and was partially offset by the collection

of financing and deposits included in financial receivables

at December 31, 2003;

■the net indebtedness of financial activities instead shows

a decrease of 2,480 million euros, reflecting lower financing

to the sales network of the Automobile Sector, the lower

amount of financing provided to suppliers and the sale

of the financial company of the Automobile Sector that

operated in the United Kingdom.