Chrysler 2004 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2004 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

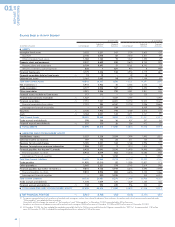

Systems), and positive foreign exchange differences of

approximately 46 million euros.

“Leased assets” decreased by 86 million euros, mainly in

consequence of disinvestments during the period (303 million

euros), which were only partially offset by the positive balance

of 221 million euros between investments and depreciation.

Aggregate investments in fixed assets totaled 2,112 million

euros in 2004 (2,011 million euros in 2003), including those

in long-term leases, which increased by 50 million euros, from

358 million euros in 2003 to 408 million euros in 2004.

Depreciation of property, plant and equipment totaled 1,693

million euros in 2004 (1,750 million euros in 2003 ), including

187 million euros for leased assets (219 million euros in 2003).

At December 31, 2004, accumulated depreciation and

writedowns of fixed assets totaled 18,364 million euros,

corresponding to approximately 66% of gross fixed assets,

compared with approximately 64% at December 31, 2003.

Financial Fixed Assets

Financial fixed assets totaled 3,779 million euros, compared

with 3,950 million euros at December 31, 2003. The decrease

of 171 million euros is largely attributable to the dividends

paid by BUC – Banca Unione di Credito (184 million euros),

accounted for using the equity method, and only partially

offset by the positive balance of revaluations and writedowns.

Financial Assets not held as Fixed Assets

Financial assets not held as fixed assets totaled 117 million

euros, substantially the same as at December 31, 2003.

Net Deferred Tax Assets

Net deferred tax assets (deferred tax assets net of deferred

income tax reserves) totaled 1,964 million euros at December

31, 2004, compared with of 1,668 million euros at December 31,

2003. The increase that occurred during the fiscal year is

attributable to the posting of net deferred tax assets (written

down in previous years as the conditions for recording them

were not met) totaling 296 million euros, of which 277 million

euros for Fiat S.p.A., the recovery of which became reasonably

certain in consequence of the settlement received in February

2005 upon cancellation of the Master Agreement with General

Motors.

Working Capital

The Group’s working capital increased by 604 million euros to a

negative 1,530 million euros, up from the negative 2,134 million

euros reported at the end of 2003.

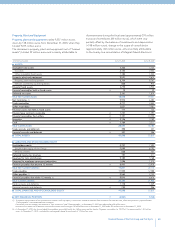

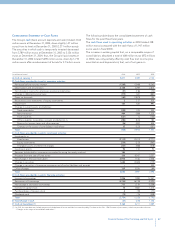

The following table illustrates the composition of working

capital at the end of 2003 and 2004.

(in millions of euros) At 12.31.2004 At 12.31.2003 Change

Net inventories (1) 5,972 6,484 (512)

Trade receivables 4,777 4,553 224

Trade payables (11,955) (12,588) 633

Other receivables/(payables) (1) (324) (583) 259

Working capital (1,530) (2,134) 604

(1) The amounts at December 31, 2003 include the effect of the adjustment for a total of

428 million euros, which is described in the footnote of the Balance Sheet.

An analysis of the changes affecting the main components

of working capital is provided below.

Net inventories (raw materials, finished products, and work

in progress), net of advances received for contract work in

progress, totaled 5,972 million euros, against 6,484 million euros

at December 31, 2003. The decrease is largely attributable to

Fiat Auto, which reduced its stock of new and used vehicles by

over 20% during the year, and the impact of the change in the

euro/dollar exchange rate on CNH inventories.

Trade receivables totaled 4,777 million euros, up by 224 million

euros from the 4,553 million euros at December 31, 2003. The

increase is mainly attributable to Iveco and Ferrari-Maserati,

which increased their levels of activity and revenues by 10%

and 20%, respectively, in 2004.

Trade payables totaled 11,955 million euros, down by 633

million euros with respect to the 12,588 million euros at

December 31, 2003. The decrease is largely attributable to Fiat

Auto, which had increased its production levels during the last

quarter of 2003 upon the introduction of new models, levels that

stabilized during 2004.

The negative balance of other receivables/(payables),

which also includes trade accruals and deferrals, improved from

-583 million euros at December 31, 2003 to -324 million euros.

The decrease of 259 million euros is mainly attributable to the

requirements generated by payment in 2004 of payables to

employees leaving the Group at the end of 2003 (especially

Fiat Auto), the increase at CNH of deposits securing disposals

of trade receivables, which were only partially offset by lower

receivables from Tax Authorities (mainly for VAT).

Reserves

Reserves (“Reserves for risks and charges” plus the “Reserves

for employee severance indemnities”) totaled 6,471 million

euros and were substantially in line (-10 million euros) with the

value at the beginning of the fiscal year, when they totaled 6,481

million euros.

At December 31, 2004, the reserves mainly included: income tax

reserves for 77 million euros (98 million euros in 2003), warranty

REPORT ON

OPERATIONS

01

34