Chrysler 2004 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2004 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

109

Consolidated Financial Statements at December 31, 2004 – Notes to the Consolidated Financial Statements

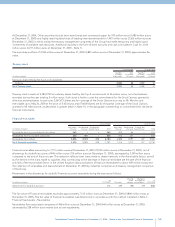

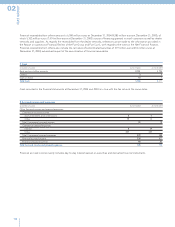

At December 31, 2004, Other securities include short-term bonds and commercial paper for 703 million euros (1,480 million euros

at December 31, 2003) and highly rated liquidity funds of leading international banks for 1,481 million euros (2,365 million euros at

December 31, 2003) in which mainly the treasury management companies of the Group had made temporary and highly liquid

investments of available cash resources. Additional liquidity in the form of bank accounts and cash is included in Cash for 3,164

million euros (3,211 million euros at December 31, 2003 - Note 7).

The securities portfolio of 2,184 million euros at December 31, 2004 (3,845 million euros at December 31, 2003) approximates fair

value.

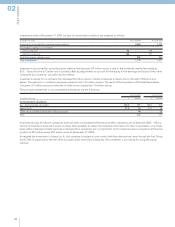

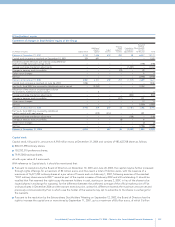

Treasury stock

At 12/31/2004 At 12/31/2003

Number Cost Number Cost

of shares (in millions of shares (in millions

(in milioni di euro) (thousands) of euros) (thousands) of euros)

Fiat S.p.A. shares held by Fiat S.p.A. and subsidiaries:

Ordinary 4,384 26 4,969 32

Total Treasury stock 4,384 26 4,969 32

Treasury stock consists of 4,384,019 Fiat ordinary shares held by Fiat S.p.A. and amounts to 26 million euros, net of writedowns

recorded during the year totaling 2 million euros. Such stock is held to cover the commitments for the Stock Options granted to

directors and employees. In particular, 2,667,615 shares are for coverage of the Stock Options accruing to Mr. Morchio and

exercisable up to May 30, 2005 at the price of 5.623 euros and 670,000 shares are for the partial coverage of the Stock Options

granted to Mr. Marchionne, as described in greater detail in Note 14, in the paragraph commenting on commitments for derivative

financial instruments.

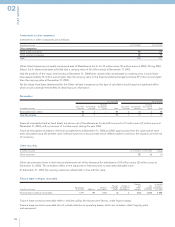

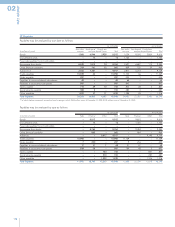

Financial receivables

At 12/31/2004 At 12/31/2003

Due within Due beyond

Of which due

Due within Due beyond

Of which due

(in millions of euros) one year one year

beyond 5 year

Total one year one year

beyond 5 year

Total

Receivables from unconsolidated subsidiaries 565 – – 565 475 46 – 521

Receivables from associated companies 225 181 – 406 413 231 – 644

Receivables from others 3,806 2,374 414 6,180 6,488 3,097 422 9,585

Total Financial receivables 4,596 2,555 414 7,151 7,376 3,374 422 10,750

Financial receivables amounting to 7,151 million euros at December 31, 2004 (10,750 million euros at December 31, 2003), net of

allowances for doubtful accounts of 440 million euros (316 million euros at December 31, 2003), decreased by 3,599 million euros

compared to the end of the prior year. This reduction reflects lower loans made to dealer networks in the Automobile Sector, as well

as the decline in the loans made to suppliers. Also contributing to the decrease in financial receivable are the sale of the financial

activities of the Automobile Sector in the United Kingdom (deconsolidation of financial receivables for about 690 million euros) and

the collection of receivables and deposits held at December 31, 2003 by industrial companies and treasury management companies

of the Group.

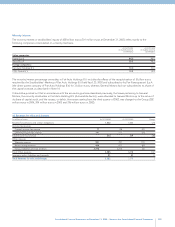

Movements in the allowances for doubtful financial accounts receivable during the year are as follows:

Use and Change in

At other the scope of At

(in millions of euros) 12/31/2003 Provisions changes consolidation 12/31/2004

Allowances for doubtful accounts 316 239 (96) (19) 440

The fair value of Financial receivables would be approximately 7,143 million euros at December 31, 2004 (10,800 million euros at

December 31, 2003). The fair value of financial receivables was determined in accordance with the method indicated in Note 3 -

Financial fixed assets – Receivables.

Receivables from associated companies of 406 million euros at December 31, 2004 (644 million euros at December 31, 2003)

decreased by 238 million euros mainly due to loan repayments.