Chrysler 2004 Annual Report Download - page 182

Download and view the complete annual report

Please find page 182 of the 2004 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FIAT S.P.A.

03

180

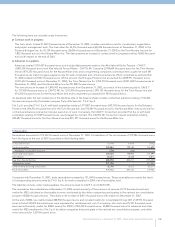

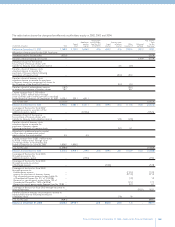

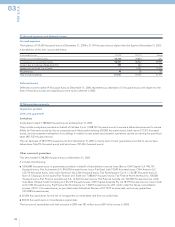

There was a net decrease in tax credits of 115,309 thousand euros with respect to December 31, 2003, resulting from:

(in thousands of euros)

Lower consolidated Group VAT credits (170,060)

IRES credit deriving from the national tax consolidation program 55,848

Miscellaneous items (1,097)

Net change (115,309)

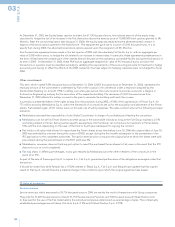

Deferred taxes consist of the balance of deferred tax assets net of deferred tax liabilities. Overall, the temporary differences and

relative theoretical tax effects, calculated on the basis of the IRES rate of 33% at December 31, 2004 and IRPEG of 34% at December

31, 2003, can be broken down as follows:

(in thousands of euros) 12/31/2004 12/31/2003

Deferred tax assets for temporary differences:

Writedowns of investments deductible in future fiscal years 632,944 694,591

Taxed liabilities and risk reserves and other minor differences 12,525 10,459

Total deferred tax assets 645,469 705,050

Deferred tax liabilities for:

Gains (sale of Ferrari S.p.A. stock) deferred for taxation in future fiscal years (79,602) (119,580)

Total theoretical benefit on temporary differences 565,867 585,470

Theoretical benefit on tax losses that can be carried forward 253,936 122,306

Value adjustments for assets whose recoverability is not reasonably certain (542,803) (707,776)

Total deferred tax assets 277,000 –

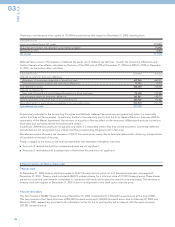

As previously indicated in the Accounting Principles and Methods, deferred tax assets are recognized only when it is reasonably

certain that they will be recovered. In particular, thanks to the indemnity paid to Fiat S.p.A. by General Motors in February 2005 for

termination of the Master Agreement, the recovery of a portion of the tax effect on the temporary differences that arose in previous

fiscal years and tax losses carried forward became certain.

In particular, deferred tax assets are recognized only when it is reasonably certain that they will be recovered. Conversely, deferred

tax liabilities are not recognized if it is unlikely that the corresponding obligations will in fact arise.

Miscellaneous items showed a net decrease of 42,217 thousand euros, mainly due to less receivables sold in factoring, in expectation

of liquidation at the end of the year.

Finally, in regard to the items on the financial statements that represent receivables, note that:

■Amounts of receivables due from companies abroad are not significant.

■Amounts of receivables with a residual term of more than five years are not significant.

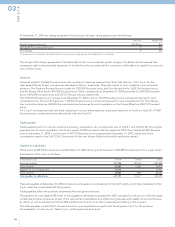

6 Financial assets not held as fixed assets

Treasury stock

At December 31, 2004, treasury stock amounted to 26,413 thousand euros, which is 1,631 thousand euros less compared with

December 31, 2003. Treasury stock included 4,384,019 ordinary shares, for a total par value of 21,920 thousand euros. These shares

are held to cover the commitments undertaken in connection with stock option plans for directors and employees. The decrease in

treasury stock with respect to December 31, 2003 is due to its alignment to the stock option exercise price.

Financial receivables

This item totaled 2,320,581 thousand euros at December 31, 2004, compared with 1,436,664 thousand euros at the end of 2003.

This item consists of two fixed rate loans of 800,000 thousand euros and 1,200,000 thousand euros, due on February 22, 2005 and

March 16, 2005, respectively, provided to the subsidiary Fiat Ge.Va. S.p.A, and liquidity left on deposit with this same company

(320,581 thousand euros).