Chrysler 2004 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2004 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

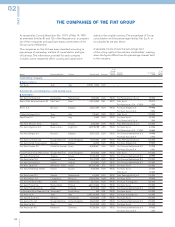

FIAT GROUP

02

132

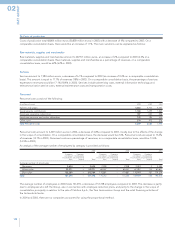

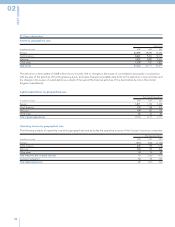

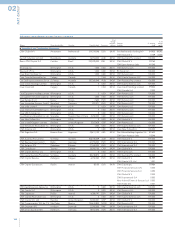

19 Extraordinary income and expenses

(in millions of euros) 2004 2003 2002

Extraordinary income

Gains on disposals of investments and other fixed assets 162 1,826 1,081

Other income:

Prior period income 19 32 8

Other income 135 159 146

Total Other income 154 191 154

Total Extraordinary income 316 2,017 1,235

Extraordinary expenses

Losses on disposal of investments and other fixed assets (5) (50) (1,239)

Taxes relating to prior years (39) (26) (79)

Other expenses:

Extraordinary provisions to reserves (432) (585) (980)

Other extraordinary expenses (685) (969) (1,400)

Prior period expenses (18) (40) (40)

Total Other expenses (1,135) (1,594) (2,420)

Total Extraordinary expenses (1,179) (1,670) (3,738)

Total Extraordinary income and expenses (863) 347 (2,503)

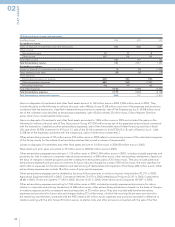

Gains on disposals of investments and other fixed assets amount to 162 million euros in 2004 (1,826 million euros in 2003). They

include the gains on the following (in millions of euros): sale of Midas Group 32 (28 million euros net of the expenses and provisions

connected with the transaction, classified in extraordinary provisions to reserves), sale of Fiat Engineering S.p.A. 60 (58 million euros

net of the collateral costs classified as extraordinary expenses), sale of Edison shares 32 million euros, Edison Warrant 30 million

euros, other minor investments 8 million euros.

Gains on disposals of investments and other fixed assets amounted to 1,826 million euros in 2003 and included the gains on the

following (in millions of euros): sale of Toro Assicurazioni Group 427 (390 million euros net of the expenses and provisions connected

with the transaction, classified as other extraordinary expenses), sale of the Automobile Sector’s Retail financing activities in Brazil

103, sale of the 55.95% investment in IPI S.p.A. 15, sale of the 50.1% investment in IN ACTION S.r.l. 8, sale of FiatAvio S.p.A. 1,266

(1,258 net of the expenses connected with the transaction), sales of other minor investments 7.

Other extraordinary income of 135 million euros (159 million euros in 2003) refers to nonrecurring income of the individual companies

of the Group mainly for the release of extraordinary reserves that proved in excess of requirements.

Losses on disposals of investments and other fixed assets amount to 5 million euros in 2004 (50 million euros in 2003).

Taxes relating to prior years amounted to 39 million euros in 2004 (26 million euros in 2003).

Other extraordinary expenses amounting to 1,135 million euros in 2004 (1,594 million euros in 2003), include principally expenses and

provisions for risks in relation to corporate restructuring transactions of 508 million euros, other extraordinary writedowns of assets on

the basis of changes in market prospects and the consequent new business plans of 35 million euros. They also include additional

extraordinary expenses and provisions to reserves for future risks and charges for a total of 592 million euros, the most significant of

which refer to expenses for the rationalization and restructuring of relationships with suppliers of the Group (246 million euros). Other

extraordinary expenses also include 18 million euros of prior period expenses.

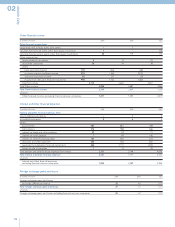

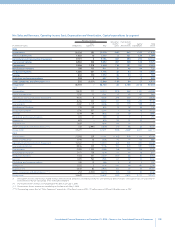

Other extraordinary expenses can be detailed by Sector as follows (amounts in millions of euros): Automobiles 742 (711 in 2003),

Agricultural Equipment 68 (142 in 2003), Commercial Vehicles 70 (170 in 2003), Metallurgical Products 25 (67 in 2003), Components

68 (86 in 2003), Production Systems 17 (140 in 2003), Services 16 (31 in 2003), Other Sectors and Companies 129 (247 in 2003).

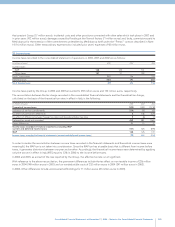

Other extraordinary expenses amounting to 1,594 million euros in 2003, included principally expenses and provisions for risks in

relation to corporate restructuring transactions of 658 million euros, other extraordinary writedowns of assets on the basis of changes

in market prospects and the consequent new business plans of 215 million euros. They also included additional extraordinary

expenses and provisions for future risks and charges totaling 721 million euros, of which the most significant were: provisions for

the remaining commitments connected with the IPSE initiative (47 million euros), expenses and provisions recorded in reference to

relations existing with the Ixfin Group (53 million euros), incidental costs and other provisions connected with the sale of the Toro