Chrysler 2004 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2004 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FIAT GROUP

02

120

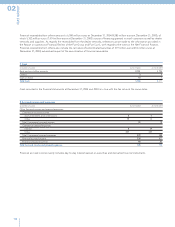

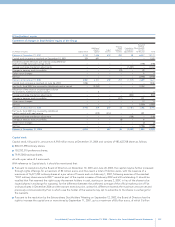

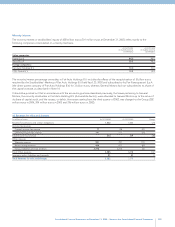

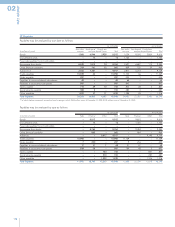

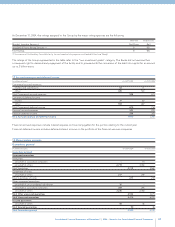

Mandatory Convertible facility

Medium and long-term financial payables also include the 3 billion euros Mandatory Convertible facility stipulated in execution of the

Framework Agreement, dated May 27, 2002, with Capitalia, Banca Intesa, SanPaolo IMI and Unicredito Italiano (Money Lending

Banks) for the purpose of providing the Fiat Group with the financial support it needs to implement its industrial plans. The facility

was secured on September 24, 2002 from a syndicate of banks, including the Money Lending Banks, in which BNL, Monte dei Paschi

di Siena, ABN Amro, BNP Paribas, Banco di Sicilia and Banca Toscana (hereinafter “the Banks”) also participated. The main features

of the Mandatory Convertible facility are listed in the following paragraphs.

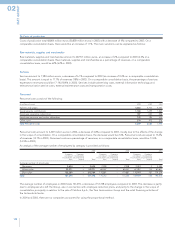

The Mandatory Convertible facility expires on September 20, 2005 and is repayable with a new issue of Fiat S.p.A. ordinary shares,

which the Banks have agreed to underwrite and offer pre-emptively to all Fiat stockholders. The issue price per share will be the

average of 14.4409 euros (the adjusted value compared to the original value of 15.50 euros in accordance with the rules established

by the AIAF – Italian Association of Financial Analysts – following the Fiat S.p.A. capital increase of July 2003) and the average stock

market price in the last three or six months, depending on the case, preceding the repayment date. The same formula will also be

applied in the event of an earlier repayment date.

The capital stock increase should be approved at the expiration of the three-year term of the facility, for an amount equal to the

outstanding balance of the facility. Fiat may elect to repay the facility in cash at an earlier date, even partially, every six months,

provided that, even after repayment, its rating is at least equal to investment grade level.

Conditions giving rise to an earlier expiration date of the facility include the occurrence of an event that creates a serious crisis for the

company, such as the request for a court-appointed administrator or other proceedings of composition with creditors, a bankruptcy

filing, or one of the causes of business dissolution set forth in the previous Article 2448 now Article 2484 of the Italian Civil Code. In

addition, the Banks in the facility arrangement have the right to demand early repayment of the entire amount of the facility and

proceed with the conversion of the debt into capital in the following cases:

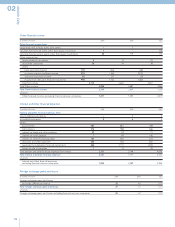

■Fiat Group companies have not fulfilled their duty to repay liquid and current financial obligations of an aggregate amount of

more than 1 billion euros;

■the independent auditors have issued a negative opinion on the consolidated financial statements, unless new auditors, who

must have accepted the assignment within 30 days, issue a favorable opinion no later than 60 days thereafter;

■Fiat becomes the target of a takeover bid in accordance with Articles 106 and 107 of the Consolidated Law on Financial

Intermediation.

Lastly, the Banks also have the right but not the obligation to demand early repayment of a portion of the amount of the facility, up

to a maximum of 2 billion euros, after 24 months have elapsed from the signing of the agreement (and, therefore, beginning from

July 26, 2004), in the event that the Group’s debt is not rated “investment grade” by at least one of the leading international rating

agencies and, after 18 months have elapsed from the signing of the agreement (January 26, 2004), in the event that the level of net

and/or gross financial indebtedness (respectively in the definitions of “Net financial position” and “Total financial liabilities” used

by the Group and detailed in the Report on Operations) is more than 20% higher than the corresponding level established by the

Financial Objectives stipulated in the facility agreement.

The aforementioned Financial Objectives refer, in particular, to the reduction of net indebtedness in the Net Financial Position to

less than 3 billion euros by the date the Board of Directors approves the 2002 annual financial statements and the maintenance of

that level at March 31, June 30, September 30 and December 31 of each year until the expiration of the facility. Pursuant to the

agreement, the proceeds are considered which are generated by the transactions related to the sale of the investment in Italenergia

Bis S.p.A., including those connected with the Citigroup facility of approximately 1,150 million euros, described previously, and the

financial effects arising from binding contracts for the sale of assets (investments, companies, plant and equipment, etc.), comprising

those not yet executed. The agreement also states that Gross Financial Indebtedness must be reduced by 12 billion euros, compared

to March 31, 2002, by the date the Board of Directors approves the 2002 annual financial statements and must be maintained at less

than 23.6 billion euros at March 31, June 30, September 30 and December 31 of each year until the expiration of the facility.

At December 31, 2004, gross indebtedness totals 19.2 billion euros and continues to be within the targets agreed upon with the

Lending Banks under the Mandatory Convertible Facility Agreement (23.6 billion euros), while the proforma net financial position

(calculated, as envisaged in the facility agreement, by subtracting from the net financial position the Citigroup loan of approximately

1,150 million euros but not the receipt of 1,550 million euros as a result of the agreements reached with General Motors on February

13, 2005) exceeds the limit of 3.6 billion euros contractually agreed for this parameter. The Lending Banks therefore have the right, in

accordance with the contractual terms and conditions, to proceed with the conversion of the facility into capital for an amount up to

2 billion euros.