Chrysler 2004 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2004 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

December 31, 2004, a 17-million-dollar loan is still outstanding

(approximately 13 million euros).

At December 31, 2004, gross indebtedness included, among

other things, the mandatory convertible facility agreement

(3 billion euros) and the loan by Citigroup (lead manager of a

restricted pool of banks), secured by the agreements with EDF

as part of the Italenergia Bis transaction (approximately 1,150

million euros).

The net financial position – net indebtedness minus financial

receivables – totaled a negative 4,961 million euros at

December 31, 2004, reflecting an increase from the negative

3,028 million euros recorded at December 31, 2003.

This change stemmed principally from the operating

requirements of the period, particularly the loss posted for the

year, the increase in working capital and lower sales of trade

receivables.

For a more detailed analysis of the above items, and more

specifically as regards bonds, please see the Notes to the

Consolidated Financial Statements.

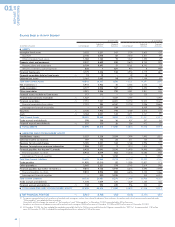

Financial receivables and lease contracts receivable at

December 31, 2004 include financial receivables from the

dealer network totaling 1,220 million euros (2,020 million

euros at December 31, 2003).

The aggregate total of Group receivables from the dealer

network is illustrated as follows.

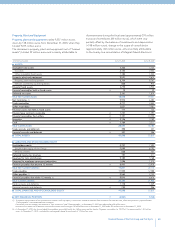

(in millions of euros) At 12.31.2004 At 12.31.2003 Change

Trade receivables 1,286 1,208 78

Financial receivables 1,220 2,020 (800)

Total receivables from the dealer network

2,506 3,228 (722)

Receivables from the dealer network are typically generated

by sales of vehicles and are generally managed under dealer

network financing programs as a typical component of the

portfolio of the financial services companies. These receivables

are interest bearing, with the exception of an initial limited,

non-interest bearing installment payment period. On the

consolidated balance sheet, the interest-bearing portion of

the receivables is classified as a financial receivable and thus

included in the net financial position, while the non-interest

bearing portion is classified as a trade receivable (and thus

excluded from the net financial position).

The contractual terms governing the relationships with the

dealer networks vary from Sector to Sector and from country

to country. However, these receivables are collected in

approximately two to four months on average.

The receivables from the dealer network illustrated in the

preceding table are net of allowances for doubtful accounts

totaling 408 million euros at December 31, 2004 (313 million

euros at December 31, 2003), computed on the basis of

historical statistical analyses and updated according to

evolutions in market trends. During 2004, 137 million euros

(27 million euros in 2003) were allocated to reserves, and 94

million euros (46 million euros in 2003) were used. At December

31, 2004, the Group held guarantees totaling more than 2 billion

euros as security for these receivables.

The receivables illustrated in the preceding table are net of sale

with or without recourse, as follows:

REPORT ON

OPERATIONS

01

36

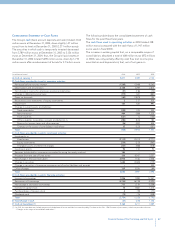

At 12.31.2004 At 12.31.2003 Change

Trade Financial Trade Financial Trade Financial

(in millions of euros) receivables receivables Total receivables receivables Total receivables receivables Total

With recourse 937 59 996 1,387 – 1,387 (450) 59 (391)

Without recourse 2,927 852 3,779 2,598 740 3,338 329 112 441

At December 31, 2004, gross indebtedness totaled 19.2 billion

euros and continued to be within the targets agreed upon with

the Lending Banks under the Mandatory Convertible Facility

Agreement (23.6 billion euros), while the pro-forma net financial

position (computed, as envisaged in the facility agreement,

by subtracting from the net financial position the Citigroup loan

of approximately 1,150 million euros but not the receipt of the

1,550 million euros as a result of the agreement reached with

General Motors on February 13, 2005) exceeded the limit of

3.6 billion euros contractually agreed for this parameter. The

Lending Banks therefore have the right according to contractual

terms and conditions, to proceed with the conversion of the

facility for an amount up to 2 billion euros in principal.