Chrysler 2004 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2004 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

105

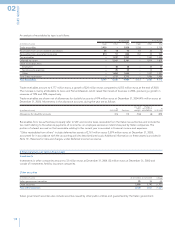

Consolidated Financial Statements at December 31, 2004 – Notes to the Consolidated Financial Statements

In conclusion, the 14% holding in Italenergia Bis sold by Fiat is subject to Put options exercisable in 2005 by each of the Banks.

Nevertheless, the effects of the sale were considered final and the resulting gain realized in 2002, in that Fiat had contemporaneously

stipulated a put option with EDF that will give it the right, in the event that the Banks ask to purchase said shares, to sell them to EDF

at the same price conditions as the EDF Put.

In order to complete disclosure, it should be pointed out that in December 2004 Fiat received a letter in which EDF advised that it

intends to invoke the arbitration rights available under the Put Option Agreement signed in September 2002 with Fiat. EDF claims

that certain recent changes to Italian legislation have raised uncertainty regarding the nature and extent of the rights and interests

that it would acquire under the Put Option Agreement. Fiat has reviewed its legal position on the issues raised by EDF and it

believes that its rights under the Put Option Agreement are unaffected by the position communicated by EDF. At the end of

December 2004, EDF asked the organization which administers arbitration proceedings – the London Court of International

Arbitration – to commence arbitration for the above reasons. Fiat has presented its defense case before the Court. It is probable that

the arbitration will end by the end of the year.

Again in December, EDF initiated arbitration proceedings against Fiat with regard to the Put on the 14% holding sold to the three Banks

in 2002 and functionally at the service of the tag-along/drag-along right granted to the same Banks in the event of exercising the Put

Option relative to the 24.6% holding. In this request, too, EDF claims that certain recent changes to Italian legislation have raised

uncertainty regarding the nature and extent of the rights and interests that it would acquire under the Put Option Agreement. Also in

this case, Fiat has reviewed its legal position on the issues raised by EDF and it believes that its rights under the Put Option Agreement

are well-founded. The arbitration is under the administration of the International Chamber of Commerce and in its initial stages.

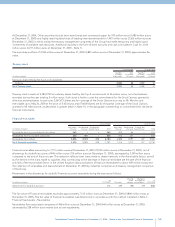

The legal steps taken by EDF are to be associated with similar actions undertaken by EDF with regard to the other stockholders of

Italenergia Bis and with the well-known initiatives, according to press reports, advanced in relation to other operators in the sector

and financial operators aimed at identifying an industrial or financial partner in Italenergia Bis. Press sources have also revealed that

negotiations are underway between the Italian and French governments concerning the reciprocal opening of the electricity market.

On March 21, 2005 Fiat exercised the Put option relating to 24.6% of the shares as well as the Put on the 14% holding sold to the

three banks in 2002.

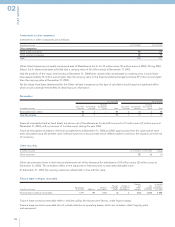

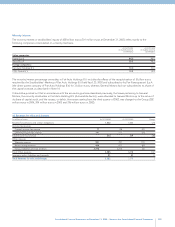

Fidis Retail Italia (FRI)

With reference to the associated company Fidis Retail Italia S.p.A. (“FRI”), this company was set up to take over the European

activities of the Automobile Sector in the area of consumer financing for retail automobile purchases. To this end, those activities,

performed by various companies operating in different countries in Europe, were gradually sold to FRI, after obtaining the necessary

authorizations from the local regulatory agencies. As envisaged by the Framework Agreement signed on May 27, 2002 by Fiat and

the “Money Lending Banks” (Capitalia, Banca Intesa, SanPaolo IMI and later Unicredito Italiano), on May 27, 2003, the Fiat Group

sold 51% of FRI’s shares and, as a result, the relative control, to Synesis Finanziaria S.p.A., an Italian company held equally by the four

Banks, at the price of 370 million euros. This transaction led to a loss of 15 million euros that had already been set aside in a specific

reserve for risks in the consolidated financial statements at December 31, 2002, based upon the binding agreements signed by the

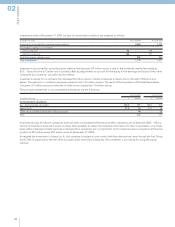

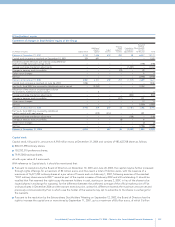

parties at that time. The sale contract calls for Put and Call options that can be summarized as follows:

■Call Option by Fiat Auto to purchase 51% of Fidis Retail Italia, held by Synesis Finanziaria, exercisable quarterly up to January 31,

2008 (initially up to January 31, 2006, before the extension agreed on February 4, 2005) at a price increased prorata temporis over

the sales price plus additional payments less any distributions.

■Synesis Finanziaria’s right to ask Fiat Auto to exercise the above purchase option on 51% of Fidis Retail Italia in the event of

which, by January 31, 2008 (January 31, 2006, before the above mentioned extension) there is a change in control of Fiat or Fiat

Auto (also through the sale of a substantial part of the companies owned by Fiat Auto or one of its brands Fiat, Alfa and Lancia)

as set forth in the relative stockholders agreement between Fiat Auto, Synesis Finanziaria and the four money lending banks.

■So-called “tag along” option on behalf of Synesis Finanziaria if the same events referred to in the preceding point occur after

January 31, 2008 (originally January 31, 2006).

■So-called “drag along” option on behalf of Fiat Auto in the event of the sale of the investment after January 31, 2008 (January 31,

2006, before the above mentioned extension).

As a result of the transaction, FRI was deconsolidated and has repaid all the loans it previously obtained from the centralized treasury

department of the Group.