Chrysler 2004 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2004 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FIAT GROUP

02

122

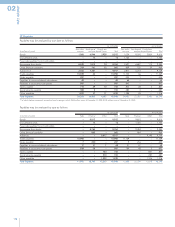

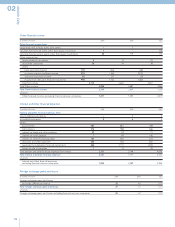

At December 31, 2004, Guarantees granted by the Group total 5,520 million euros (6,430 million euros at December 31, 2003),

detailed as follows:

■suretyships total 2,719 million euros (3,060 million euros at December 31, 2003). The reduction of 341 million euros is principally

due to the deconsolidation of Fiat Engineering and lower guarantees granted on behalf of Sava S.p.A. for the bonds it has issued

and are now falling due;

■other unsecured guarantees of 2,534 million euros (3,075 million euros at December 31, 2003) include commitments for

receivables and bills discounted with recourse in the amount of 1,696 million euros (2,203 million euros at December 31, 2003).

The receivables and bills discounted with recourse refer to trade receivables and other receivables for 1,613 million euros (2,144

million euros at December 31, 2003) and financial receivables for 83 million euros (59 million euros at December 31, 2003). The

volume of receivables discounted with recourse in 2004 was 13,178 million euros (15,341 million euros in 2003).

Although not included in the memorandum accounts, receivables and bills discounted by the Group without recourse having due

dates beyond December 31, 2004 amount to 9,809 million euros (in 2003, 9,852 million euros with due dates beyond December 31,

2003). Receivables and bills discounted without recourse refer to trade receivables and other receivables for 4,689 million euros (4,638

million euros at December 31, 2003) and financial receivables for 5,210 million euros (5,214 million euros at December 31, 2003). The

discounting of financial receivables principally refers to securitization transactions involving accounts receivables from the final (retail)

customers of the financial services companies. The accounting treatment for securitization transactions is disclosed in the Accounting

Principles. The volume of receivables and bills discounted without recourse in 2004 was 27,540 million euros (33,298 million euros in

2003).

In summary, the discounted receivables and bills at December 31, 2004 are as follows:

At 12/31/2004 At 12/31/2003

Trade Trade

receivables receivables

and Other Financial and Other Financial

(in millions of euros) receivables receivables Total receivables receivables Total

With recourse 1,613 83 1,696 2,144 59 2,203

Without recourse 4,689 5,120 9,809 4,638 5,214 9,852

The Parent Company and certain of its subsidiaries are involved in various legal actions and disputes. However, the settlement of

such actions and disputes should not give rise to significant losses or liabilities which have not already been set aside in specific risk

reserves.

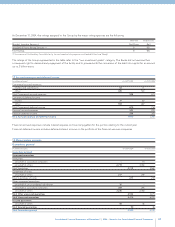

Commitments

(in millions of euros) At 12/31/2004 At 12/31/2003

Commitments and rights related to derivative financial instruments 21,319 20,798

Commitments to purchase property, plant and equipment 408 329

Other commitments 12,813 10,350

Total Commitments 34,540 31,477

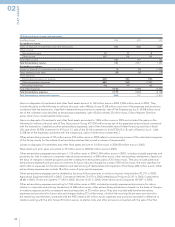

Commitments amount to 34,540 million euros at December 31, 2004 (31,477 million euros at December 31, 2003) and include

commitments and rights for derivative financial instruments of 21,319 million euros at December 31, 2004 (20,798 million euros at

December 31, 2003). Derivative financial instruments are shown at their notional value (the amount of reference used to calculate the

economic effects of the contract) which does not necessarily represent the amount exchanged between the parties.

In particular, the following transactions exist at December 31, 2004:

■contracts to hedge foreign exchange risks of 5,350 million euros (4,830 million euros at December 31, 2003);

■contracts to hedge interest rate exposure of 13,880 million euros (14,142 million euros at December 31, 2003);