Chrysler 2004 Annual Report Download - page 190

Download and view the complete annual report

Please find page 190 of the 2004 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FIAT S.P.A.

03

188

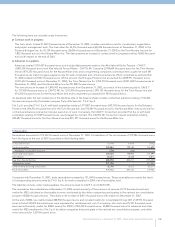

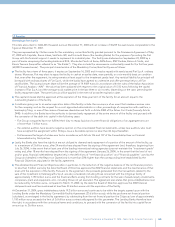

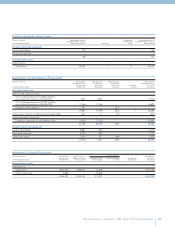

13 Accrued expenses and deferred income

Accrued expenses

The balance of 129,650 thousand euros at December 31, 2004 is 37,394 thousand euros higher than the figure at December 31, 2003.

A breakdown of this item is provided below:

(in thousands of euros) 12/31/04 12/31/03 Change

Interest on convertible facility 30,258 29,833 425

Commissions on convertible facility 98,951 58,952 39,999

Interest due to Intermap (Nederland) B.V. 395 344 51

Interest on Fiat Ge.Va. S.p.A. loans –3,101 (3,101)

Miscellaneous 46 26 20

Total accrued expenses 129,650 92,256 37,394

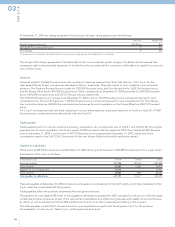

Deferred income

Deferred income totaled 19 thousand euros at December 31, 2004, representing a decrease of 2 thousand euros with respect to the

end of the previous year and regarding income to be collected in 2005.

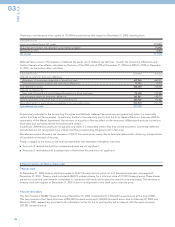

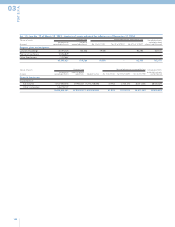

14 Memorandum accounts

Guarantees granted

Unsecured guarantees

Suretyships

Suretyships totaled 1,788,660 thousand euros at December 31, 2004.

They include suretyships provided on behalf of FiatSava S.p.A. (1,008,367 thousand euros) to secure a debenture issue and to secure

Billets de Trésorerie issued by Group companies and third parties (totaling 200,000 thousand euros), bank loans (172,361 thousand

euros), and rent payment obligations for buildings in relation to real estate securitization operations carried out during the past fiscal

years (407,932 thousand euros).

The net decrease of 283,939 thousand euros from December 31, 2003 is mainly due to lower guarantees provided to secure Sava

debentures (166,475 thousand euros) and bank loans (107,456 thousand euros).

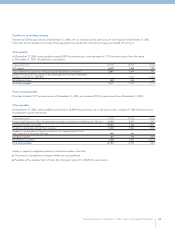

Other unsecured guarantees

This item totaled 9,768,248 thousand euros at December 31, 2004.

It includes the following:

■9,596,884 thousand euros in guarantees provided on behalf of subsidiaries to secure loans (Banco CNH Capital S.A. 496,143

thousand euros, Fiat Automoveis S.A. 89,629 thousand euros, Iveco Fiat Brasil Ltda 19,540 thousand euros, CNH America LLC

125,716 thousand euros, Iveco Latin America Ltda 2,366 thousand euros, Fiat Partecipazioni S.p.A. 1,130,387 thousand euros in

favor of Citigroup), bond issues (Fiat Finance and Trade Ltd. 7,088,647 thousand euros, Fiat Finance North America Inc. 100,000

thousand euros, Fiat Finance Luxembourg S.A. 12,623 thousand euros, Fiat Finance Canada Ltd. 100,000 thousand euros), credit

lines (New Holland Credit Company LLC 25,475 thousand euros, CNH Capital Australia Pty Ltd 18,799 thousand euros, Case Credit

Ltd 61,052 thousand euros, Fiat Finance North America Inc. 1,468 thousand euros), VAT credit under the Group consolidation

process (125,111 thousand euros), as provided under Ministerial Decree of 12/13/79 as amended, and sundry guarantees

(199,928 thousand euros);

■87,204 thousand euros for the risk of nonpayment on receivables due from tax authorities;

■84,160 thousand euros in miscellaneous guarantees.

The turnover of receivables sold with recourse in 2004 was 183 million euros (387 million euros in 2003).