Chrysler 2004 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2004 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

101

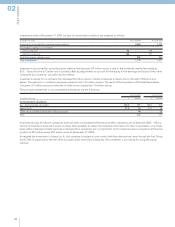

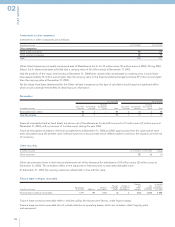

Consolidated Financial Statements at December 31, 2004 – Notes to the Consolidated Financial Statements

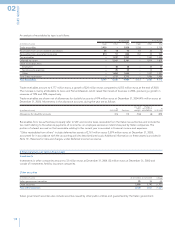

3 Financial fixed assets

Investments

Change in Acquisitions Foreign Disposals

Value at Equity in Equity in the scope of and exchange and Other Value at

(in millions of euros) 12/31/2003 earnings losses consolidation

Capitalizations

effects changes 12/31/2004

Unconsolidated subsidiaries 435 11 (31) (13) 16 2 (184) 236

Associated companies 3,202 113 (70) 3 74 17 (9) 3,330

Other companies 257 1 (9) (3) 7 – (95) 158

Total Investments 3,894 125 (110) (13) 97 19 (288) 3,724

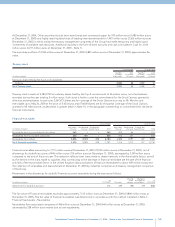

Equity in earnings and Equity in losses include the Group’s share of the income or the loss of companies accounted for using the

equity method. With regard to the companies accounted for at cost, Equity in losses includes the loss in value recorded in the year.

The negative Change in the scope of consolidation of 13 million euros, with reference to Investments in unconsolidated subsidiaries,

is due to the line-by-line consolidation of some minor subsidiaries.

The amounts included in “Acquisitions and Capitalizations” (97 million euros) are mainly related to the following acquisitions and

capitalizations:

■Investments in unconsolidated subsidiaries (16 million euros): capitalization of the company Fiat Auto S.A. de Ahorro para Fines

Determinados (6 million euros), acquisition of the company BMI S.p.A. (4 million euros) and other minor companies (6 million

euros);

■Investments in associated companies (74 million euros): acquisitions of the companies Maire Engineering S.p.A (35 million euros)

and Immobiliare Novoli S.p.A. (21 million euros); capitalization of the companies CNH Capital Europe S.A.S. (8 million euros),

CNH de Mexico SA de CV (5 million euros) and other minor companies (5 million euros);

■Investments in other companies (7 million euros): acquisition of the company Lingotto S.p.A. (3 million euros) and other minor

companies (4 million euros).

Disposals and Other changes, which show a decrease of 288 million euros, refer principally to:

■Investments in unconsolidated subsidiaries (-184 million euros): the change refers to the dividends distributed by BUC-Banca

Unione Credito;

■Investments in associated companies (-9 million euros): sale of the company Toro Targa Assicurazioni S.p.A. (-13 million euros)

and other minor companies (4 million euros);

■Investments in other companies (-95 million euros): the decrease is due to the sale of Edison S.p.A. shares for 65 million euros

and the sale of the company Gas Turbine Technologies S.p.A. for 6 million euros, the liquidation of Kish Receivables Company (21

million euros) and sales of other minor companies (3 million euros).