Chrysler 2004 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2004 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

REPORT ON

OPERATIONS

01

32

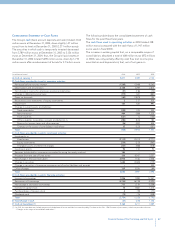

Result before taxes

The Group’s loss before taxes was 1,577 million euros,

compared with a loss of 1,298 million euros in 2003 (loss of 1,501

million euros for Continuing Operations). The slight worsening

in comparison with the figure for Continuing Operations stems

from the previously mentioned decrease in EBIT, although this

was offset by lower net financial expenses.

Net financial expenses totaled 744 million euros in 2004,

compared with 979 million euros in 2003. The comparison

with Continuing Operations alone, which had total net financial

expenses of 1,067 million euros, shows an improvement of 323

million euros. Excluding the net positive effect of approximately

300 million euros in non-recurring gains from the unwinding of

the equity swap on General Motors shares and the negative

effects of adjustments to receivables and financial fixed assets

of approximately 90 million euros, the improvement with respect

to Continuing Operations is largely attributable to the lower

average level of indebtedness in 2004, and lower interest rates.

Result for the Fiscal Year

The consolidated net loss before minority interest was 1,548

million euros, compared with the loss of 1,948 million euros in

2003 (net loss of 2,042 million euros for Continuing Operations).

Income taxes totaled a positive balance of 29 million euros,

compared with a negative balance of 541 million euros for

Continuing Operations in 2003 (and a negative balance of 650

million euros at the consolidated level). The income taxes due

for fiscal 2004 include: 128 million euros (125 million euros in

2003) for IRAP, the regional tax on production activities in Italy

and 187 million euros (31 million euros in 2003) for other current

taxes, largely in consequence of the positive results posted by

a number of companies operating abroad. These amounts were

offset by the benefits of the Italian tax consolidation program

and posting of net deferred tax assets, principally for Fiat S.p.A.,

the recovery of which became reasonably certain in

consequence of the settlement received in February 2005 upon

termination of the Master agreement with General Motors.

Income taxes in 2003 included the reversal of 494 million euros

in deferred tax assets, largely against the gains realized upon

sale of the Toro Assicurazioni Group and FiatAvio S.p.A.

The Group’s interest in net loss was 1,586 million euros,

compared with a loss of 1,900 million euros in fiscal 2003.

As a result, the net loss per share amounted to 1.62 euros,

compared with a net loss per share of 2.412 euros in 2003.

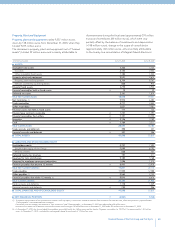

BALANCE SHEET

On the previous page, the financial structure shows items on

both the assets and liabilities side, with a breakdown between

current and non-current assets and liabilities. Specifically:

■In addition to cash and securities, current assets include

assets held for sale or consumption in the normal course

of business and thus comprise assets generated by financial

services, including assets under financial lease. Current assets

also include amounts which are expected to be received

within twelve months of the year-end.

■Current liabilities include those to be settled in the normal

course of business, liabilities held primarily for trading

purposes, and those due within twelve months of the

year-end or which cannot be renegotiated in that period.

The following analysis provides the information necessary for

correlation with the principal items characteristic of the industrial

activities, such as working capital and net invested capital.

For a more complete analysis of these items, please see

the Notes to the Consolidated Financial Statements.

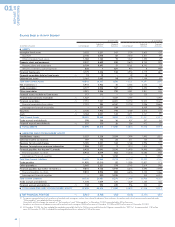

Intangible Fixed Assets

Intangible fixed assets (start-up and expansion costs, goodwill,

intangible fixed assets in progress, and others) totaled 3,322

million euros, down by 402 million euros from the 3,724 million

euros at December 31, 2003. Of this decrease, approximately

160 million euros are attributable to changes in foreign

exchange rates, which particularly impacted the carrying value

of goodwill, and 211 million euros are attributable to the

negative balance of amortization and investments.

Investments during the year totaled 264 million euros (527

million euros in 2003), while amortization totaled 475 million

euros (519 million euros in 2003), of which 162 million euros

for goodwill (192 million euros in 2003).