Capital One 2004 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2004 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

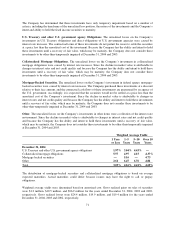

Junior Subordinated Capital Income Securities

In January 1997, Capital One Capital I, a subsidiary of the Bank created as a Delaware statutory business trust,

issued $100.0 million aggregate amount of Floating Rate Junior Subordinated Capital Income Securities that

mature on February 1, 2027. The securities represent a preferred beneficial interest in the assets of the trust.

Other Short-Term Borrowings

Revolving Credit Facility

In June 2004, the Company terminated its Domestic Revolving and Multicurrency Credit Facilities and replaced

them with a new revolving credit facility (“Credit Facility”) providing for an aggregate of $750.0 million in

unsecured borrowings from various lending institutions to be used for general corporate purposes. The Credit

Facility is available to the Corporation, the Bank, the Savings Bank, and Capital One Bank, plc. The

Corporation’s availability has been increased to $500.0 million under the Credit Facility. All borrowings under

the Credit Facility are based upon varying terms of London Interbank Offering Rate (“LIBOR”).

Collateralized Revolving Credit Facility

In April 2002, COAF entered into a revolving warehouse credit facility collateralized by a security interest in

certain auto loan assets (the “Collateralized Revolving Credit Facility”). As of December 31, 2004, the

Collateralized Revolving Credit Facility had the capacity to issue up to $4.4 billion in secured notes. The

Collateralized Revolving Credit Facility has multiple participants, each with a separate renewal date. The facility

does not have a final maturity date. Instead, each participant may elect to renew the commitment for another set

period of time. Interest on the facility is based on commercial paper rates. At December 31, 2004 and 2003,

$197.5 million and $1.2 billion, respectively, were outstanding under the facility.

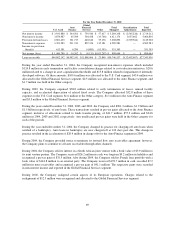

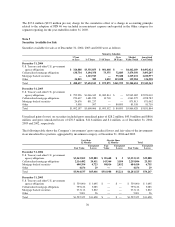

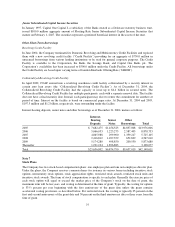

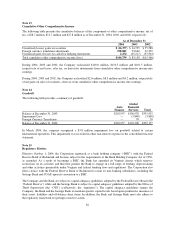

Interest-bearing deposits, senior notes and other borrowings as of December 31, 2004, mature as follows:

Interest-

Bearing

Deposits

Senior

Notes

Other

Borrowings Total

2005 $ 7,682,475 $1,456,523 $4,837,008 $13,976,006

2006 5,066,053 1,225,275 2,587,405 8,878,733

2007 4,065,988 299,900 1,359,217 5,725,105

2008 2,416,812 1,497,359 652,839 4,567,010

2009 5,174,280 498,850 200,550 5,873,680

Thereafter 1,231,194 1,896,883 — 3,128,077

Total $25,636,802 $6,874,790 $9,637,019 $42,148,611

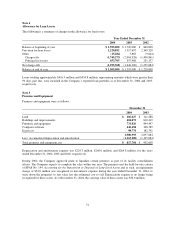

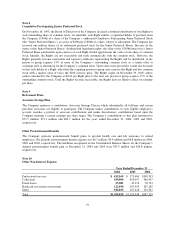

Note 7

Stock Plans

The Company has two stock-based compensation plans: one employee plan and one non-employee director plan.

Under the plans, the Company reserves common shares for issuance in various forms including incentive stock

options, nonstatutory stock options, stock appreciation rights, restricted stock awards, restricted stock units and

incentive stock awards. The form of stock compensation is specific to each plan. Generally the exercise price of

each stock option will equal or exceed the market price of the Company’s stock on the date of grant, the

maximum term will be ten years, and vesting is determined at the time of grant. Typically, the vesting for options

is 33

1

⁄

3

percent per year beginning with the first anniversary of the grant date unless the grant contains

accelerated vesting provisions, as described below. For restricted stock, the vesting is typically 25 percent on the

first and second anniversary of the grant date and 50 percent on the third anniversary date or three years from the

time of grant.

75