Capital One 2004 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2004 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A car buyer carrying a Capital One Blank Check®can go shopping

with no jitters about loan approvals and no doubts about financing

costs. The loan is a done deal, often completed in minutes, delivering

great value and giving the consumer as much bargaining power as a

buyer with cash. By simplifying the car loan process, we’re changing

the whole experience of buying a car.

Capital One Auto Finance now has a $10 billion loan portfolio and

is a big contributor to the Company’s bottom line: $163.8 million in

net income for 2004, up from $99.3 million in 2003 and $10.3 million

in 2002. And as we’ve grown, charge-offs have dropped from 4.62%

for 2003 to 3.28% for 2004.

We entered the business six years ago as part of our long-range

strategy of diversifying beyond credit cards. Auto finance is a great fit

with Capital One’s strengths in direct marketing, risk analysis and

information technology – a combination that lets us tailor each loan

to the customer’s financial circumstances.

We market the loans by direct mail and cross-selling, through car

dealers and on the Internet. Capital One is the largest online auto lender

and the largest direct marketer of auto loans, and with the acquisition

of Onyx Acceptance Corporation®in early 2005, we have become the

second-largest independent auto lender in the United States. The Onyx

acquisition also diversifies our asset base, and it greatly strengthens

and expands our dealer relationships in the Southwest and on the

West Coast.

Looking down the road, we see possibilities for substantial growth.

The auto finance category of financial services is almost twice as big as

the credit card sector. The auto companies’ financing subsidiaries furnish

about a third of U.S. auto loans, but the rest of the market is highly

fragmented, creating a significant opportunity for Capital One to build

market share by offering consumers innovative, no-hassle products

and great value.

With a Capital One Blank Check®

consumers everywhere are

measuring momentum in mph.

10

auto finance

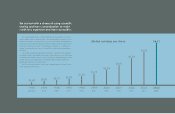

managed loans ($ in billions)

2004

$10

2003

$8

2002

$7

2001

$4

net income ($ in millions)

2004

$164

2003

$99

2002

$10

2001

($35)