Capital One 2004 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2004 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

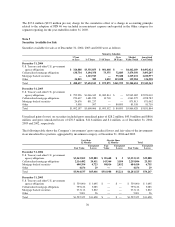

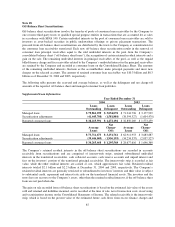

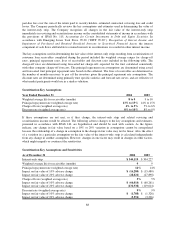

Note 11

Income Taxes

Deferred income taxes reflect the net tax effects of temporary differences between the carrying amounts of assets

and liabilities for financial reporting purposes and the amounts used for income tax purposes. Significant

components of the Company’s deferred tax assets and liabilities as of December 31, 2004 and 2003 were as

follows:

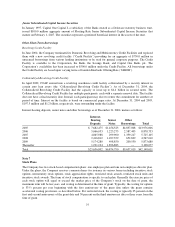

December 31

2004 2003

Deferred tax assets:

Allowance for loan losses $324,308 $337,715

Unearned income 161,682 260,324

Stock incentive plan 64,493 64,585

Foreign 6,013 25,890

Net operating losses 11,258 15,212

State taxes, net of federal benefit 35,134 42,140

Derivative instruments 168 32,228

Other 271,982 204,505

Subtotal 875,038 982,599

Valuation allowance (29,125) (52,083)

Total deferred tax assets 845,913 930,516

Deferred tax liabilities:

Securitizations 21,851 27,042

Deferred revenue 686,579 760,021

Securities available for sale (8,536) 20,511

Other 107,688 73,756

Total deferred tax liabilities 807,582 881,330

Net deferred tax (liabilities) assets $ 38,331 $ 49,186

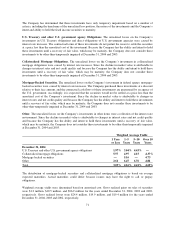

During 2004, the valuation allowance for certain loss and tax credit carryforwards decreased by a net $23.0

million. The valuation allowance decreased because of a $30.2 million reduction associated with the reversal of

timing differences for state purposes and a $9.0 million reduction associated with international loss

carryforwards utilized during the year. The valuation allowance increased because of the establishment of a $16.2

million allowance for capital loss and tax credit carryforwards.

At December 31, 2004, the Company had net operating losses available for federal income taxes purposes of

$32.4 million which are subject to certain annual limitations under the Internal Revenue Code, and expire on

various dates from 2018 to 2020. Also, foreign net operating losses of $1.8 million are available and expire in

2012. The Company also had capital loss carryovers in the amount of $54.2 million, which expire on various

dates from 2006 to 2008 and foreign tax credit carryovers in the amount of $9.6 million which expire in 2014.

The Company provides income taxes on the undistributed earnings of non-U.S. subsidiaries except to the extent

that such earnings are indefinitely invested outside the United States. At December 31, 2004, all of the

accumulated undistributed earnings of non-U.S. subsidiaries were insignificant and have been indefinitely

invested. In addition, the Company has evaluated the effect of the Foreign Earnings Repatriation Provision of the

American Jobs Creation Act of 2004. Based upon this evaluation, the Company has determined that there is no

effect on income tax expense or benefit.

80