Capital One 2004 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2004 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.With the exception of the American Express civil antitrust lawsuit, the Company and its affiliates are not parties

to the suits described above and therefore will not be directly liable for any amount related to any possible or

known settlements, the suits filed by merchants who have opted out of the settlements of those suits, or the class

action suits pending in state and federal courts. However, the banks are member banks of MasterCard and Visa

and thus may be affected by settlements or suits relating to these issues. In addition, it is possible that the scope

of these suits may expand and that other member banks, including the Company, may be brought into the suits or

future suits. Given the complexity of the issues raised by these suits and the uncertainty regarding: (i) the

outcome of these suits, (ii) the likelihood and amount of any possible judgment against the associations, (iii) the

likelihood and the amount and validity of any claim against the associations’ member banks, including the

Company, and (iv) the effects of these suits, in turn, on competition in the industry, member banks, and

interchange and association fees, we cannot determine at this time the long-term effects of these suits on us.

Fluctuations in Our Expenses and Other Costs May Hurt Our Financial Results

Our expenses and other costs, such as operating and marketing expenses, directly affect our earnings results. In

light of the extremely competitive environment in which we operate, and because the size and scale of many of

our competitors provides them with increased operational efficiencies, it is important that we are able to

successfully manage such expenses. Many factors can influence the amount of our expenses, as well as how

quickly they grow. For example, further increases in postal rates or termination of our negotiated service

arrangement with the United States Postal Service could raise our costs for postal service. As our business

develops, changes or expands, additional expenses can arise from management of outsourced services, asset

purchases, structural reorganization, a reevaluation of business strategies and/or expenses to comply with new or

changing laws or regulations. Other factors that can affect the amount of our expenses include legal and

administrative cases and proceedings, which can be expensive to pursue or defend. In addition, changes in

accounting fluctuations can significantly affect how we calculate expenses and earnings.

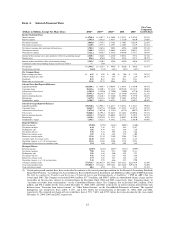

Statistical Information

The statistical information required by Item 1 can be found in Item 6 “Selected Financial Data”, Item 7

“Management Discussion and Analysis of Financial Condition and Results of Operations” and in Item 8,

“Financial Statements and Supplementary Data”, as follows:

I. Distribution of Assets, Liabilities and

Stockholders’ Equity; Interest Rates and Interest

Differential pages 36-37

II. Investment Portfolio page 70

III. Loan Portfolio pages 36-37; 40-41; 43-45; 56-57; 64-65

IV. Summary of Loan Loss Experience pages 43-45; 72

V. Deposits pages 48-49; 73-75

VI. Return on Equity and Assets page 27

VII. Other Borrowings pages 47-49; 73-75

Item 2. Properties.

We lease our new, 570,000 square foot, headquarters building at 1680 Capital One Drive, McLean, Virginia. The

building houses our primary executive offices and Northern Virginia staff, and is leased through December 2010,

with the right to purchase at a fixed cost at the end of the lease term.

Additionally, we own approximately 316 acres of land in Goochland County, Virginia purchased for the

construction of an office campus to consolidate certain operations in the Richmond area. In 2002, two office

buildings and a support facility consisting of approximately 365,000 square feet were completed and occupied. In

2003 four office buildings and a training center consisting of approximately 690,000 square feet were completed

and occupied. In 2004, one additional office building consisting of approximately 130,000 square feet was

completed with expected occupancy in the first quarter of 2005.

25