Capital One 2004 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2004 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

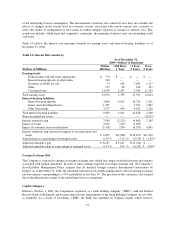

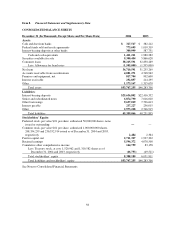

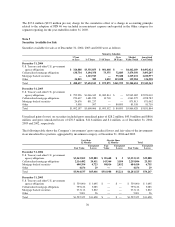

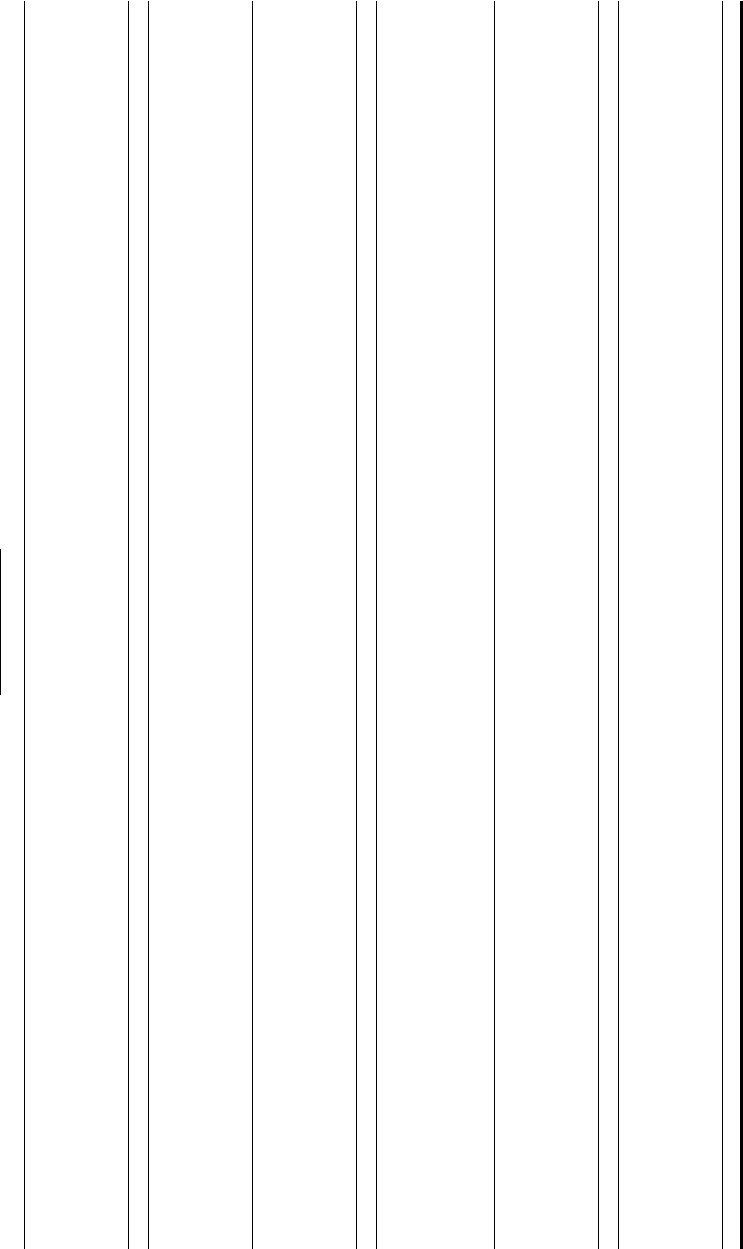

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

Common Stock Paid-In

Capital,

Net

Deferred

Compensation

Retained

Earnings

Cumulative

Other

Comprehensive

Income (Loss)

Treasury

Stock

Total

Stockholders’

Equity(In Thousands, Except Per Share Data) Shares Amount

Balance, December 31, 2001 217,656,985 $2,177 $1,394,596 $ (44,488) $2,090,761 $ (84,598) $(34,970) $3,323,478

Comprehensive income:

Net income — — — — 899,644 — — 899,644

Other comprehensive income, net of income tax:

Unrealized gains on securities, net of income taxes of $28,619 — — — — — 46,694 — 46,694

Foreign currency translation adjustments — — — — — 41,816 — 41,816

Loss on cash flow hedging instruments, net of income tax benefit of $11,938 — — — — — (19,478) — (19,478)

Other comprehensive income — — — — — 69,032 — 69,032

Comprehensive income — — — — — — — 968,676

Cash dividends—$.11 per share — — — — (23,457) — — (23,457)

Issuance of mandatory convertible securities — — 36,616 — — — — 36,616

Issuances of common and restricted stock 7,968,831 80 317,454 (85,231) — — 18 232,321

Exercise of stock options 1,447,346 14 55,585 — — — — 55,599

Amortization of deferred compensation — — — 27,749 — — — 27,749

Other items, net — — 2,189 — — — — 2,189

Balance, December 31, 2002 227,073,162 2,271 1,806,440 (101,970) 2,966,948 (15,566) (34,952) 4,623,171

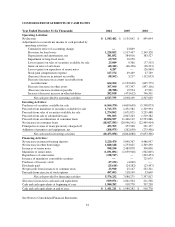

Comprehensive income:

Net income — — — — 1,135,842 — — 1,135,842

Other comprehensive income, net of income tax:

Unrealized losses on securities, net of income tax benefit of $12,247 — — — — — (20,853) — (20,853)

Foreign currency translation adjustments — — — — — 71,290 — 71,290

Unrealized gain on cash flow hedging instruments, net of income taxes of $28,359 — — — — — 48,287 — 48,287

Other comprehensive income — — — — — 98,724 — 98,724

Comprehensive income 1,234,566

Cash dividends—$.11 per share — — — — (24,282) — — (24,282)

Purchase of treasury stock — — — — — — (14,569) (14,569)

Issuances of common and restricted stock, net of forfeitures 3,755,271 38 201,515 (165,906) — — — 35,647

Exercise of stock options 5,524,481 55 147,532 — — — — 147,587

Amortization of deferred compensation — — — 40,743 — — — 40,743

Common stock issuable under incentive plan — — 8,706 — — — — 8,706

Other items, net — — 242 — — — — 242

Balance, December 31, 2003 236,352,914 2,364 2,164,435 (227,133) 4,078,508 83,158 (49,521) 6,051,811

Comprehensive income:

Net income — — — — 1,543,482 — — 1,543,482

Other comprehensive income, net of income tax:

Unrealized losses on securities, net of income tax benefit of $29,048 — — — — — (51,112) — (51,112)

Foreign currency translation adjustments — — — — — 65,242 — 65,242

Unrealized gain on cash flow hedging instruments, net of income taxes of $26,516 — — — — — 47,471 — 47,471

Other comprehensive income — — — — — 61,601 — 61,601

Comprehensive income 1,605,083

Cash dividends—$.11 per share — — — — (25,618) — — (25,618)

Purchase of treasury stock — — — — — — (17,232) (17,232)

Issuances of common and restricted stock, net of forfeitures (59,534) (1) 7,182 16,729 — — — 23,910

Exercise of stock options 12,060,879 121 622,940 — — — — 623,061

Amortization of deferred compensation — — — 87,431 — — — 87,431

Common stock issuable under incentive plan — — 39,743 — — — — 39,743

Balance, December 31, 2004 248,354,259 $2,484 $2,834,300 $(122,973) $5,596,372 $144,759 $(66,753) $8,388,189

See Notes to Consolidated Financial Statements.

60