Capital One 2004 Annual Report Download - page 87

Download and view the complete annual report

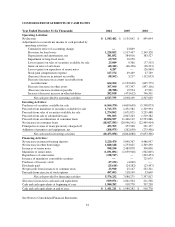

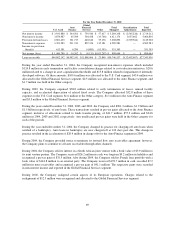

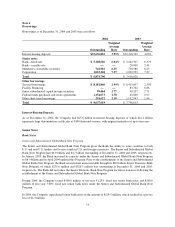

Please find page 87 of the 2004 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2002 was $1.8 billion, $1.6 billion and $1.4 billion, respectively. Cash paid for income taxes for the years ended

December 31, 2004, 2003 and 2002 was $705.1 million, $571.2 million and $585.8 million, respectively.

Securities Available for Sale

The Company classifies all debt securities as securities available for sale. These securities are stated at fair value,

with the unrealized gains and losses, net of tax, reported as a component of cumulative other comprehensive

income. The amortized cost of debt securities is adjusted for amortization of premiums and accretion of discounts

to maturity. Such amortization or accretion is included in interest income. Realized gains and losses on sales of

securities are determined using the specific identification method. The Company evaluates its unrealized loss

positions for impairment in accordance with EITF Issue No. 03-1, “The Meaning of Other-Than-Temporary

Impairment and its Application to Certain Investments”.

Revenue Recognition

The Company recognizes earned finance charges and fee income on loans according to the contractual provisions

of the credit arrangements. When the Company does not expect full payment of finance charges and fees, it does

not accrue the estimated uncollectible portion as income (hereafter the “suppression amount”). To calculate the

suppression amount, the Company first estimates the uncollectible portion of finance charge and fee receivables

using a formula based on historical account migration patterns and current delinquency status. This formula is

consistent with that used to estimate the allowance related to expected principal losses on reported loans. The

suppression amount is calculated by adding any current period change in the estimate of the uncollectible portion

of finance charge and fee receivables to the amount of finance charges and fees charged-off (net of recoveries)

during the period. The Company subtracts the suppression amount from the total finance charges and fees billed

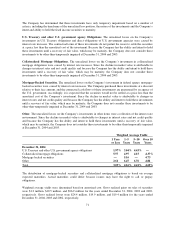

during the period to arrive at total reported revenue. The amount of finance charge and fees suppressed were $1.1

billion, $2.0 billion and $2.2 billion for the years ended December 31, 2004, 2003 and 2002, respectively.

Interchange income is a fee paid by a merchant bank to the card-issuing bank through the interchange network.

Interchange fees are set by MasterCard International Inc. (“MasterCard”) and Visa U.S.A. Inc. (“Visa”) and are

based on cardholder purchase volumes. The Company recognizes interchange income as earned.

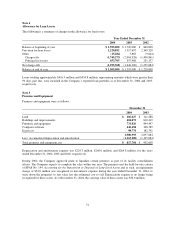

Annual membership fees and direct loan origination costs are deferred and amortized over one year on a straight-

line basis. Dealer fees and premiums are deferred and amortized over the average life of the related loans using

the interest method for auto loan originations. Direct loan origination costs consist of both internal and external

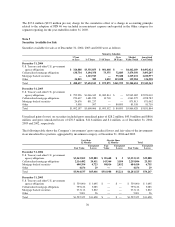

costs associated with the origination of a loan. Deferred fees (net of deferred costs) were $302.5 million and

$319.8 million as of December 31, 2004 and 2003, respectively.

Rewards

The Company offers credit cards that provide reward program members with various rewards such as airline

tickets, free or deeply discounted products or cash rebates, based on purchase volume. The Company establishes

a rewards liability based upon points earned which are ultimately expected to be redeemed and the average cost

per point redemption. As points are redeemed, the rewards liability is relieved. The estimated cost of reward

programs is reflected as a reduction to interchange income. The cost of reward programs related to securitized

loans is deducted from servicing and securitizations income.

Loan Securitizations

Loan securitization involves the transfer of a pool of loan receivables to a trust or other special purpose entity.

The trust sells an undivided interest in the pool of loan receivables to third-party investors through the issuance

of asset backed securities and distributes the proceeds to the Company as consideration for the loans transferred.

The Company removes loan receivables from the Consolidated Balance Sheets for securitizations that qualify as

sales in accordance with SFAS 140. The trusts are qualified special purpose entities as defined by SFAS 140 and

64