Capital One 2004 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2004 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

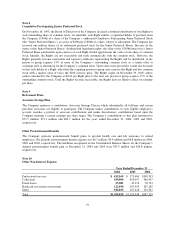

Note 8

Cumulative Participating Junior Preferred Stock

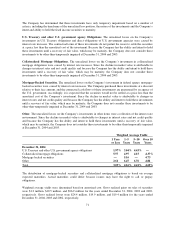

On November 16, 1995, the Board of Directors of the Company declared a dividend distribution of one Right for

each outstanding share of common stock. As amended, each Right entitles a registered holder to purchase from

the Company 1/300th of a share of the Company’s authorized Cumulative Participating Junior Preferred Stock

(the “Junior Preferred Shares”) at a price of $200 per 1/300th of a share, subject to adjustment. The Company has

reserved one million shares of its authorized preferred stock for the Junior Preferred Shares. Because of the

nature of the Junior Preferred Shares’ dividend and liquidation rights, the value of the 1/300th interest in a Junior

Preferred Share purchasable upon exercise of each Right should approximate the value of one share of common

stock. Initially, the Rights are not exercisable and trade automatically with the common stock. However, the

Rights generally become exercisable and separate certificates representing the Rights will be distributed, if any

person or group acquires 15% or more of the Company’s outstanding common stock or a tender offer or

exchange offer is announced for the Company’s common stock. Upon such event, provisions would also be made

so that each holder of a Right, other than the acquiring person or group, may exercise the Right and buy common

stock with a market value of twice the $200 exercise price. The Rights expire on November 29, 2005, unless

earlier redeemed by the Company at $0.01 per Right prior to the time any person or group acquires 15% of the

outstanding common stock. Until the Rights become exercisable, the Rights have no dilutive effect on earnings

per share.

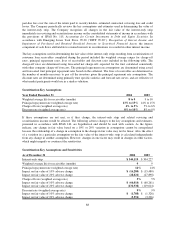

Note 9

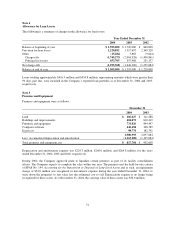

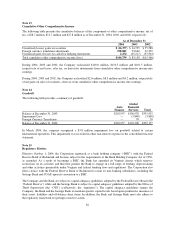

Retirement Plans

Associate Savings Plan

The Company sponsors a contributory Associate Savings Plan in which substantially all full-time and certain

part-time associates are eligible to participate. The Company makes contributions to each eligible employee’s

account, matches a portion of associate contributions and makes discretionary contributions based upon the

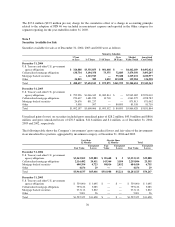

Company meeting a certain earnings per share target. The Company’s contributions to this plan amounted to

$71.7 million, $71.1 million and $62.7 million for the years ended December 31, 2004, 2003 and 2002,

respectively.

Other Postretirement Benefits

The Company sponsors postretirement benefit plans to provide health care and life insurance to retired

employees. Net periodic postretirement benefit expense was $6.7 million, $9.4 million and $6.8 million in 2004,

2003 and 2002, respectively. The liabilities recognized on the Consolidated Balance Sheets for the Company’s

defined postretirement benefit plan at December 31, 2004 and 2003 were $33.5 million and $26.8 million,

respectively.

Note 10

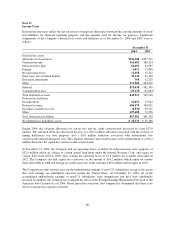

Other Non-Interest Expense

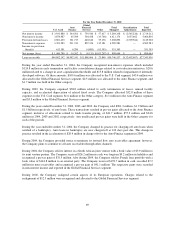

Year Ended December 31

2004 2003 2002

Professional services $ 415,169 $ 373,404 $308,593

Collections 530,909 493,057 360,437

Fraud losses 55,981 49,176 78,733

Bankcard association assessments 122,934 107,493 107,185

Other 184,836 167,418 132,567

Total $1,309,829 $1,190,548 $987,515

79