Capital One 2004 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2004 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

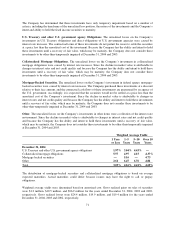

the year ended December 31, 2002. The change in estimate resulted in an increase of $38.4 million to interest

income and $44.4 million to non-interest income offset by an increase in the provision for loan losses of $133.4

million for the year ended December 31, 2002. Therefore, net income for the year ended December 31, 2002, was

negatively impacted by $31.4 million or $.14 per diluted share as a result of the change in estimate.

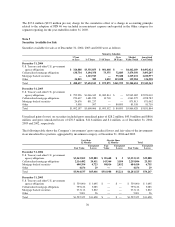

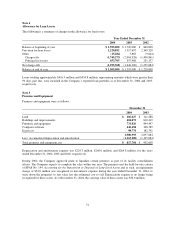

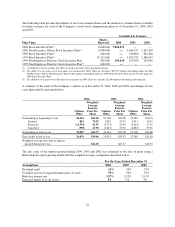

Note 2

Segments

The Company maintains three distinct operating segments: U.S. Card, Auto Finance, and Global Financial

Services. The U.S. Card segment consists of domestic credit card lending activities. The Auto Finance segment

consists of automobile financing activities. The Global Financial Services segment is comprised of international

lending activities (including credit card lending), installment lending, small business lending and healthcare

financing. The U.S. Card, Auto Finance and Global Financial Services segments are considered reportable

segments based on quantitative thresholds applied to the managed loan portfolio for reportable segments

provided by SFAS No. 131 and are disclosed separately. The Other caption includes the Company’s liquidity

portfolio, emerging businesses not included in the reportable segments, investments in external companies, and

various non-lending activities. The Other caption also includes the net impact of transfer pricing, certain

unallocated expenses and gains/losses related to the securitization of assets.

Management decision making is performed on a managed portfolio basis. An adjustment to reconcile the

managed financial information to the reported financial information in the consolidated financial statements is

provided. This adjustment reclassifies a portion of net interest income, non-interest income and provision for

loan losses into non-interest income from servicing and securitization.

The Company maintains its books and records on a legal entity basis for the preparation of financial statements in

conformity with GAAP. The following tables present information prepared from the Company’s internal

management information system, which is maintained on a line of business level through allocations from the

consolidated financial results.

See Note 1, Significant Accounting Policies, for the accounting policies of the reportable segments.

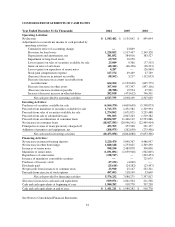

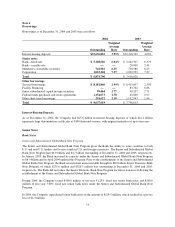

For the Year Ended December 31, 2004

U.S. Card

Auto

Finance

Global

Financial

Services Other

Total

Managed

Securitization

Adjustments

Total

Reported

Net interest income $ 4,655,897 $ 797,936 $ 1,421,508 $(240,599) $ 6,634,742 $ (3,631,764) $ 3,002,978

Non-interest income 3,219,567 80,712 844,192 80,115 4,224,586 1,675,571 5,900,157

Provision for loan losses 2,207,888 279,981 683,612 5,564 3,177,045 (1,956,193) 1,220,852

Non-interest expenses 3,499,918 342,761 1,265,549 213,991 5,322,219 — 5,322,219

Income tax provision (benefit) 780,357 92,126 103,459 (159,360) 816,582 — 816,582

Net income (loss) $ 1,387,301 $ 163,780 $ 213,080 $(220,679) $ 1,543,482 $ — $ 1,543,482

Loans receivable $48,609,571 $9,997,497 $21,240,325 $ 13,906 $79,861,299 $(41,645,708) $38,215,591

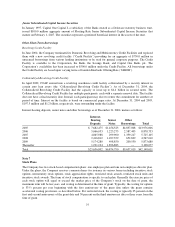

For the Year Ended December 31, 2003

U.S. Card

Auto

Finance

Global

Financial

Services Other

Total

Managed

Securitization

Adjustments

Total

Reported

Net interest income $ 4,287,814 $ 727,987 $ 1,072,098 $ (49,985) $ 6,037,914 $ (3,252,825) $ 2,785,089

Non-interest income 3,583,357 101,984 605,821 (90,536) 4,200,626 1,215,298 5,415,924

Provision for loan losses 2,647,406 382,952 595,543 (70,877) 3,555,024 (2,037,527) 1,517,497

Non-interest expenses 3,348,894 289,414 988,321 253,963 4,880,592 — 4,880,592

Income tax provision

(benefit) 693,702 58,314 29,216 (114,150) 667,082 — 667,082

Net income (loss) $ 1,181,169 $ 99,291 $ 64,839 $(209,457) $ 1,135,842 $ — $ 1,135,842

Loans receivable $46,278,750 $8,466,873 $16,507,937 $ (8,764) $71,244,796 $(38,394,527) $32,850,269

68