Capital One 2004 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2004 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.are not subsidiaries of the Company and are not included in the Company’s consolidated financial statements.

Gains on securitization transactions, fair value adjustments related to residual interests and earnings on the

Company’s securitizations are included in servicing and securitizations income in the Consolidated Statements of

Income and amounts due from the trusts are included in accounts receivable from securitizations on the

Consolidated Balance Sheets.

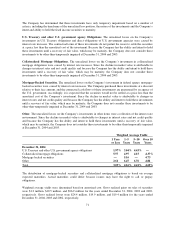

The gain on sale recorded from off-balance sheet securitizations is based on the estimated fair value of the assets

sold and retained and liabilities incurred, and is recorded at the time of sale, net of transaction costs, in servicing

and securitizations income on the Consolidated Statements of Income. The related receivable is the interest-only

strip, which is based on the present value of the estimated future cash flows from excess finance charges and

past-due fees over the sum of the return paid to security holders, estimated contractual servicing fees and credit

losses. To the extent assumptions used by management do not prevail, fair value estimates of the interest-only

strip could differ significantly, resulting in either higher or lower future servicing and securitization income, as

applicable.

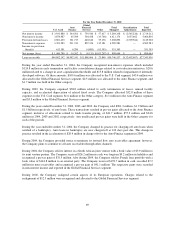

Allowance for Loan Losses

The allowance for loan losses is maintained at the amount estimated to be sufficient to absorb probable principal

losses, net of principal recoveries (including recovery of collateral), inherent in the existing reported loan

portfolio. The provision for loan losses is the periodic cost of maintaining an adequate allowance. The amount of

allowance necessary is determined primarily based on a migration analysis of delinquent and current accounts

and forward loss curves. The entire balance of an account is contractually delinquent if the minimum payment is

not received by the payment due date. In evaluating the sufficiency of the allowance for loan losses, management

takes into consideration the following factors: recent trends in delinquencies and charge-offs including bankrupt,

deceased and recovered amounts; forecasting uncertainties and size of credit risks; the degree of risk inherent in

the composition of the loan portfolio; economic conditions; legal and regulatory guidance; credit evaluations and

underwriting policies; seasonality; and the value of the collateral supporting the loans. To the extent credit

experience is not indicative of future performance or other assumptions used by management do not prevail, loss

experience could differ significantly, resulting in either higher or lower future provision for loan losses, as

applicable.

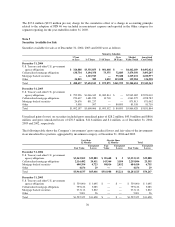

The Company charges off credit card loans at 180 days past the due date, and generally charges off other

consumer loans, including auto loans, at 120 days past the due date or upon repossession of collateral. Bankrupt

consumers’ accounts, excluding auto accounts, are generally charged-off within 30 days of receipt of the

bankruptcy petition. Bankrupt auto accounts are charged-off at 120 days past the due date. Amounts collected on

previously charged-off accounts related to principal are included in recoveries for the determination of net

charge-offs. Costs to recover previously charged-off accounts are recorded as collection expense in other non-

interest expense.

Premises and Equipment

Premises and equipment are stated at cost less accumulated depreciation and amortization. The Company

capitalizes direct costs (including external costs for purchased software, contractors, consultants and internal staff

costs) for internally developed software projects that have been identified as being in the application

development stage. Depreciation and amortization expenses are computed generally by the straight-line method

over the estimated useful lives of the assets. Useful lives for premises and equipment are as follows: buildings

and improvements—5-39 years; furniture and equipment—3-10 years; computers and software—3 years.

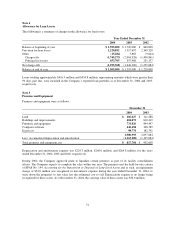

Goodwill

The Company performs annual impairment tests for acquisition goodwill in accordance with Statement of

Financial Accounting Standards No. 142, Goodwill and Other Intangible Assets (“SFAS 142”).

65