Capital One 2004 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2004 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.restrictions on its activities and therefore permits the Bank to engage in a full range of lending, deposit-taking

and other activities permissible under Virginia and federal banking laws and regulations. The Corporation also

filed a notice with the Federal Reserve Bank of Richmond to retain its non-banking subsidiaries, including the

Savings Bank and COAF, upon its conversion to a BHC.

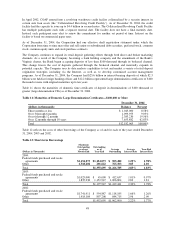

The Company and the Bank are subject to capital adequacy guidelines adopted by the Federal Reserve Board (the

“Federal Reserve”) while and the Savings Bank is subject to capital adequacy guidelines adopted by the Office of

Thrift Supervision (the “OTS”) (collectively, the “regulators”). The capital adequacy guidelines require the

Company, the Bank and the Savings Bank to maintain specific capital levels based upon quantitative measures of

their assets, liabilities and off-balance sheet items. In addition, the Bank and Savings Bank must also adhere to

the regulatory framework for prompt corrective action.

The most recent notifications received from the regulators categorized the Bank and the Savings Bank as “well-

capitalized.” As of December 31, 2004, the Company’s, the Bank’s and the Savings Bank’s capital exceeded all

minimum regulatory requirements to which they were subject, and there were no conditions or events since the

notifications discussed above that management believes would have changed either the Company, the Bank or

the Savings Bank’s capital category.

The Company, the Bank and Savings Bank treat a portion of their loans as “subprime” under the “Expanded

Guidance for Subprime Lending Programs” (the “Subprime Guidelines”) issued by the four federal banking

agencies and have assessed their capital and allowance for loan losses accordingly. Under the Subprime

Guidelines, the Company, the Bank and the Savings Bank exceed the minimum capital adequacy guidelines as of

December 31, 2004.

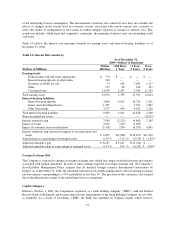

For purposes of the Subprime Guidelines, the Company has treated as subprime all loans in the Bank’s and

Savings Bank’s targeted subprime programs to customers either with a FICO score of 660 or below or with no

FICO score. The Bank and Savings Bank hold on average 200% of the total risk-based capital requirement that

would otherwise apply to such assets. This results in higher levels of required regulatory capital at the Bank and

the Savings Bank. As of December 31, 2004, approximately $5.3 billion or 18.3% of the Bank’s, and $2.3 billion

or 16.6% of the Savings Bank’s, on-balance sheet assets were treated as subprime for purposes of the Subprime

Guidelines.

The Company currently expects to operate each of the Bank and Savings Bank in the future with a total risk-

based capital ratio of at least 12%. The Corporation has a number of alternatives available to meet any additional

regulatory capital needs of the Bank and the Savings Bank, including substantial liquidity held at the Corporation

and available for contribution.

Additionally, certain regulatory restrictions exist that limit the ability of the Bank and the Savings Bank to

transfer funds to the Corporation. As of December 31, 2004, retained earnings of the Bank and the Savings Bank

of $715.9 million and $633.3 million, respectively, were available for payment of dividends to the Corporation

without prior approval by the regulators.

Additional information regarding capital adequacy can be found on pages 82-83 in Item 8 “Financial Statements

and Supplementary Data—Notes to the Consolidated Financial Statements—Note 15”.

Dividend Policy

Although the Company expects to reinvest a substantial portion of its earnings in its business, the Company also

intends to continue to pay regular quarterly cash dividends on its common stock. The declaration and payment of

dividends, as well as the amount thereof, are subject to the discretion of the Board of Directors of the Company

and will depend upon the Company’s results of operations, financial condition, cash requirements, future

prospects and other factors deemed relevant by the Board of Directors. Accordingly, there can be no assurance

53