Capital One 2004 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2004 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.amounts collected in excess of that needed to pay the above amounts are remitted, in general, to the Company.

Under certain conditions, some of the cash collected may be retained to ensure future payments to investors. For

amortizing securitizations, amounts collected in excess of the amount that is used to pay the above amounts are

generally remitted to the Company, but may be paid to investors in further reduction of their outstanding

principal. See page 87-89 in Item 8 “Financial Statements and Supplementary Data—Notes to the Consolidated

Financial Statements—Note 18” for quantitative information regarding revenues, expenses and cash flows that

arise from securitization transactions.

Securitization transactions may amortize earlier than scheduled due to certain early amortization triggers, which

would accelerate the need for funding. Additionally, early amortization would have a significant impact on the

ability of the Bank and Savings Bank to meet regulatory capital adequacy requirements as all off-balance sheet

loans experiencing such early amortization would be recorded on the balance sheet and accordingly would

require incremental regulatory capital. As of December 31, 2004, no early amortization events related to its off-

balance sheet securitizations have occurred. The Company believes that it has the ability to continue to utilize

off-balance sheet securitization arrangements as a source of liquidity.

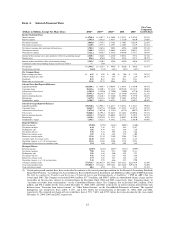

The amounts of investor principal from off-balance sheet consumer loans as of December 31, 2004 that are

expected to amortize into the Company’s consumer loans, or be otherwise paid over the periods indicated, are

summarized in Table 13. Of the Company’s total managed loans, 52% and 53% were included in off-balance

sheet securitizations for the years ended December 31, 2004 and 2003, respectively.

Funding Commitments Related to Synthetic Fuel Tax Credit Transaction

In June 2004, the Corporation established and consolidated Capital One Appalachian LLC (“COAL”). COAL is a

special purpose entity established to invest a 24.9% minority ownership interest in a limited partnership. The

partnership was established to operate a facility which produces a coal-based synthetic fuel that qualifies for tax

credits pursuant to Section 29 of the Internal Revenue Code. COAL purchased its interest in the partnership from

a third party paying $2.1 million in cash and agreeing to pay an estimated $115.0 million comprised of fixed note

payments, variable payments and the funding of its 24.9% share of the operating losses of the partnership. Actual

total payments will be based on the amount of tax credits generated by the partnership through the end of 2007.

In exchange, COAL will receive an estimated $137.7 million in tax benefits resulting from a combination of

deductions, allocated partnership operating losses, and tax credits. The Corporation has guaranteed COAL’s

commitments to both the partnership and the third party. As of December 31, 2004, the Company has recorded

$19.7 million in tax benefits and had an estimated remaining commitment for fixed note payments, variable

payments and the funding of its 24.9% share of the operating losses of the partnership of $100.2 million.

Guarantees

Residual Value Guarantees

In December 2000, the Company entered into a 10-year agreement for the lease of the headquarters building

being constructed in McLean, Virginia. The agreement called for monthly rent to commence upon completion,

which occurred in the first quarter of 2003, and is based on LIBOR rates applied to the cost of the building

funded. If, at the end of the lease term, the Company does not purchase the property, the Company guarantees a

maximum residual value of up to $114.8 million representing approximately 72% of the $159.5 million cost of

the building. This agreement, made with a multi-purpose entity that is a wholly-owned subsidiary of one of the

Company’s lenders, provides that in the event of a sale of the property, the Company’s obligation would be equal

to the sum of all amounts owed by the Company under a note issuance made in connection with the lease

inception. As of December 31, 2004, the value of the building was estimated to be above the maximum residual

value that the Company guarantees; thus, no deficiency existed and no liability was recorded relative to this

property.

Other Guarantees

In connection with certain installment loan securitization transactions, the transferee (off-balance sheet special

purpose entity receiving the installment loans) entered into interest rate hedge agreements (the “swaps”) with a

31