Capital One 2004 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2004 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Capital One has entered markets outside the U.S. and consumer-

lending sectors beyond credit cards and auto finance. Both paths have

led to the destination we have for all our businesses: profitable long-term

growth. Collectively, our Global Financial Services businesses are now

generating 27% of Capital One’s managed loans and 14% of its earnings.

Internationally, our $8.2 billion U.K. card portfolio is growing more

rapidly than the U.K. card industry as a whole. Our Canadian credit card

portfolio crossed the $2.4 billion (U.S.) threshold in 2004. We’re now

the U.K.’s seventh-largest card issuer and one of Canada’s top ten.

Building on our credit card successes and growing brand strength in

the U.K., we now offer British consumers installment loans and savings

instruments. Though still small, our U.K. participation in these categories

is profitable, and the strong growth of these lending sectors makes them

attractive opportunities for Capital One. We also plan to strengthen our

position with the 2005 acquisition of Hfs Group, one of Britain’s leading

home-equity loan brokers.

In the U.S., we’re now well established in small-business lending,

installment loans and healthcare finance (loans for medical and dental

procedures not covered by traditional health insurance). And with the

2005 acquisition of eSmartloan, a leading online home-equity lender

based in the U.S., we now have an excellent platform for success in the

fastest-growing segment of consumer finance.

Like our U.S. credit cards and auto loans, our small-business products

are designed to deliver great value without the hassle. For example, by

making Small Business Administration (SBA) loans available online,

we’ve streamlined the process of applying for these government-backed

loans. Through lines of credit, credit cards and loans, our small-business

franchise is succeeding by giving entrepreneurs lower rates, better credit

access and great financing flexibility.

Global Financial Services is already successful and serves markets with

excellent growth potential. These markets are also highly compatible with

Capital One’s Information-Based Strategy, skills in risk management and

expertise in direct marketing.

Our products break through the

time zones and cultural barriers.

12

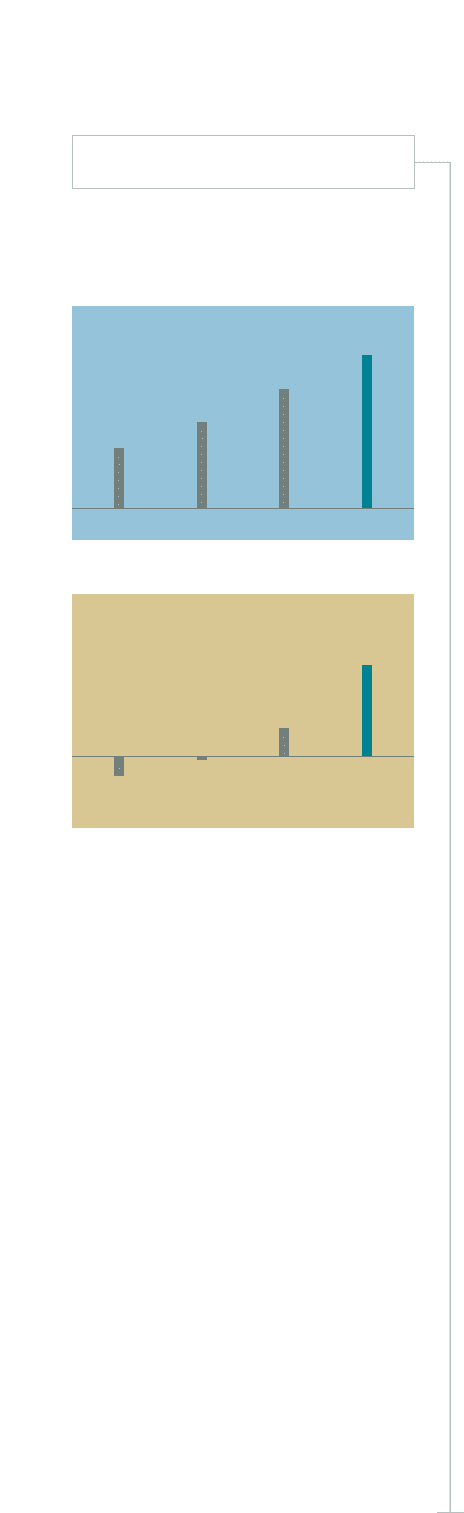

global financial services

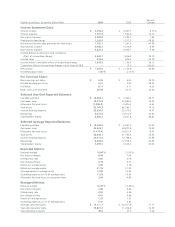

managed loans ($ in billions)

2004

$21

2003

$17

2002

$12

2001

$8

net income ($ in millions)

2004

$213

2003

$65

20022001

($45) ($8)