Capital One 2004 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2004 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Static pool credit losses are calculated by summing the actual and projected future credit losses and dividing

them by the original balance of each pool of assets. Due to the short-term revolving nature of the consumer loan

receivables, the weighted average percentage of static pool credit losses is not considered materially different

from the assumed charge-off rates used to determine the fair value of the retained interests.

The Company acts as a servicing agent and receives contractual servicing fees of between 0.50% and 6% of the

investor principal outstanding, based upon the type of assets serviced. The Company generally does not record

material servicing assets or liabilities for these rights since the contractual servicing fee approximates market

rates.

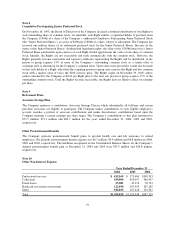

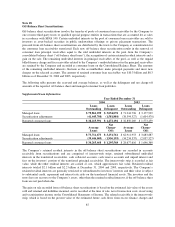

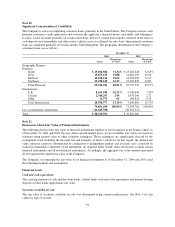

Securitization Cash Flows

Year Ended December 31 2004 2003

Proceeds from new securitizations $10,854,927 $11,466,122

Collections reinvested in revolving-period securitizations 63,050,917 59,574,458

Repurchases of accounts from the trust ——

Servicing fees received 766,883 693,166

Cash flows received on retained interests(1) 3,668,344 2,901,126

(1) Includes all cash receipts of excess spread and other payments (excluding servicing fees) from the Trust to the Company.

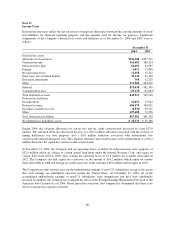

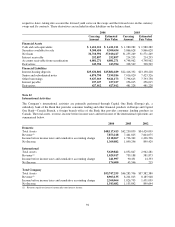

For the year ended December 31, 2004, the Company recognized gross gains of $55.8 million on the sale of

$10.9 billion of consumer loan principal receivables compared to gross gains of $62.0 million on the sale of

$11.5 billion of consumer loan principal receivables for the year ended December 31, 2003 and gross gains of

$73.6 million on the sale of $12.5 billion of consumer loans in 2002. These gross gains are included in servicing

and securitization income. In addition, the Company recognized, as a reduction to servicing and securitization

income, upfront securitization transaction costs and recurring credit facility commitment fees of $69.0 million,

$88.6 million and $43.5 million for the years ended December 31, 2004, 2003 and 2002, respectively. The

remainder of servicing and securitizations income represents servicing income and excess interest and non-

interest income generated by the transferred receivables, less the related net losses on the transferred receivables

and interest expense related to the securitization debt.

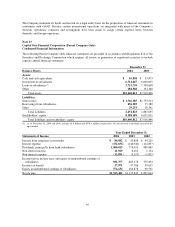

Note 19

Derivative Instruments and Hedging Activities

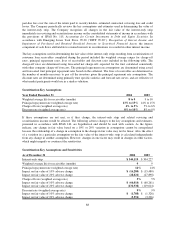

The Company maintains a risk management strategy that incorporates the use of derivative instruments to

minimize significant unplanned fluctuations in earnings caused by interest rate and foreign exchange rate

volatility. The Company’s goal is to manage sensitivity to changes in rates by modifying the repricing or

maturity characteristics of certain balance sheet assets and liabilities, thereby limiting the impact on earnings. By

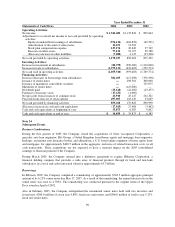

using derivative instruments, the Company is exposed to credit and market risk. If the counterparty fails to

perform, credit risk is equal to the extent of the fair value gain in a derivative. When the fair value of a derivative

contract is positive, this generally indicates that the counterparty owes the Company, and, therefore, creates a

repayment risk for the Company. When the fair value of a derivative contract is negative, the Company owes the

counterparty, and therefore, has no repayment risk. The Company minimizes the credit (or repayment) risk in

derivative instruments by entering into transactions with high-quality counterparties that are reviewed

periodically by the Company’s Asset and Liability Committee, a committee of Senior Management. The

Company also maintains a policy of requiring that all derivative contracts be governed by an International Swaps

and Derivatives Association Master Agreement; depending on the nature of the derivative transaction, bilateral

collateral agreements may be required as well.

Market risk is the adverse effect that a change in interest rates, currency, or implied volatility rates has on the

value of a financial instrument. The Company manages the market risk associated with interest rate and foreign

exchange contracts by establishing and monitoring limits as to the types and degree of risk that may be

undertaken.

89