Capital One 2004 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2004 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

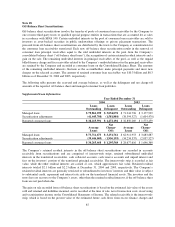

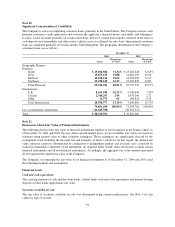

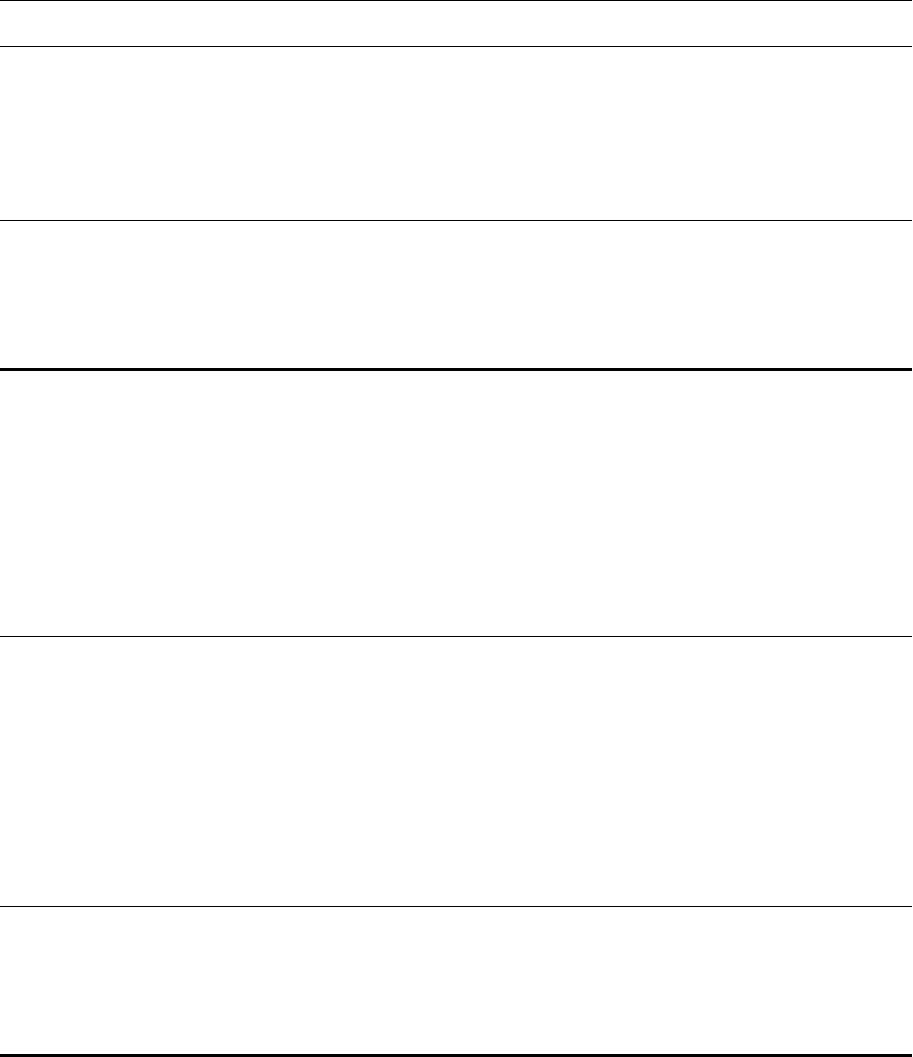

respective dates, taking into account the forward yield curve on the swaps and the forward rates on the currency

swaps and f/x contracts. These derivatives are included in other liabilities on the balance sheet.

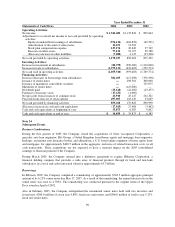

2004 2003

Carrying

Amount

Estimated

Fair Value

Carrying

Amount

Estimated

Fair Value

Financial Assets

Cash and cash equivalents $ 1,411,211 $ 1,411,211 $ 1,980,282 $ 1,980,282

Securities available for sale 9,300,454 9,300,454 5,866,628 5,866,628

Net loans 36,710,591 37,010,417 31,255,269 31,571,269

Interest receivable 252,857 252,857 214,295 214,295

Accounts receivable from securitization 4,081,271 4,081,271 4,748,962 4,748,962

Derivatives 243,594 243,594 338,549 338,549

Financial Liabilities

Interest-bearing deposits $25,636,802 $25,882,189 $22,416,332 $23,138,228

Senior and subordinated notes 6,874,790 7,199,186 7,016,020 7,423,326

Other borrowings 9,637,019 9,621,173 7,796,613 7,793,758

Interest payable 237,227 237,227 256,015 256,015

Derivatives 427,012 427,012 481,228 481,228

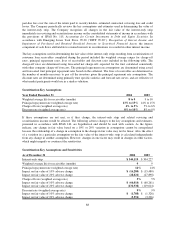

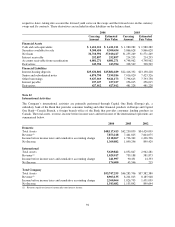

Note 22

International Activities

The Company’s international activities are primarily performed through Capital One Bank (Europe) plc, a

subsidiary bank of the Bank that provides consumer lending and other financial products in Europe and Capital

One Bank—Canada Branch, a foreign branch office of the Bank that provides consumer lending products in

Canada. The total assets, revenue, income before income taxes and net income of the international operations are

summarized below.

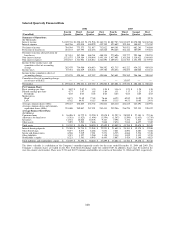

2004 2003 2002

Domestic

Total Assets $48,117,413 $42,230,859 $34,420,099

Revenue(1) 7,873,218 7,461,825 7,604,075

Income before income taxes and cumulative accounting change 2,118,067 1,736,362 1,436,706

Net Income 1,369,082 1,090,296 899,429

International

Total Assets 5,629,842 4,052,847 2,962,281

Revenue(1) 1,029,917 739,188 581,873

Income before income taxes and cumulative accounting change 241,997 90,431 14,333

Net Income 174,400 45,546 215

Total Company

Total Assets $53,747,255 $46,283,706 $37,382,380

Revenue(1) 8,903,135 8,201,013 8,185,948

Income before income taxes and cumulative accounting change 2,360,064 1,826,793 1,451,039

Net Income 1,543,482 1,135,842 899,644

(1) Revenue equals net interest income plus non-interest income.

94