Capital One 2004 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2004 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

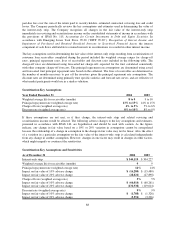

Note 16

Commitments, Contingencies and Guarantees Commitments

Line of Credit Commitments

As of December 31, 2004, the Company had outstanding lines of credit of approximately $216.2 billion

committed to its customers. Of that total commitment, approximately $135.6 billion was unused. While this

amount represented the total available lines of credit to customers, the Company has not experienced, and does

not anticipate, that all of its customers will exercise their entire available line at any given point in time. The

Company generally has the right to increase, reduce, cancel, alter or amend the terms of these available lines of

credit at any time.

Lease Commitments

Certain premises and equipment are leased under agreements that expire at various dates through 2012, without

taking into consideration available renewal options. Many of these leases provide for payment by the lessee of

property taxes, insurance premiums, cost of maintenance and other costs. In some cases, rentals are subject to

increases in relation to a cost of living index. Total rent expenses amounted to approximately $38.5 million,

$63.7 million, and $63.2 million for the years ended December 31, 2004, 2003 and 2002, respectively.

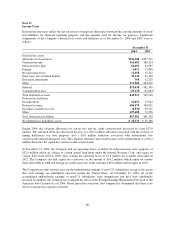

Future minimum rental commitments as of December 31, 2004, for all non-cancelable operating leases with

initial or remaining terms of one year or more are as follows:

2005 $ 41,275

2006 35,486

2007 34,696

2008 34,916

2009 33,837

Thereafter 34,513

Total $214,723

Minimum sublease rental income of $26.6 million, due in future years under noncancelable leases, has not been

included in the table above as a reduction to minimum lease payments.

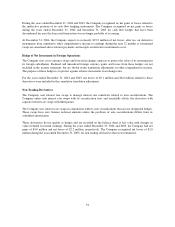

Synthetic Fuel Commitments

In June 2004, the Company established and consolidated Capital One Appalachian LLC (“COAL”) which

qualifies as a variable interest entity under the requirements of FIN 46. COAL purchased a limited interest in a

partnership from a third party that operates a facility which produces a coal-based synthetic fuel that qualifies for

tax credits pursuant to Section 29 of the Internal Revenue Code. COAL paid $2.1 million in cash and agreed to a

fixed note payable of $26.4 million and additional quarterly variable payments based on the amount of tax credits

generated by the partnership from June 2004 through the end of 2007. COAL has an ongoing commitment to

fund the losses of the partnership to maintain its 24.9% minority ownership interest, and make fixed and variable

payments to the third party. The Corporation has guaranteed COAL’s commitments to both the partnership and

the third party. COAL’s equity investment in the partnership was included in Other Assets at December 31, 2004.

As of December 31, 2004, the Company had an estimated remaining commitment for the fixed note payments,

variable payments and the funding of its 24.9% share of the operating losses of the partnership of $100.2 million.

Guarantees

Residual Value Guarantees

The Company has entered into synthetic lease transactions to finance several facilities. A synthetic lease structure

involves establishing a special purpose vehicle (“SPV”) that owns the properties to be leased. The SPV is funded

84