Capital One 2004 Annual Report Download - page 62

Download and view the complete annual report

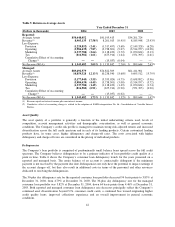

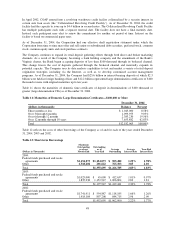

Please find page 62 of the 2004 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Other non-interest income increased $100.6 million, or 51%, to $297.9 million for the year ended December 31,

2004 compared to $197.3 million for the prior year. The increase in other non-interest income was primarily due

to $72.6 million in pre-tax gains recognized in 2004 related to the sale of the Company’s joint venture investment

in South Africa ($31.5 million pre-tax) and sale of the French loan portfolio ($41.1 million pre-tax) and an

increase in income earned from purchased charged-off loan portfolios of $43.7 million for the year ended

December 31, 2004, when compared to 2003. These increases were partially offset by decreases in auto gains of

$26.1 million and an $18.0 million increase in losses realized on the sale of securities and the repurchase of

senior notes for the year ended December 31, 2004 when compared with the prior year.

Other non-interest income decreased $78.6 million, or 28%, to $197.3 million for the year ended December 31,

2003 compared to $275.9 million for the prior year. The decrease in other non-interest income was primarily due

to $9.4 million of losses recognized on sales of securities for the year ended December 31, 2003, compared to

$77.5 million of gains recognized on sales of securities for the year ended December 31, 2002. In addition, there

were no gains recognized for senior note repurchases in 2003, compared to $27.0 million recognized in 2002.

There was a $23.6 million decrease in the fair value of free-standing derivatives for the year ended December 31,

2003. These decreases were offset in part by a $38.2 million increase in gains on sales of auto loans for the year

ended December 31, 2003 and an increase in income earned from purchased charged-off loan portfolios of $34.5

million for the year ended December 31, 2003, compared to 2002.

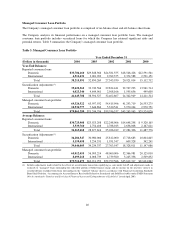

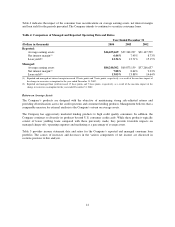

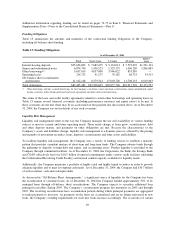

Non-Interest Expense

Non-interest expense, which consists of marketing and operating expenses, increased $465.5 million, or 10%, to

$5.3 billion for the year ended December 31, 2004 compared to $4.9 billion for the year ended December 31,

2003. Marketing expense increased $219.4 million, or 20%, for the year ended December 31, 2004, compared to

the prior year. The increase in marketing expense is the result of favorable opportunities to originate loans during

2004 combined with continued brand investments. Operating expenses were $4.0 billion for the year ended

December 31, 2004, compared to $3.7 billion for December 31, 2003. The increase in operating expense of

$246.1 was primarily due to $161.2 million in pre-tax charges consisting of $124.8 million in employee

termination benefits and facility consolidation costs related to corporate-wide cost reduction initiatives, $20.6

million related to a change in asset capitalization thresholds and $15.8 million related to impairment of internally

developed software. Additionally, a $41.8 million increase in professional services expense and a $50.5 million

increase in expenses related to credit recovery efforts contributed to the increase in operating expense for the

year ended December 31, 2004 when compared with the prior year. Although operating expenses increased,

operating expenses as a percentage of average managed loans for the year ended December 31, 2004 fell 53 basis

points to 5.41% from 5.94% for the prior year. This reduction reflects the continued improvement in the

Company’s operating efficiencies.

Non-interest expense increased $271.1 million, or 6%, to $4.9 billion for the year ended December 31, 2003

compared to $4.6 billion for the year ended December 31, 2002. Marketing expense increased $47.8 million, or

4%, for the year ended December 31, 2003, compared to the prior year. The increase is the result of the Company

investing in new and existing product opportunities. Operating expenses were $3.7 billion for the year ended

December 31, 2003, compared to $3.5 billion for December 31, 2002. The increase in operating expense of

$223.3 was primarily due to increased credit and recovery efforts of $137.1 million, investment in IT

infrastructure to support future growth of $30.0 million and costs associated with the expansion of the

Company’s enterprise risk management programs and systems to further strengthen internal controls.

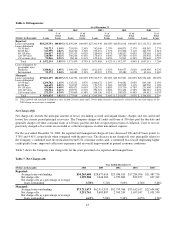

Income Taxes

The Company’s income tax rate was 34.6%, 37% and 38% for the years ended December 31, 2004, 2003 and

2002, respectively. The decrease in the 2004 income tax rate was primarily due to increased profitability in the

Company’s International businesses which are in lower taxed territories, investment in synthetic fuel credits and

ongoing tax planning activities. The effective rate includes state, federal and international income tax

components.

39