Capital One 2004 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2004 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

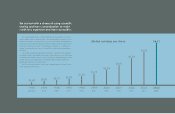

We’ve come a long way during our first decade

as a public company, and we’re well positioned

to sustain our success.

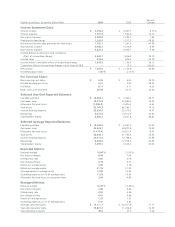

Capital One celebrated its tenth anniversary as a public company in 2004 by turning in another

outstanding financial performance. For ten straight years, our earnings per share growth and return on equity

have exceeded 20%, a record equaled by only a handful of public companies. Our momentum is the result

of a winning strategy, great products, a strong brand and, most of all, the talents of our almost 15,000

associates worldwide.

In 2004, Capital One delivered record earnings of $1.5 billion, up 36% from last year. Managed loans

increased 12% to $79.9 billion, and we grew by 1.5 million accounts. Our U.S. credit card business delivered

solid growth. Managed loans topped $48 billion in 2004, up 5%, and earnings rose 17% to $1.4 billion.

The diversification efforts we began years ago are paying off. Together, Capital One Auto Finance and

Global Financial Services accounted for 39% of Capital One’s managed loans at the end of 2004 and

24% of earnings.

We’ve come a long way since our spin-off from a regional bank in 1994. Back then, we had a single

line of business and 5 million accounts. Today, we’re a diversified FORTUNE®200 company with more

than 48 million accounts. We’ve become one of the largest consumer franchises in America, providing

innovative products across a broad spectrum of financial services, including credit cards, auto lending,

small-business lending, installment lending and savings. In the U.K. and Canada, we’ve created leading

credit card businesses and are expanding into new financial products and services.

One thing that hasn’t changed during the past decade is our proprietary Information-Based Strategy

(IBS), which combines the power of information, technology, testing and great people to bring customized

solutions to consumers. IBS has been the foundation of Capital One’s success in credit cards and is driving

growth and profitability in our newer businesses. The credit card business is now consolidated, with the

top seven players accounting for over 85% of the market. Other lending businesses are more fragmented,

but will consolidate over time. The financial services industry increasingly will be dominated by large players

with multiple, national-scale lending platforms and national brands. IBS, a proven strategy for capturing

market share and building national scale, puts us in a strong position to continue winning in consolidated

markets, like credit cards, and to capitalize on future waves of consolidation in financial services.

In 2004, we announced several acquisitions that were completed in early 2005. The acquisition of

Onyx Acceptance Corporation®made Capital One Auto Finance the second-largest independent auto

lender in the United States. We also acquired Kansas City-based eSmartloan, an online originator of

home equity loans and mortgages, Hfs Group, a home equity loan broker in the United Kingdom, and

InsLogic, an insurance brokerage based in Tennessee.

chairman’s letter to shareholders and friends