Capital One 2004 Annual Report Download - page 74

Download and view the complete annual report

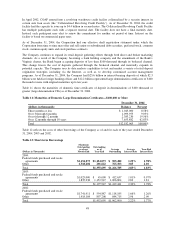

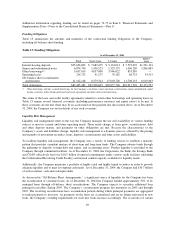

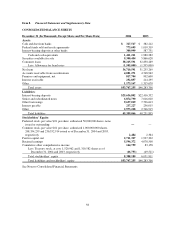

Please find page 74 of the 2004 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.cash equivalents at December 31, 2003. As of December 31, 2004, the weighted average life of the investment

securities was approximately 3.6 years. These investment securities, along with cash and cash equivalents,

provide increased liquidity and flexibility to support the Company’s funding requirements.

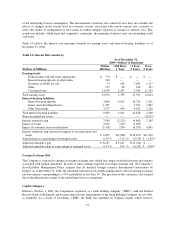

The Company has a $750.0 million credit facility committed through June 2007. The Company may take

advances under the facility subject to covenants and conditions customary in a transaction of this nature. This

facility may be used for general corporate purposes and was not drawn upon at December 31, 2004.

Derivative Instruments

The Company enters into interest rate swap agreements in order to manage interest rate exposure. In most cases,

this exposure is related to the funding of fixed rate assets with floating rate obligations, including off-balance

sheet securitizations. The Company also enters into forward foreign currency exchange contracts and cross

currency swaps to reduce sensitivity to changing foreign currency exchange rates. The hedging of foreign

currency exchange rates is limited to certain intercompany obligations related to international operations. These

derivatives expose the Company to certain credit risks. The Company has established policies and limits, as well

as collateral agreements, to manage credit risk related to derivative instruments.

Additional information regarding derivative instruments can be found on pages 89-91 in Item 8 “Financial

Statements and Supplementary Data—Notes to the Consolidated Financial Statements—Note 19”.

Market Risk Management

Interest Rate Risk

Interest rate risk refers to changes in earnings or the net present value of assets and off-balance sheet positions

less liabilities (termed “economic value of equity”) due to interest rate changes. To the extent that managed

interest income and expense do not respond equally to changes in interest rates, or that all rates do not change

uniformly, earnings and economic value of equity could be affected. The Company’s managed net interest

income is affected primarily by changes in short-term interest rates, as variable rate card receivables,

securitization bonds and corporate debts are repriced. The Company manages and mitigates its interest rate

sensitivity through several techniques, which include, but are not limited to, changing the maturity and repricing

characteristics of various balance sheet categories and by entering into interest rate swaps.

The Company’s measurement of interest rate risk considers both earnings and market value exposures. The

consolidated balance sheet and all off-balance sheet positions are included in the analysis. When available,

contractual maturities related to balance sheet and off-balance sheet positions are assumed. Balance sheet

positions lacking contractual maturities and those with a likelihood of maturing prior to their contractual term are

assumed to mature consistent with business line expectations or, when available in the case of marketable

securities, market expectations. The Company’s Asset/Liability Management Policy limits the change in

projected 12-month net interest income due to instantaneous parallel rate shocks of up to 300 basis points to less

than 3% of base net interest income. As of December 31, 2004 the Company estimated a 2.6% increase in 12

month net interest income for an immediate 300 basis point rate increase and a 2.9% decline in 12 month net

interest income for an immediate 300 basis point rate decline. The impacts to net interest income resulting from

the rate shocks do not consider the impact of loan convexity.

In addition to limits related to possible changes in 12-month net interest income, the Asset/Liability Management

Policy limits the pre-tax change in economic value of equity due to instantaneous parallel rate shocks of 100

basis points to less than 6%. As of December 31, 2004, the estimated reduction in economic value of equity due

to an adverse 100 basis point rate shock is 2.1%.

As of December 31, 2004, the Company was in compliance with all of its interest rate risk management related

policies. The precision of the measures used to manage interest rate risk is limited due to the inherent uncertainty

51