Capital One 2004 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2004 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

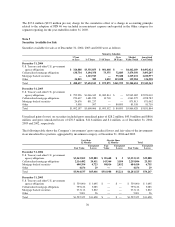

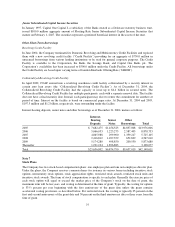

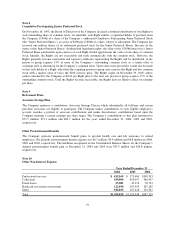

The $15.0 million ($23.9 million pre-tax) charge for the cumulative effect of a change in accounting principle

related to the adoption of FIN 46 was included in non-interest expense and reported in the Other category for

segment reporting for the year ended December 31, 2003.

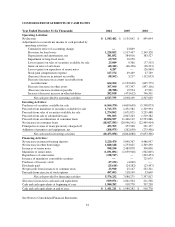

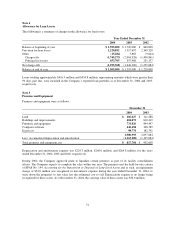

Note 3

Securities Available for Sale

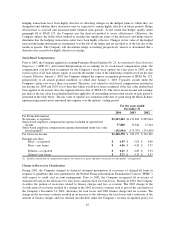

Securities available for sale as of December 31, 2004, 2003 and 2002 were as follows:

Maturity Schedule

1Year

or Less 1–5 Years 5–10 Years

Over

10 Years

Market

Value Totals

Amortized

Cost Totals

December 31, 2004

U.S. Treasury and other U.S. government

agency obligations $ 324,888 $3,335,853 $ 801,448 $ — $4,462,189 $4,492,021

Collateralized mortgage obligations 138,734 3,194,358 73,375 72,883 3,479,350 3,495,207

Mortgage backed securities — 1,163,943 — 55,688 1,219,631 1,220,577

Other 24,815 389 1,052 113,028 139,284 134,558

Total $ 488,437 $7,694,543 $ 875,875 $241,599 $9,300,454 $9,342,363

December 31, 2003

U.S. Treasury and other U.S. government

agency obligations $ 792,926 $1,066,342 $1,082,814 $ — $2,942,082 $2,920,310

Collateralized mortgage obligations 270,637 1,681,920 10,718 — 1,963,275 1,958,782

Mortgage backed securities 24,676 851,237 — — 875,913 871,062

Other 3,958 507 — 80,893 85,358 81,710

Total $1,092,197 $3,600,006 $1,093,532 $ 80,893 $5,866,628 $5,831,864

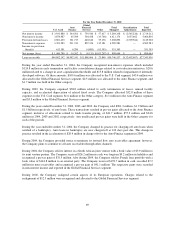

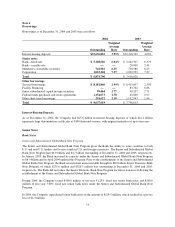

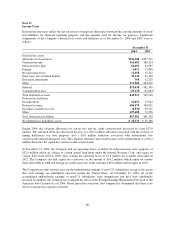

Unrealized gains (losses) on securities included gross unrealized gains of $28.2 million, $43.0 million and $80.6

million, and gross unrealized losses of $70.3 million, $11.6 million and $.4 million, as of December 31, 2004,

2003 and 2002, respectively.

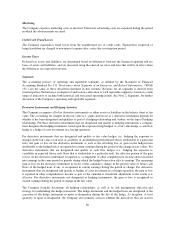

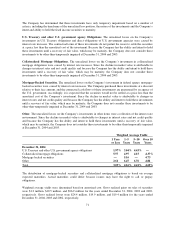

The following table shows the Company’s investments’ gross unrealized losses and fair value of the investments

in an unrealized loss position, aggregated by investment category, at December 31, 2004 and 2003.

Less than

12 Months

Greater than

12 Months Total

Fair Value

Unrealized

Losses

Fair

Value

Unrealized

Losses Fair Value

Unrealized

Losses

December 31, 2004

U.S. Treasury and other U.S. government

agency obligations $3,243,505 $39,883 $ 89,608 $ 5 $3,333,113 $39,888

Collateralized mortgage obligations 2,116,482 20,411 143,364 3,184 2,259,846 23,595

Mortgage backed securities 600,394 4,723 84,016 2,032 684,410 6,755

Other 4,156 29 — — 4,156 29

Total $5,964,537 $65,046 $316,988 $5,221 $6,281,525 $70,267

December 31, 2003

U.S. Treasury and other U.S. government

agency obligations $ 559,090 $ 3,695 $ — $ — $ 559,090 $ 3,695

Collateralized mortgage obligations 795,122 5,085 — — 795,122 5,085

Mortgage backed securities 233,112 2,822 — — 233,112 2,822

Other 5,001 26 — — 5,001 26

Total $1,592,325 $11,628 $ — $ — $1,592,325 $11,628

70