Capital One 2004 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2004 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

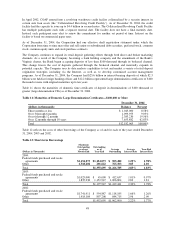

December 31, 2004, down 94 basis points from December 31, 2003 and the reported charge-off rate which was

3.78% for the year ended December 31, 2004, down 196 basis points from the prior year.

For the year ended December 31, 2003, the provision for loan losses decreased to $1.5 billion, or 29%, from $2.1

billion for the year ended December 31, 2002. This decrease resulted from the improving credit quality of the

reported loan portfolio. The 30-plus day reported delinquency rate was 4.79% at December 31, 2003, down from

6.12% at December 31, 2002. While, the Company’s reported loan portfolio increased to $32.9 billion at

December 31, 2003 from $27.3 billion at December 31, 2002, the impact of the loan growth to the allowance was

mitigated by the growth being concentrated in higher credit quality loans and an improvement in collection

experience.

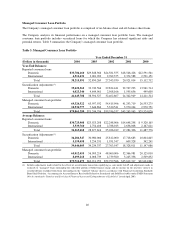

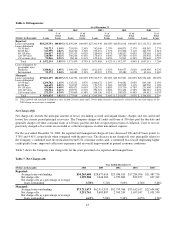

Reportable Segments

The Company manages its business by three distinct operating segments: U.S. Card, Auto Finance and Global

Financial Services. The U.S. Card, Auto Finance and Global Financial Services segments are considered

reportable segments based on quantitative thresholds applied to the managed loan portfolio for reportable

segments provided by SFAS No. 131, Disclosures about Segments of an Enterprise and Related Information.

Management decision making is performed on a managed portfolio basis, and such information about reportable

segments is provided on a managed basis.

The Company maintains its books and records on a legal entity basis for the preparation of financial statements in

conformity with GAAP. The following table presents information prepared from the Company’s internal

management information system, which is maintained on a line of business level through allocations from the

consolidated financial results.

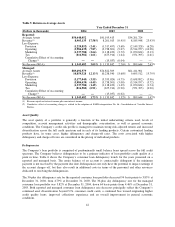

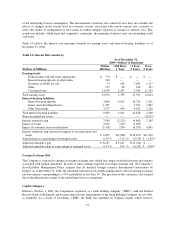

Table 9: Segments (Managed Basis)

U.S. Card Auto Finance Global Financial Services

(Dollars in thousands) 2004 2003 2004 2003 2004 2003

Loans receivable $48,609,571 $46,278,750 $9,997,497 $8,466,873 $21,240,325 $16,507,937

Net income 1,387,301 1,181,169 163,780 99,291 213,080 64,839

Net charge-off rate 5.05% 6.88% 3.28% 4.62% 3.39% 3.83%

30+ Delinquency rate 3.97 4.60 5.50 7.55 2.81 2.70

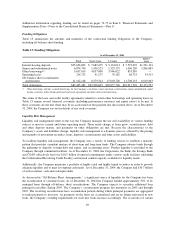

U.S. Card Segment

The U.S. Card segment consists of domestic credit card lending activities. Total U.S. Card segment loans

increased 5% to $48.6 billion at December 31, 2004, compared to $46.3 billion at December 31, 2003. The

Company achieved loan growth in this highly competitive segment by continuing to develop innovative new

products and leverage its brand. The contribution to net income from the U.S. Card segment increased $206.1

million, or 17%, to $1.4 billion for the year ended December 31, 2004 when compared with the prior year. The

increase in net income is attributable to growth in the loan portfolio, improving credit quality and operating

efficiencies, partially offset by $62.1 million in after-tax severance and facility consolidation charges related to

cost reduction initiatives and $9.6 million in after-tax charges related to a change in asset capitalization

thresholds allocated to the U.S. Card segment during 2004.

The U.S. Card segment’s net charge-off rate decreased 183 basis points to 5.05% for the year ended December

31, 2004 when compared with the prior year. The reduction in the net charge-off rate resulted from a decrease in

net charge-offs of $527.2 million, or 19%, while average U.S. Card segment loans grew 11% during 2004. The

decrease in net charge-offs was driven by the Company’s continued bias toward originating higher credit quality

loans, improved collections experience and an overall improvement in general economic conditions.

45