Capital One 2004 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2004 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

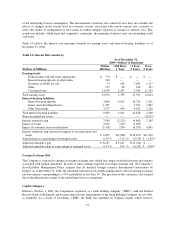

of the underlying forecast assumptions. The measurement of interest rate sensitivity also does not consider the

effects of changes in the overall level of economic activity associated with various interest rate scenarios or

reflect the ability of management to take action to further mitigate exposure to changes in interest rates. This

action may include, within legal and competitive constraints, the repricing of interest rates on outstanding credit

card loans.

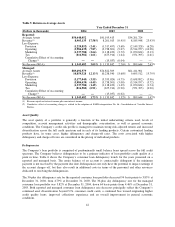

Table 14 reflects the interest rate repricing schedule for earning assets and interest-bearing liabilities as of

December 31, 2004.

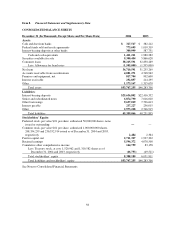

Table 14: Interest Rate Sensitivity

As of December 31,

2004—Subject to Repricing

(Dollars in Millions)

Within

180 Days

>180 Days-

1Year

>1 Year-

5 Years

Over

5 Years

Earning assets:

Federal funds sold and resale agreements $ 774 $ — $ — $ —

Interest-bearing deposits at other banks 310 — — —

Securities available for sale 74 414 7,695 1,117

Other 175 28 120 137

Consumer loans 14,539 2,357 9,950 11,370

Total earning assets 15,872 2,799 17,765 12,624

Interest-bearing liabilities:

Interest-bearing deposits 3,669 4,013 16,724 1,231

Senior and subordinated notes 1,457 — 3,521 1,897

Other borrowings 3,237 999 4,181 1,220

Total interest-bearing liabilities 8,363 5,012 24,426 4,348

Non-rate related net assets — — — (6,911)

Interest sensitivity gap 7,509 (2,213) (6,661) 1,365

Impact of swaps 2,016 (413) (1,603) —

Impact of consumer loan securitizations (3,318) (334) (6,193) 9,845

Interest sensitivity gap adjusted for impact of securitizations and

swaps $ 6,207 $(2,960) $(14,457) $11,210

Adjusted gap as a percentage of managed assets 6.55 % (3.12) % (15.25) % 11.82%

Adjusted cumulative gap $ 6,207 $ 3,247 $(11,210) $ —

Adjusted cumulative gap as a percentage of managed assets 6.55 % 3.43 % (11.82) % 0.00%

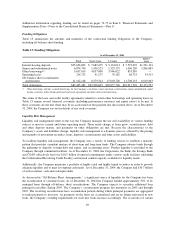

Foreign Exchange Risk

The Company is exposed to changes in foreign exchange rates which may impact translated income and expense

associated with foreign operations. In order to limit earnings exposure to foreign exchange risk, the Company’s

Asset/Liability Management Policy requires that all material foreign currency denominated transactions be

hedged. As of December 31, 2004, the estimated reduction in 12-month earnings due to adverse foreign exchange

rate movements corresponding to a 95% probability is less than 1%. The precision of this estimate is also limited

due to the inherent uncertainty of the underlying forecast assumptions.

Capital Adequacy

Effective October 1, 2004, the Corporation registered as a bank holding company (“BHC”) with the Federal

Reserve Bank of Richmond and became subject to the requirements of the Bank Holding Company Act of 1956,

as amended. As a result of becoming a BHC, the Bank has amended its Virginia charter which removes

52