Capital One 2004 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2004 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

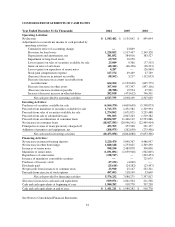

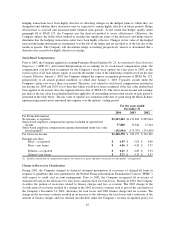

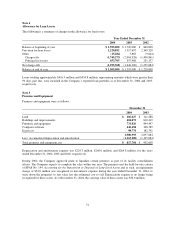

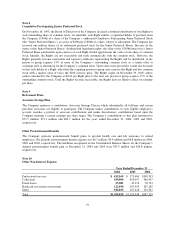

For the Year Ended December 31, 2002

U.S. Card

Auto

Finance

Global

Financial

Services Other

Total

Managed

Securitization

Adjustments

Total

Reported

Net interest income $ 3,931,880 $ 544,501 $ 750,540 $ 57,417 $ 5,284,338 $ (2,565,226) $ 2,719,112

Non-interest income 3,874,987 65,509 504,438 (33,760) 4,411,174 1,055,662 5,466,836

Provision for loan losses 2,801,423 361,717 440,616 55,136 3,658,892 (1,509,564) 2,149,328

Non-interest expenses 3,391,283 231,741 827,376 135,181 4,585,581 — 4,585,581

Income tax provision

(benefit) 613,381 6,290 (4,883) (63,393) 551,395 — 551,395

Net income (loss) $ 1,000,780 $ 10,262 $ (8,131) $(103,267) $ 899,644 $ — $ 899,644

Loans receivable $40,862,142 $6,992,541 $11,868,006 $ 23,848 $59,746,537 $(32,402,607) $27,343,930

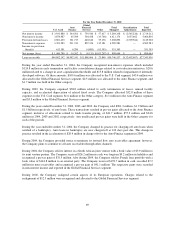

During the year ended December 31, 2004, the Company recognized non-interest expenses which included

$124.8 million in early termination and facility consolidation charges related to cost reduction initiatives, $20.6

million related to a change in asset capitalization thresholds and $15.8 million related to impairment of internally

developed software. Of these amounts, $109.6 million was allocated to the U.S. Card segment, $45.4 million was

allocated to the Global Financial Services segment, $4.5 million was allocated to the Auto Finance segment, and

$1.7 million was held in the Other category.

During 2002, the Company expensed $38.8 million related to early termination of leases, unused facility

capacity, and accelerated depreciation of related fixed assets. The Company allocated $32.8 million of these

expenses to the U.S. Card segment, $1.6 million to the Other category, $1.1 million to the Auto Finance segment

and $3.3 million to the Global Financial Services segment.

During the years ended December 31, 2004, 2003 and 2002, the Company sold $901.3 million, $1.9 billion and

$1.5 billion respectively, of auto loans. These transactions resulted in pre-tax gains allocated to the Auto Finance

segment, inclusive of allocations related to funds transfer pricing, of $41.7 million, $57.3 million and $24.6

million in 2004, 2003 and 2002, respectively. Any unallocated pre-tax gains were held in the Other category for

each of the periods.

During the year ended December 31, 2004, the Company changed its practice for charging-off auto loans when

notified of a bankruptcy. Auto loans in bankruptcy are now charged-off at 120 days past due. This change in

practice resulted in the acceleration of $20.4 million in charge-offs for the Auto Finance segment in 2004.

During 2004, the Company provided notice to terminate its forward flow auto receivables agreement; however,

the Company plans to continue to sell auto receivables through other channels.

During 2004, the Company sold its interest in a South African joint venture with a book value of $3.9 million to

its joint venture partner. The Company received $26.2 million in cash, was forgiven $9.2 million in liabilities and

recognized a pre-tax gain of $31.5 million. Also during 2004, the Company sold its French loan portfolio with a

book value of $144.8 million to an external party. The Company received $178.7 million in cash, recorded $7.2

million in notes receivables and recognized a pre-tax gain of $41.1 million. The respective gains were recorded

in non-interest income and reported in the Global Financial Services segment.

During 2002, the Company realigned certain aspects of its European operations. Charges related to the

realignment of $12.5 million were recognized and allocated to the Global Financial Services segment.

69