Capital One 2004 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2004 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

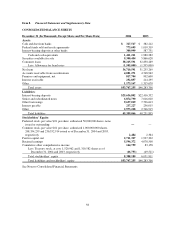

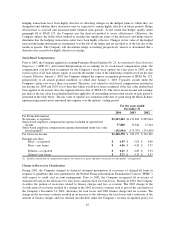

Item 8. Financial Statements and Supplementary Data

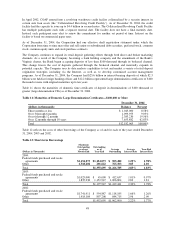

CONSOLIDATED BALANCE SHEETS

December 31 (In Thousands, Except Share and Per Share Data) 2004 2003

Assets:

Cash and due from banks $ 327,517 $ 382,212

Federal funds sold and resale agreements 773,695 1,010,319

Interest-bearing deposits at other banks 309,999 587,751

Cash and cash equivalents 1,411,211 1,980,282

Securities available for sale 9,300,454 5,866,628

Consumer loans 38,215,591 32,850,269

Less: Allowance for loan losses (1,505,000) (1,595,000)

Net loans 36,710,591 31,255,269

Accounts receivable from securitizations 4,081,271 4,748,962

Premises and equipment, net 817,704 902,600

Interest receivable 252,857 214,295

Other 1,173,167 1,315,670

Total assets $53,747,255 $46,283,706

Liabilities:

Interest-bearing deposits $25,636,802 $22,416,332

Senior and subordinated notes 6,874,790 7,016,020

Other borrowings 9,637,019 7,796,613

Interest payable 237,227 256,015

Other 2,973,228 2,746,915

Total liabilities 45,359,066 40,231,895

Stockholders’ Equity:

Preferred stock, par value $.01 per share; authorized 50,000,000 shares, none

issued or outstanding ——

Common stock, par value $.01 per share; authorized 1,000,000,000 shares,

248,354,259 and 236,352,914 issued as of December 31, 2004 and 2003,

respectively 2,484 2,364

Paid-in capital, net 2,711,327 1,937,302

Retained earnings 5,596,372 4,078,508

Cumulative other comprehensive income 144,759 83,158

Less: Treasury stock, at cost; 1,520,962 and 1,310,582 shares as of

December 31, 2004 and 2003, respectively (66,753) (49,521)

Total stockholders’ equity 8,388,189 6,051,811

Total liabilities and stockholders’ equity $53,747,255 $46,283,706

See Notes to Consolidated Financial Statements.

58