Capital One 2004 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2004 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

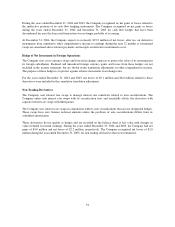

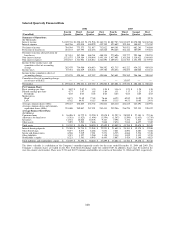

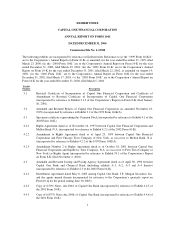

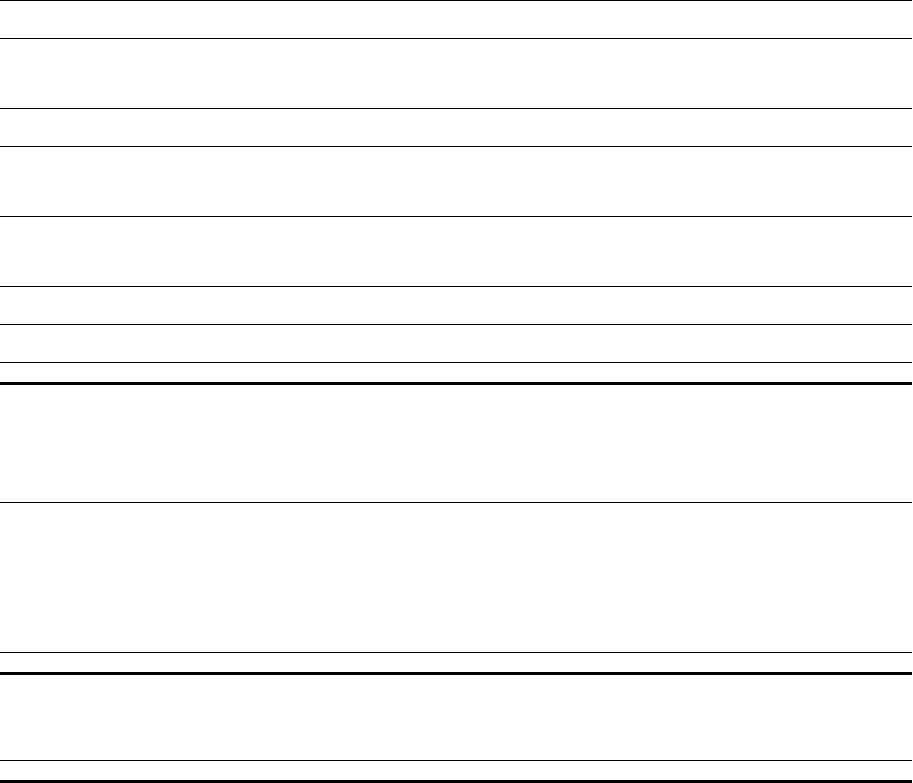

Selected Quarterly Financial Data

2004 2003

(Unaudited)

Fourth

Quarter

Third

Quarter

Second

Quarter

First

Quarter

Fourth

Quarter

Third

Quarter

Second

Quarter

First

Quarter

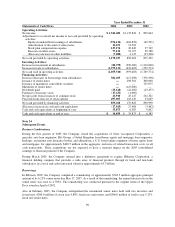

Summary of Operations:

(In Thousands)

Interest income $1,249,330 $1,228,413 $1,151,946 $1,164,731 $1,087,783 $1,103,025 $1,070,280 $1,106,566

Interest expense 464,766 453,038 440,929 432,709 423,682 399,104 388,017 371,762

Net interest income 784,564 775,375 711,017 732,022 664,101 703,921 682,263 734,804

Provision for loan losses 467,133 267,795 242,256 243,668 390,405 364,144 387,097 375,851

Net interest income after provision for

loan losses 317,431 507,580 468,761 488,354 273,696 339,777 295,166 358,953

Non-interest income 1,521,575 1,539,384 1,396,064 1,443,134 1,437,491 1,363,208 1,310,622 1,304,603

Non-interest expense 1,556,527 1,311,984 1,228,812 1,224,896 1,289,472 1,241,763 1,151,556 1,173,932

Income before income taxes and

cumulative effect of accounting

change 282,479 734,980 636,013 706,592 421,715 461,222 454,232 489,624

Income taxes 87,351 244,819 228,626 255,786 156,034 170,653 168,066 181,161

Income before cumulative effect of

accounting change 195,128 490,161 407,387 450,806 265,681 290,569 286,166 308,463

Cumulative effect of accounting change,

netoftaxesof$8,832 —————15,037——

Net income $ 195,128 $ 490,161 $ 407,387 $ 450,806 $ 265,681 $ 275,532 $ 286,166 $ 308,463

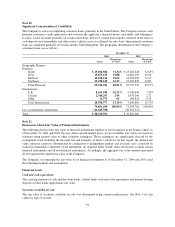

Per Common Share:

Basic earnings per share $ 0.82 $ 2.07 $ 1.74 1.94 $ 1.16 $ 1.23 $ 1.28 1.38

Diluted earnings per share 0.77 1.97 1.65 1.84 1.11 1.17 1.23 1.35

Dividends 0.03 0.03 0.03 0.03 0.03 0.03 0.03 0.03

Market prices

High 84.75 75.49 77.65 76.66 64.25 62.02 54.99 39.70

Low 67.62 64.93 61.15 60.04 55.15 44.51 30.05 24.91

Average common shares (000s) 239,247 236,405 234,732 232,021 228,110 224,615 223,691 222,951

Average common shares and common

equivalent shares (000s) 253,008 249,007 247,591 245,413 239,206 236,270 232,553 228,422

Average Balance Sheet Data:

(In Millions)

Consumer loans $ 36,096 $ 34,772 $ 33,290 $ 32,878 $ 31,297 $ 28,949 $ 27,101 $ 27,316

Allowance for loan losses (1,381) (1,425) (1,494) (1,594) (1,567) (1,590) (1,635) (1,719)

Securities 11,531 10,646 10,578 9,347 7,598 7,331 7,535 5,352

Other assets 7,093 7,503 7,646 7,068 7,674 7,014 6,677 7,369

Total assets $ 53,339 $ 51,496 $ 50,020 $ 47,699 $ 45,002 $ 41,704 $ 39,678 $ 38,318

Interest-bearing deposits $ 25,580 $ 24,714 $ 23,948 $ 22,993 $ 21,605 $ 20,303 $ 19,178 $ 17,940

Other borrowings 9,077 8,675 8,488 7,834 7,661 6,892 6,683 7,010

Senior and deposit notes 6,946 7,219 7,381 7,271 6,735 6,066 5,534 5,310

Other liabilities 3,515 3,327 3,260 3,158 3,114 3,019 3,135 3,235

Stockholder’s equity 8,221 7,561 6,943 6,443 5,887 5,424 5,148 4,823

Total liabilities and stockholders’ equity $ 53,339 $ 51,496 $ 50,020 $ 47,699 $ 45,002 $ 41,704 $ 39,678 $ 38,318

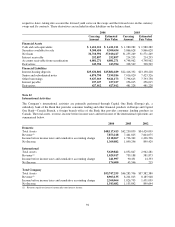

The above schedule is a tabulation of the Company’s unaudited quarterly results for the years ended December 31, 2004 and 2003. The

Company’s common shares are traded on the New York Stock Exchange under the symbol COF. In addition, shares may be traded in the

over-the-counter stock market. There were 9,721 and 10,227 common stockholders of record as of December 31, 2004 and 2003, respectively.

100