Capital One 2004 Annual Report Download - page 73

Download and view the complete annual report

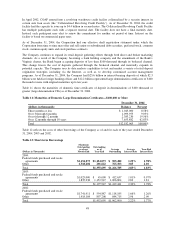

Please find page 73 of the 2004 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.events may cause the securitization transactions to amortize earlier than scheduled, which would accelerate the

need for funding. Additionally, this early amortization could have a significant effect on the ability of the Bank

and the Savings Bank to meet the capital adequacy requirements as all off-balance sheet loans experiencing such

early amortization would have to be recorded on the balance sheet and accordingly would require incremental

regulatory capital. As such amounts mature or are otherwise paid, the Company believes it can securitize

additional consumer loans, gather deposits, purchase federal funds and establish other funding sources to fund

new loan growth, although no assurance can be given to that effect.

The Company is a leading issuer in the securitization markets, which have remained resilient through adverse

conditions. Despite the size and relative stability of these markets and the Company’s position as a leading

issuer, if these markets experience difficulties the Company may be unable to securitize its loan receivables or to

do so at favorable pricing levels. Factors affecting the Company’s ability to securitize its loan receivables or to

do so at favorable pricing levels include the overall credit quality of the Company’s securitized loans, the

stability of the market for securitization transactions, and the legal, regulatory, accounting and tax environments

governing securitization transactions. If the Company was unable to continue to securitize its loan receivables at

current levels, the Company would use its investment securities and money market instruments in addition to

alternative funding sources to fund increases in loan receivables and meet its other liquidity needs. The resulting

change in the Company’s current liquidity sources could potentially subject the Company to certain risks. These

risks would include an increase in the Company’s cost of funds, an increase in the reserve and the provision for

possible credit losses as more loans would remain on the Company’s consolidated balance sheet, and limited or

no loan growth, if the Company were unable to find alternative and cost-effective funding sources. In addition, if

the Company could not continue to remove the loan receivables from the balance sheet the Company would

possibly need to raise additional capital to support loan and asset growth.

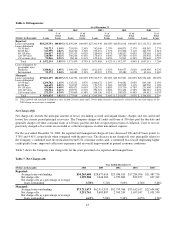

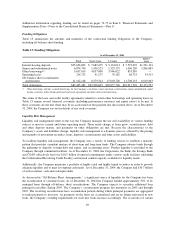

Based on past deposit activity, the Company expects to retain a portion of its deposit balances as they mature.

Therefore, the Company anticipates the net cash outflow related to deposits within the next year will be

significantly less than reported in Table 13. The Company utilizes deposits to fund loan and other asset growth

and to diversify funding sources.

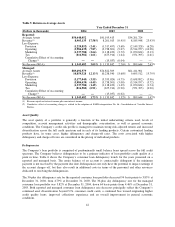

Direct deposits are deposits marketed to and received from individual customers without the use of a third-party

intermediary. Other deposits are deposits generally obtained through the use of a third-party intermediary.

Included in the Company’s other deposits at December 31, 2004, were brokered deposits of $9.1 billion,

compared to $8.3 billion at December 31, 2003. These deposits represented 36% and 37% of total deposits at

December 31, 2004 and 2003, respectively. If these brokered deposits are not renewed at maturity, the Company

would use its investment securities and money market instruments in addition to alternative funding sources to

fund increases in loan receivables and meet its other liquidity needs. The Federal Deposit Insurance Corporation

Improvement Act of 1991 limits the use of brokered deposits to “well-capitalized” insured depository institutions

and, with a waiver from the Federal Deposit Insurance Corporation, to “adequately capitalized” institutions. At

December 31, 2004, the Bank and Company were “well-capitalized” as defined under the federal bank regulatory

guidelines. Based on the Company’s historical access to the brokered deposit market, it expects to replace

maturing brokered deposits with new brokered deposits or with the Company’s direct deposits.

Other funding programs established by the Company include senior notes. At December 31, 2004, the Company

had $6.9 billion in senior notes outstanding that mature in varying amounts from 2005 to 2014, as compared to

$7.0 billion at December 31, 2003.

An additional source of funding for the Bank is provided by its global bank note program. Notes may be issued

under this program with maturities of thirty days or more from the date of issue. During 2004, the Bank issued

$1.0 billion (par value) of bank notes. At December 31, 2004, the Bank had $5.1 billion in bank notes

outstanding. The bank notes are included in long-term debt and senior and subordinated notes in the Company’s

balance sheet.

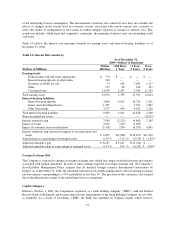

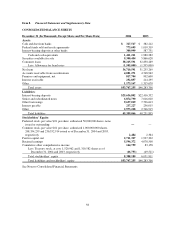

The Company also held $9.3 billion in available-for-sale investment securities and $1.4 billion of cash and cash

equivalents at December 31, 2004, compared to $5.9 billion in investment securities and $2.0 billion of cash and

50